Curious Case of Anil Ambani: Poor Old Rich Guy

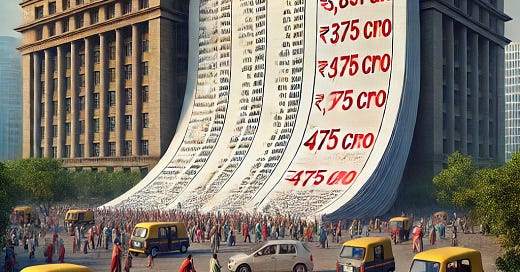

Reliance Infra’s Debt Settlement or Resolution: A Dubious Triumph at Public Expense—Debt Shaved from ₹3,831 Crore to ₹475 Crore.

Reliance Infra’s Debt Settlement/ Resolution

Reliance Infrastructure (RInfra), part of the embattled Anil Ambani-led Reliance Group, has recently claimed its sharp reduction in debt as a major financial victory. Yet, beneath the surface of this apparent success lies a deeper and more troubling reality—one that shifts the burden of corporate mismanagement onto public financial institutions, leaving taxpayers to foot the bill. The massive debt shave-off, achieved through settlements with public-sector banks and institutions, or other quasi-judicial processes, raises serious questions about fairness and accountability in India’s corporate restructuring framework.

Debt Reduction: A Misleading Victory?

RInfra’s announcement of slashing its standalone external debt from ₹3,831 crore to ₹475 crore—a substantial 87.6% reduction—might appear commendable at first glance, with the company also claiming a net worth of ₹9,041 crore. However, this so-called achievement has been largely built on the backs of public financial institutions and banks, which have taken severe haircuts in the process. The company's settlement approach, which includes major public entities like Life Insurance Corporation (LIC), Edelweiss Asset Reconstruction Company, and Union Bank, essentially shifts private sector failures onto public institutions. This immediately raises a glaring red flag, one that even a basic student of commerce or accountancy would question: if the company’s net worth is so significantly positive, why could it not pay off its original debt of ₹3,831 crore in full?

Rather than signalling a robust turnaround, this debt resolution strategy highlights a recurring theme in India’s corporate sector: the socialisation of private losses. By striking deals that result in massive reductions in obligations, companies like Reliance Infra are able to survive while leaving public institutions to bear the brunt of financial missteps. It is a pattern that raises the question: Why should public entities, funded by taxpayers, consistently absorb the losses of private promoters?

The Mechanics Behind the Debt Haircuts

RInfra’s debt reduction was primarily achieved through settlements with public-sector financial institutions, raising concerns about the fairness of the process. Consider these moves:

Invent Assets Securitisation and Reconstruction Private Limited (ARC): RInfra cleared its outstanding dues with this ARC, achieving a clean slate in a critical settlement.

Life Insurance Corporation of India (LIC): The company negotiated a one-time settlement with LIC for ₹600 crore, significantly reducing its liabilities to this public-sector giant.

Edelweiss Asset Reconstruction Company: A settlement for ₹235 crore was struck, again allowing RInfra to wipe away substantial debt without addressing the broader mismanagement that led to the liabilities.

Repayments to Banks: Settlements with ICICI Bank, Union Bank, and other lenders reduced RInfra’s obligations to a fraction of their original amounts.

While RInfra claims its net worth now stands at ₹9,041 crore following these settlements, this figure offers little consolation to the public institutions that have taken substantial haircuts in the name of corporate restructuring. It begs the question of who truly benefits from these resolutions—the companies and their promoters, or the public institutions left holding the bag?

Anil Ambani's Financial Woes: A Deepening Crisis

RInfra’s debt resolution must be viewed in the broader context of Anil Ambani’s collapsing business empire. Once regarded as one of India’s richest individuals, Ambani has seen his fortunes evaporate over the past decade due to aggressive expansion, poor business strategies, and mounting legal troubles. These include:

1. Reliance Communications (RCom) Bankruptcy

The most striking example of Anil Ambani’s financial troubles is the collapse of Reliance Communications (RCom). At its peak, RCom was one of India’s leading telecom companies, but mounting debts and the fierce competition of India’s telecom wars led the company to bankruptcy in 2019. With debts exceeding ₹46,000 crore, the collapse of RCom marked the beginning of the end for Anil Ambani’s telecom dreams.

2. Ericsson Dues Crisis

In 2019, Anil Ambani narrowly avoided jail when the Supreme Court of India held him personally liable for ₹550 crore in unpaid dues to Ericsson. His elder brother, Mukesh Ambani, stepped in at the eleventh hour to clear the dues, but the incident highlighted the precarious state of Anil Ambani’s finances and his inability to meet his obligations without external help.

3. UK Bankruptcy Case

Anil Ambani’s financial woes were laid bare internationally when a UK court ruled in 2020 that he must pay $717 million to Chinese banks. In court, Anil claimed his net worth had plummeted to zero—a statement contradicted by evidence of a lavish lifestyle that included luxury cars, private jets, and yachts. This incident raised further questions about his financial transparency and management practices.

4. Black Money Act Show-Cause Notice

In 2022, Indian income tax authorities issued Anil Ambani a show-cause notice under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 for allegedly holding undeclared foreign accounts. This unresolved notice has added yet another layer to Anil Ambani's already complex web of legal and financial challenges. The matter has been challenged in the Bombay High Court, and proceedings before the statutory, quasi-judicial authorities of the income tax department appear to have been stalled due to the ongoing litigation. This delay underscores the need for a swift resolution to ensure accountability and bring clarity to the imputations, as prolonged litigation only exacerbates the uncertainty surrounding the case.

5. SEBI Ban

In August 2024, the Securities and Exchange Board of India (SEBI) banned Ambani and 24 others from the securities market for five years, alleging fund diversion in Reliance Home Finance and Reliance Commercial Finance. SEBI described Ambani as the "mastermind" behind the diversion of funds, underscoring the extent of financial mismanagement within his companies.

Shifting Private Losses to the Public: The Real Cost of Corporate Restructuring

RInfra’s debt resolution reflects a worrying trend where public financial institutions absorb the brunt of corporate mismanagement, while the promoters often emerge unscathed. The settlements negotiated with LIC, Union Bank, and others, while ensuring the company’s survival, come at a high cost to the public sector. This process of "haircutting" for banks and institutions effectively transfers private-sector losses onto taxpayers and public institutions—an arrangement that seems fundamentally unjust.

The infrastructure sector, in particular, is prone to such bailouts. Unlike industries where assets depreciate quickly, infrastructure assets like roads and power plants retain value over time. Losses in this sector, therefore, often stem not from the natural depreciation of assets, but from poor management, or worse, the siphoning of funds to related parties, often abroad.

Need for Forensic Audits and the Role of the PMLA

Given the opaque nature of these settlements, there is a pressing need for forensic audits in cases like Reliance Infra’s debt restructuring. A forensic audit would shed light on whether funds were misappropriated or diverted to related entities, ensuring that those responsible are held accountable.

Moreover, in such cases, the stringent provisions of the Prevention of Money Laundering Act (PMLA), 2002, should be invoked to investigate potential financial misconduct. While the Insolvency and Bankruptcy Code (IBC) and the National Company Law Tribunal (NCLT) frameworks are designed to facilitate restructuring, they often allow promoters to evade deeper scrutiny. The application of the PMLA would bring about a more rigorous examination of the financial dealings, ensuring greater accountability.

Summing Up: A Stark Question of Fairness

The debt resolution of Reliance Infrastructure serves as a stark reminder of the deep inequities embedded in India’s corporate restructuring process. While private promoters like Anil Ambani manage to walk away with substantially reduced debt burdens, public financial institutions and, ultimately, taxpayers are left to absorb the losses. This practice, where public funds are routinely deployed to rescue private mismanagement, demands a heightened level of scrutiny, transparency, and accountability. The urgency for forensic audits and stricter laws, like the Prevention of Money Laundering Act (PMLA), 2002, to be enforced in such cases is long overdue.

a.) Corporate Bailouts vs. Farmer Debts

This pattern of systemic injustice is especially glaring when contrasted with the treatment of other borrowers in the country. Consider, for instance, the plight of India's farmers. Struggling with small, often unsecured loans, many farmers face the harsh consequences of default—harassment, loss of land, or even suicides—while corporate giants like Reliance Infra are afforded lenient bailouts despite possessing large, durable assets in sectors like infrastructure. The question must be asked: why is there such a stark difference in how the debts of farmers and corporate behemoths are treated?

b.) Revisiting the Divide: Corporate vs. Farmer Loans

We have previously written about this divide in our article, "The Stark Divide: Corporate Debt vs. Farmer Loans in India," highlighting the contrasting narratives propagated by mainstream media and the well-oiled PR machinery of large corporations. As the latest saga of Reliance Infra’s debt reduction unfolds, generously gifting Anil Ambani’s company an escape from crippling liabilities, it may be an appropriate time to revisit that discussion. The generous treatment given to corporate defaulters like RInfra underscores the need for a national dialogue on fairness in financial accountability1.

c.) Safeguarding India’s Financial Integrity

If these inequities are allowed to persist, where the financial health of public institutions is repeatedly eroded by the transfer of private losses, India risks perpetuating a deeply unjust system. Revisiting how we treat corporate debt, compared to the treatment of the country’s vulnerable borrowers, will be key to restoring fairness and protecting the integrity of India’s financial ecosystem.

Looking Forward: A Call for Scrutiny and Wider Debate

The indiscriminate freebies and massive debt write-offs granted to the corporate sector, whether through bilateral settlements or the quasi-judicial frameworks of the Insolvency and Bankruptcy Code (IBC), National Company Law Tribunal (NCLT), and National Company Law Appellate Tribunal (NCLAT), must be scrutinised by all concerned stakeholders. This process requires a broader debate within policy circles, political parties, legal luminaries, academic institutions, think tanks, NGOs, civil society, and even farmers' organisations. It is imperative to ensure that such daylight robberies—where private corporate failures are cushioned at the public’s expense—are not passed off as reforms, especially when farmer debts are framed as an unjust drag on the state exchequer. Only through collective vigilance and public discourse can we prevent the corporate sector from exploiting the system, while ensuring true financial equity across all sectors of society.

Debt Reduction News

Ericsson Case

UK Bankruptcy Case

SEBI Ban