The Congress Quagmire: Story Behind the Income Tax Thunderbolt

Congress Party Income Tax Saga— explained

The Congress Party's Income Tax Controversy: An Introduction

Close on the heels of the landmark judgment by the Supreme Court of India, which declared the controversial "Electoral Bonds Scheme" unconstitutional, mainstream and social media outlets were abuzz with news, confirmed by Congress Party leaders, that the Income Tax Department had "frozen" or "attached" the Party's bank accounts. This action resulted in their cheques bouncing or being returned to the payee, dishonoured. The total demand from the Income Tax Department, inclusive of interest for delayed payment and penalties, was reported to exceed Rs 200 crores, attributed to a mere 45-day delay in filing the Income Tax return for the Assessment Year 2018-19. Amidst the ensuing blame game and counterattacks, we thought it prudent to explore the basic legal provisions and likely scenarios, as requested by numerous readers of "The KBS Chronicle".

Political Parties in India Pay No Income Tax

In India, political parties, duly registered by the Election Commission of India (ECI), enjoy a unique financial status that exempts them from paying income tax, provided they adhere to certain conditions set forth under the Income Tax Act, 1961. This exemption is granted to encourage transparency in the financial activities of political parties and to ensure their operations are not hindered by financial constraints. However, to avail of this exemption, political parties must fulfill specific criteria:

Section 13A of the Income Tax Act, 1961: It specifies that any income of a political party, which is chargeable under the head "Income from house property", "Income from other sources", "Capital gains", or "Income from voluntary contributions", is exempt from income tax provided the political party keeps a detailed record of all such contributions in excess of ₹20,000 and reports the same to the Election Commission of India1.

Reporting to the Election Commission: Political parties are required to submit their annual audit reports to the Election Commission of India to maintain their tax-exempt status. This audit report should include details of donations received above ₹20,000, expenditures, and other financial transactions as mandated by the Election Commission.

Maintenance of Records: Proper books of accounts and other documents must be maintained by the political party, reflecting all its financial transactions, to qualify for the income tax exemption.

The tax exemption provision for political parties in India serves a dual purpose: fostering transparency in political financing while offering financial relief to support their activities. By mandating strict compliance, including maintaining detailed accounts, recording significant donations, undergoing audits, and submitting audit reports to the Election Commission, the framework aims to prevent misuse of this privilege. These measures are designed to promote clean electoral financing practices, ensuring that the democratic process is supported by transparent and accountable financial management.

While this exemption facilitates the smooth operation of political parties, essential for a vibrant democracy, it also sparks a debate between critics and supporters. Critics call for even more stringent transparency and accountability measures to eliminate any shadows of financial mismanagement. In contrast, supporters argue that the existing regulations provide a balanced approach to nurturing a healthy democratic environment, highlighting the continuous effort to balance transparency with the practical needs of political parties.

Consequences of late filing of Income Tax returns.

The consequences of late filing of income tax returns in India can involve several penalties and restrictions, as outlined by the Income Tax Act, 1961. These consequences have evolved over time to encourage timely compliance with tax regulations. Here are the key consequences for late filing:

Interest on Due Taxes: In addition to the late filing fee, interest under Section 234A may be charged on any tax due. This interest is calculated from the due date of the return until the date the tax is actually paid.

Carry Forward of Losses: Taxpayers who file their returns late may not be allowed to carry forward certain losses to subsequent years for set-off against future income. This primarily affects losses under the head "Profits and gains of business or profession" and "Capital gains".

Delayed Refunds: If the return is filed late, any tax refund due to the taxpayer may also be delayed. Additionally, the interest on refunds may be affected, reducing the amount received by the taxpayer.

Implications for Loans and Visas: Late filing of tax returns can impact the taxpayer's eligibility for loans or visa applications. Financial institutions and foreign consulates often require the latest tax returns as part of their application processes.

Restriction on Deductions and Exemptions: Certain deductions under Section 80C to 80U may not be allowed if the return is filed after the due date.

Prosecution: In extreme cases, where the tax evasion amounts are significant and the delay in filing is substantial without reasonable cause, the taxpayer could be subject to prosecution. However, this is a rare consequence and usually pertains to cases involving substantial evasion.

Filing income tax returns, especially by political parties, on time is crucial to avoid these consequences and ensure compliance with tax laws.

Consequences of non-compliance with the terms and conditions of section 13A

For registered political parties in India, compliance with Section 13A of the Income Tax Act, 1961, is crucial for maintaining their income tax exemption status. Failure to comply with the stipulations of Section 13A can lead to several consequences:

Loss of Tax Exemption: The most direct consequence of non-compliance is the loss of income tax exemption on the income categories specified under Section 13A. This means that the political party could be taxed on its income, including donations, which would otherwise have been exempted.

Scrutiny and Assessments: Non-compliance may trigger scrutiny from the Income Tax Department. The department may undertake detailed assessments of the party's income, deductions, and liabilities. This process can be time-consuming and may require the party to produce extensive documentation and explanations of their financial activities.

Penalties and Fines: The Income Tax Department may impose penalties and fines on the political party for non-compliance. These penalties can be for not maintaining proper books of account, not filing the audit report with the Election Commission, or not submitting the tax returns itself by the prescribed deadline.

Recovery Proceedings: If it is determined that taxes are due from the political party due to non-compliance, the Income Tax Department may initiate recovery proceedings to collect the due taxes. This could involve attaching the party's bank accounts or other assets.

Impact on Public Perception and Funding: Beyond the direct financial and legal repercussions, non-compliance can adversely affect the political party's public image. Donors may be hesitant to contribute to a party that does not comply with tax laws, fearing their contributions may not be used efficiently or legally.

Legal Challenges: Non-compliance can also lead to legal challenges, including litigation, which can further drain the party's resources and distract from its political activities.

Reporting to the Election Commission: Since political parties are required to submit their audit reports to the Election Commission, failure to comply with Section 13A may also have electoral repercussions. The Election Commission may take actions, including reprimanding the party or even affecting its registered status in severe non-compliance cases.

It's important for political parties to adhere to the stipulations of Section 13A to avoid these consequences, ensuring their operations remain lawful and transparent. Regular audits, accurate bookkeeping, and timely reporting are essential practices for maintaining compliance and securing the trust of both the electorate and the authorities.

Any tax-breaks or deductions to donors of political parties?

Yes, in India, individuals and companies who donate to registered political parties are entitled to tax benefits under Section 80GGC (for individuals) and Section 80GGB (for companies) of the Income Tax Act, 1961. These provisions encourage donations to political parties by offering tax incentives, thus aiming to enhance transparency and accountability in political funding. Here's a brief overview of these sections:

Section 80GGC

For Individuals: Section 80GGC allows any Indian citizen who makes a donation to a registered political party or an electoral trust to claim a deduction for the amount donated from their total income, thus reducing their taxable income.

Exclusions: This deduction is not available for donations made in cash. To claim the deduction, donations must be made through banking channels or a prescribed mode.

Section 80GGB

For Companies: Similar to Section 80GGC, Section 80GGB allows companies to claim a deduction for contributions made to registered political parties or electoral trusts. This helps companies lower their taxable income, provided the contributions adhere to the specified conditions.

Exclusions: As with individual donations, companies cannot claim deductions for donations made in cash. The donations must be made through an account payee cheque, draft, or through electronic means to be eligible for the deduction.

Important Points to Note

No Upper Limit: There is no upper limit on the amount that can be deducted under these sections. The entire amount donated (except for cash donations) can be claimed as a deduction.

Documentation and Compliance: To claim these deductions, proper documentation of the donation is necessary. For individuals, it's essential to have a receipt from the political party or electoral trust, along with proof of payment made through an approved channel. Companies must also ensure they maintain records of the transaction and comply with any reporting requirements as per the Companies Act and Income Tax Act.

Registered Political Parties: Only donations made to political parties registered under Section 29A of the Representation of the People Act, 1951, and electoral trusts approved by the Income Tax Department are eligible for these deductions.

These tax benefits are part of the government's efforts to encourage lawful funding of political parties and electoral processes, aiming to ensure transparency in political donations while offering tax incentives to donors.

The Dual Facets of the Congress Party Tax Dilemma

In the unfolding tax dilemma facing the Congress Party, there appear to be two primary issues at play. The first issue is a 45-day delay in filing the income tax return, and the second concerns a cash-credit sum of approximately Rs 75 lakhs, a relatively more trivial matter. This amount, the Party contends, represents the collective one-month salary contributions deposited by Congress MLAs and MPs.

Scrutiny and Assessment: The Assessing Officer's Stance

During the scrutiny proceedings, it became evident that the Assessing Officer, the initial quasi-judicial statutory authority within the Income Tax Department, was not persuaded by the genuineness or the adequacy of the reasons provided for the delay in filing. It appeared that he lacked the discretion to condone this delay, leading him to pass an assessment order that culminated in a demand exceeding Rs 200 crores. Notably, this assessment included the entire income of the Congress Party as part of the "assessed income," income that would otherwise have been exempt had the return been filed in a timely manner.

Appeal and Preliminary Dismissal: The Congress Party's Legal Challenge

Subsequent to the assessment, the Congress Party pursued the next available remedy by filing a statutory appeal with the Commissioner (Appeals). According to the standard guidelines issued by the Central Board of Direct Taxes (CBDT), any appellant seeking a stay on recovery proceedings must deposit 20% of the tax demand raised before the appellate authority can grant such a stay. Given that the Congress Party presumably failed to either settle the outstanding tax demand or provide an adequate bank guarantee for the same, their appeal was dismissed by the Commissioner (Appeals) on this preliminary basis alone, without delving into the substantive merits of the case, including the reasons for the filing delay.

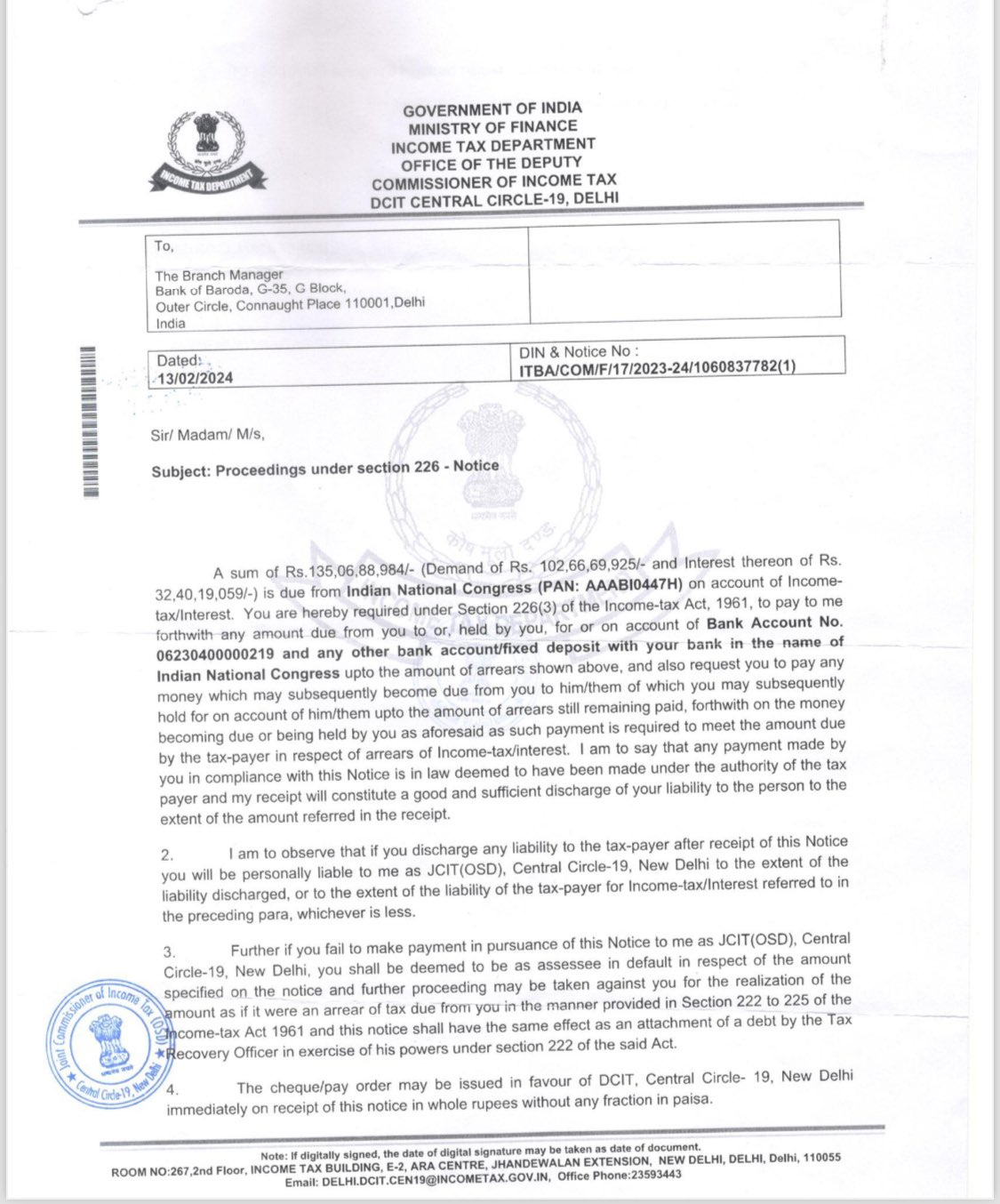

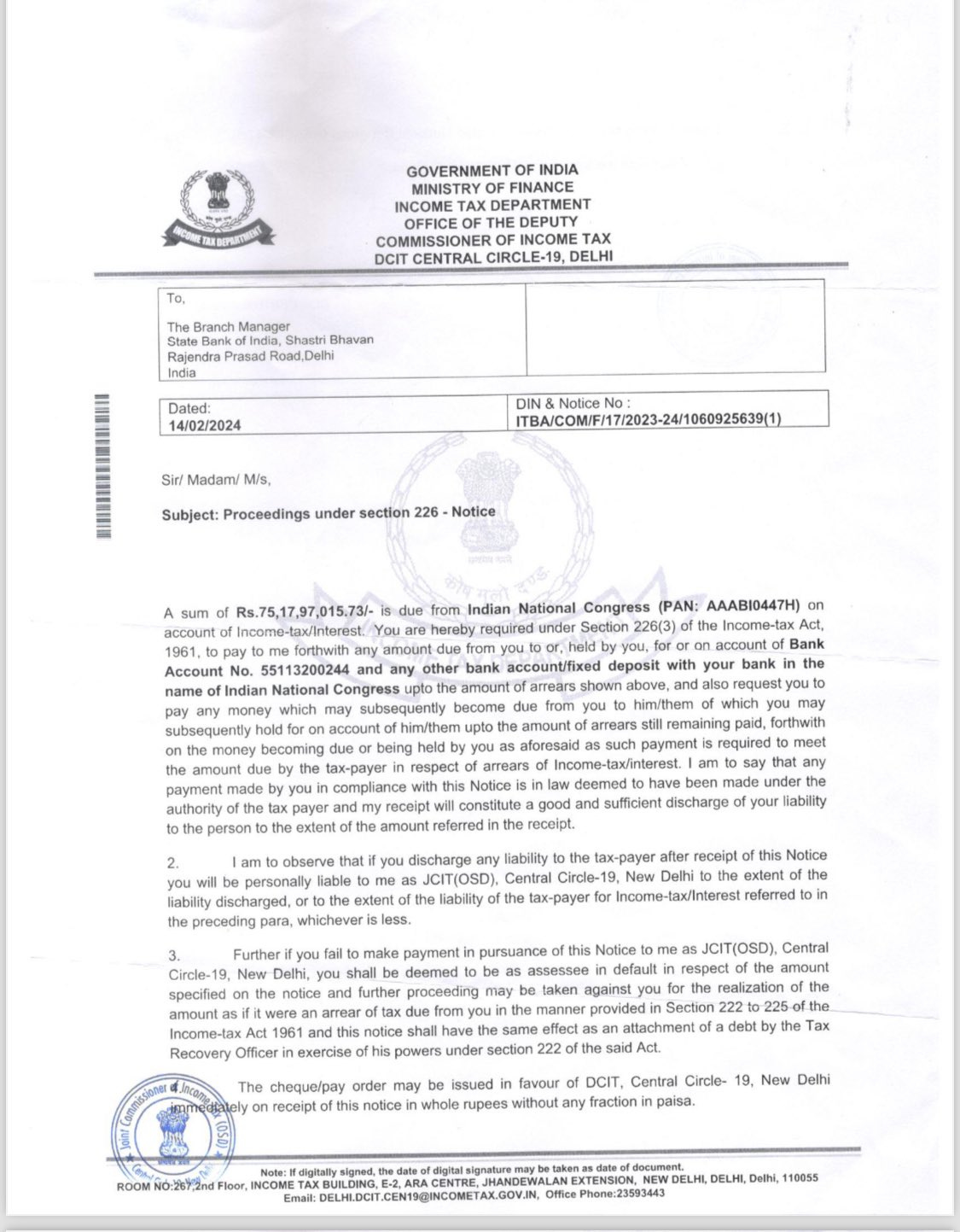

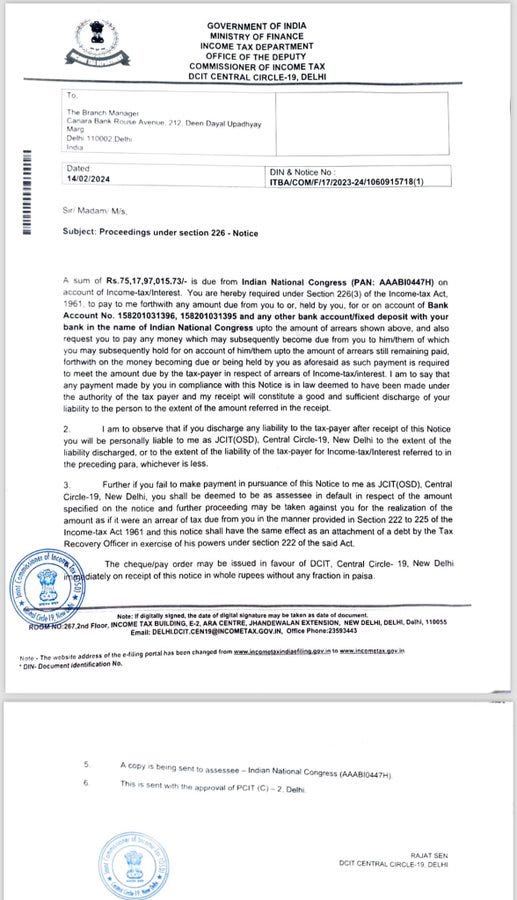

Clarifying the Nature of Notices: Section 226(3) and Bank Accounts

The issuance of notices under Section 226(3) of the Income Tax Act, 1961, to the banks holding the accounts of the Indian National Congress reveals a nuanced distinction in enforcement actions. Contrary to the terms "freezing" or "attachment" commonly used in public discourse, these notices serve as directives to the bank managers, instructing them to debit the specified amount from the party's accounts and remit it directly to the Central Government's treasury. This clarification underscores the procedural mechanism employed by the Income Tax Department in recovering assessed tax liabilities.

The ITAT Appeal: A Strategic Move Amidst Electoral Pressures

In response to the impactful notice that significantly unsettled the Grand Old Party (GOP) during the critical period leading up to the 2024 Lok Sabha election, the Party's executives and office bearers, seemingly jolted into action, proceeded to file a second appeal. This appeal was lodged against the decision of the Commissioner (Appeals), which had dismissed their initial appeal, and was filed before the Income Tax Appellate Tribunal (ITAT). The ITAT's response, however, did not grant a complete stay on the recovery process. Instead, it issued a nuanced directive allowing the banks to create a lien up to the amount of the demand raised. This means that the operation of the Congress Party’s accounts, to the extent exceeding the demand, would continue as usual. It's important to note that this is merely an interim order, which may be subject to future modifications and does not entirely halt the recovery or demand process.

Lessons for Political Party Administrators: The Importance of Compliance

As the income tax litigation saga involving the Congress Party progresses through the ITAT and potentially advances to the Delhi High Court and the Supreme Court of India, there emerges a crucial lesson for administrators of registered political parties across the country. It underscores the imperative of meticulous compliance with the provisions of Section 13A and the timely filing of tax returns. The unfolding events highlight that deviations from these legal requirements can lead to severe consequences, disrupting not only financial operations but also potentially impacting the party's public standing and electoral prospects. This episode serves as a potent reminder of the critical nature of adherence to tax laws and regulations, reinforcing the importance of diligent financial management within the political landscape.

Navigating the Perception Battle: Accountability versus Allegations

In addition to the legal challenges, the Congress Party faces a complex battle of perception, where playing the victim card—alleging that the Income Tax Department is acting under the influence of the ruling BJP—may prove to be a double-edged sword. This strategy risks prompting public scrutiny over the Party's own compliance failures rather than extraneous influences. The critical voices in the public sphere might argue that accountability for adhering to the law rests solely with the party itself, and failure to meet these legal obligations should not be obscured by political narratives.

As the saga unfolds, it becomes increasingly clear that facing the consequences of these lapses, rather than resorting to political posturing, might be the more honorable course of action in the eyes of the electorate. This moment serves as a poignant reminder that in the political ecosystem, integrity and adherence to the law remain paramount, transcending the immediate tactical gains of playing the victim.

Section 13A reproduced verbatim.

The exemption for political parties from income tax in India is outlined in Section 13A of the Income Tax Act, 1961. The exact wording of Section 13A, is as follows:

Section 13A: Special provision relating to incomes of political parties

Notwithstanding anything contained in this Act, any income of a political party which is chargeable under the head "Income from house property" or "Income from other sources" or "Capital gains" or "Income by way of voluntary contributions received by a political party" shall not be included in its total income, provided that—

(a) such political party keeps and maintains such books of account and other documents as would enable the Assessing Officer to properly deduce its income therefrom;

(b) in respect of each such voluntary contribution other than contribution by way of electoral bond in excess of ₹20,000, such political party keeps and maintains a record of such contribution and the name and address of the person who has made such contribution; and

(c) the accounts of such political party are audited by an accountant as defined in the Explanation below sub-section (2) of section 288; and

(d) the political party furnishes a report of such audit in such form as may be prescribed to the Election Commission before the due date under sub-section (1) of section 139 for furnishing the return of income of that previous year.

Explanation.—For the purposes of this section, "political party" means a political party registered under section 29A of the Representation of the People Act, 1951.