RBI Governor's Expertise Shines: Diplomatically Silent on Finance Ministry

Our summary and critique

After our recent article dissecting the RBI Governor’s post-MPC speech, specifically focusing on “Developmental and Regulatory Policies”, I've received a flood of requests from esteemed colleagues, scholars, and journalists.1 They're all eager for a similarly insightful analysis of the main speech, but in a concise and impactful form. One of my friends even quoted Shakespeare, saying "brevity is the soul of wit."

So, despite my yearning for an afternoon siesta, I've set my drowsiness aside and delivered. Please forgive any shortcomings, as this was composed in a less-than-alert state.

Summary of the Report

The RBI Governor's statement reflects a positive outlook for India's economy on the eve of its 77th Independence Day. Despite global economic shocks, India's economy has exhibited strength and stability, becoming the world's fifth-largest and contributing significantly to global growth. The financial sector showcases robust indicators, including healthy banks, strong corporate balance sheets, and improved external sector strength. The statement underscores the need to maintain macro-financial stability while pushing for further growth, positioning India as a pivotal player in the global economy.

The Monetary Policy Committee (MPC) maintained the policy repo rate at 6.50%. While inflation remains a concern, the recent rise in vegetable prices is expected to reverse, and domestic economic activity is holding steady. The statement emphasizes the MPC's commitment to aligning inflation with the target of 4% and supporting growth.

The global economic landscape is challenged by inflation, debt, geopolitical tensions, and weather disruptions. India is well-positioned to weather these challenges due to its domestic demand, untapped resources, and demographic advantage. Economic activity in India remains positive, with agricultural activity picking up, industrial production holding ground, and services showing expansion. The statement projects a real GDP growth of 6.5% for 2023-24.

Inflation moderation to 4.6% in Q1 2023-24 was in line with projections, though there's a recent uptick due to food inflation, particularly vegetable prices. Global and domestic uncertainties necessitate vigilance in tracking inflation trends. The projection for CPI inflation in 2023-24 is revised to 5.4%. The MPC's focus on aligning inflation with the target is reiterated, considering the impact of frequent food price shocks.

The statement addresses liquidity conditions, noting surplus liquidity due to several factors. The RBI plans to implement an incremental cash reserve ratio (I-CRR) of 10% on increased net demand and time liabilities from May to July 2023, aimed at managing excess liquidity temporarily.

Several regulatory and policy measures are introduced, including revisions in benchmark administration regulations, changes in the regulatory framework for Infrastructure Debt Fund - NBFCs (IDF-NBFCs), enhanced transparency in interest rate reset for floating interest loans, and efforts to consolidate and harmonize supervisory data submission guidelines. Initiatives to enhance digital payments, conversational payments, and frictionless credit delivery are also highlighted.

Critical Assessment

The RBI Governor's statement paints a generally positive picture of India's economic resilience and growth potential amidst global challenges. The overview of India's economy, particularly its growth, stability, and financial sector health, is detailed and informative. The analysis of inflation trends and the MPC's policy decisions provide insight into the central bank's approach to maintaining a balance between growth and price stability.

The statement's projection of India's growth outlook appears optimistic, considering the ongoing global uncertainties and challenges. The approach to inflation management, while pragmatic, may need to be further scrutinized to effectively respond to potential inflationary pressures. The assessment of liquidity conditions and the implementation of the I-CRR showcases the RBI's efforts to manage liquidity, but its effectiveness and potential implications warrant deeper examination.

The introduction of various regulatory measures highlights the RBI's commitment to enhancing financial infrastructure and promoting digitalization. However, a more comprehensive discussion on potential challenges, risks, and mitigating strategies associated with these measures could enhance the overall critical assessment.

In conclusion

In summary, the RBI Governor's statement offers valuable insights into India's economic progress and challenges, while showcasing the central bank's proactive regulatory initiatives. By incorporating a more balanced assessment of potential risks, the analysis of the country's economic prospects gains depth and clarity.

Shifting focus to interest rates and inflation, the RBI grapples with constraints stemming from heightened open-market borrowing by the Central Government and states. As the nation enters an election year, expectations of reduced government spending remain unrealistic. This intricate landscape demands the RBI's adept navigation, underscoring that while interest rates are pivotal, they are but one facet in the broader mosaic of economic management.

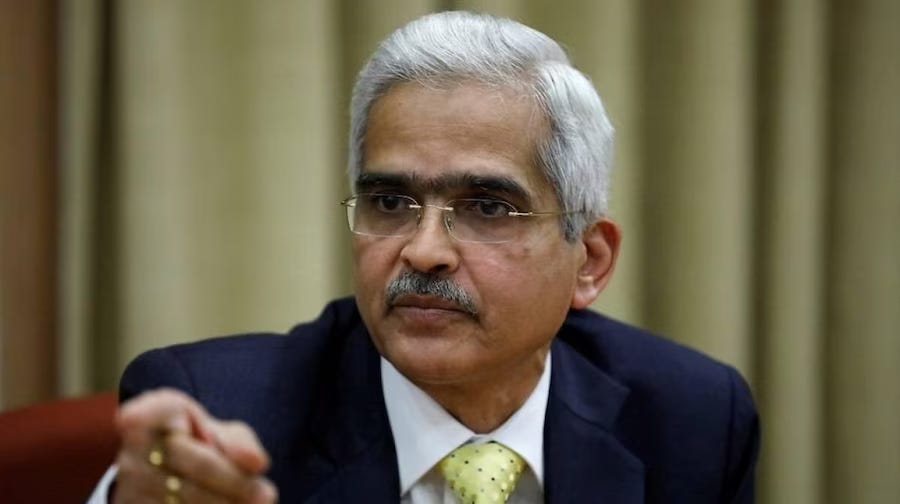

Given the RBI Governor's seasoned bureaucratic background and extensive experience in the Finance Ministry2, one can't blame him for not attempting to second-guess the intentions of the Finance Ministry, at least not in his speech or the official press notes.

RBI Statement post-MPC 2023: Our Analysis

RBI Statement Released RBI's post-three-day Monetary Policy Committee (MPC) meeting statement was unveiled today (10.08.2023), highlighting the following key statistics: The Repo Rate remains unchanged at 6.50%. The Growth Rate projection for FY 2023-24 …

IAS Officers as Reserve Bank Governors

Ten “good” reasons why IAS officers make better RBI Governors than technocrats or economists. When the Central Government appointed Shaktikanta Das, a former/ retired/ superannuated IAS officer, as the Governor of the RBI, the social media was abuzz with the incongruity of a History Major heading the autonomous apex banking…