Counsel I Wish My 21-Year-Old Self Had Received

Guiding Notes to My 21-Year-Old Self: Twelve Timeless Tips for the Next Generation of IAS Officers and Professionals

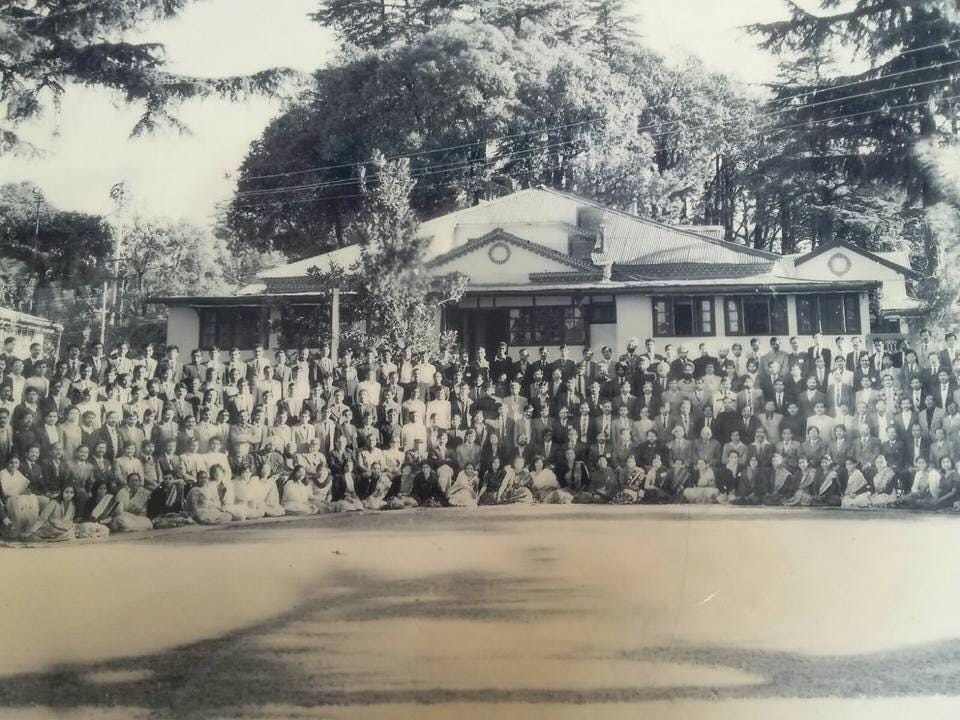

The Genesis of My Journey

In 1984, as a fresh-faced entrant, I found myself walking the hallowed halls of the Indian Administrative Service, humbly pledging my services to the Punjab cadre that embraced me, like my own mother. Over an enriching 37-year marathon, I was fortunate to amass a wide variety of experiences, lessons, and cherished interactions. My journey was enriched with insights from revered seniors, wisdom from dedicated mentors, camaraderie with my vibrant colleagues, and occasionally, pearls of knowledge from the bright-eyed junior specialist officers. Each interaction honed my perception, teaching me about the Service and, more pivotally, the delicate balance between personal and professional realms. Now, two years after bidding adieu in July 2021, I find myself introspecting, wishing certain lessons had sign-posted my path earlier in this adventure1.

A 12-Point Unsolicited Guide

Prompted by introspection, I've distilled my journey into 12 pivotal insights. While crafted primarily for IAS officers, members of the All-India Services, and Central Services, these tenets universally echo with young professionals across the corporate sphere. This piece, written at the close of my chapter as a civil servant, elucidates cardinal principles designed to steer the next generation in their distinct journeys.

1. Initial Financial Assessment and Transparency

Upon your IAS results announcement and before joining the Mussoorie Academy, prioritize organizing your financial assets, especially movable and immovable properties. Gifts from parents or significant acquisitions should be made during this window to align with conduct rules. Starting with a clear and complete declaration sets a strong foundation for a transparent career ahead.

2. Income Tax Insights

Dive into the foundational aspects of the Income Tax Act. There's no need to delve deep, but an essential grasp will significantly shape your financial strategies, encompassing salary income, long-term capital gains, and agricultural income. The digital realm offers a treasure trove of simplified resources, with platforms like YouTube at the forefront. Moreover, don't hesitate to tap into the expertise of IRS colleagues—they can provide invaluable guidance.

3. Harnessing the Power of an HUF

For those wedded within the realms of Hindu, Sikh, Jaina, or Buddhist traditions, seriously consider the idea of establishing a Hindu Undivided Family (HUF). Contrary to common belief, this legal tax structure activates right from the day you tie the marital knot, and not necessarily when children come into the picture. The HUF framework unfolds a spectrum of favorable fiscal and tax avenues. Kickstarting it requires just a modest gift to the HUF post-marriage. Promptly secure a PAN for it and remain diligent in filing income tax returns, even if the declared income is nominal or falls below the taxable threshold.

4. The Importance of a PPF Account

Maintaining a Public Provident Fund account is paramount. Regardless of your dependency on the New Pension Scheme (NPS), General Provident Fund (GPF), or Contributory Provident Fund (CPF), the PPF ensures a secure, long-term investment. Notably, the interest accrued in a PPF, irrespective of its amount, is entirely exempt from income tax. This also applies to both partial and total withdrawals from the account.

5. Future-Proofing for Minor Children

For parents, streamline documents like Aadhaar card, PAN card, and passport for your children. Understand the clubbing provisions of minors' income with parents and consider opening dependent PPF accounts for them. Stay informed about the nuances surrounding minors' potential non-clubbable income2.

6. Investing in Property with Adherence to Conduct Rules

Contemplate purchasing residential property, ehther a plot or a flat, even if borrowing is required. Initial property investment not only grows over time but also offers tax breaks on repayments of loan, separately for the principal and interest components of the EMIs. Ideally, if possible, invest as an HUF property. Adherence to conduct rule intimations and permissions concerning property transactions is crucial and ensures you remain within the boundaries of your professional code.

7. Adherence to Official Deadlines

Maintain the sanctity of your position by diligently adhering to official timelines, particularly concerning income tax returns and the “Annual Returns of Immovable Property” submissions. It's imperative to file the latter every year, regardless of any property transactions during that span. Always ensure timely communication or secure necessary approvals for property dealings, in line with the Conduct Rules. This meticulous attention to procedure acts as a shield against any unforeseen professional predicaments.

8. Navigating the World of Stocks

Acquaint yourself with the foundational principles of stocks (equity shares) and mutual funds, including their ever-evolving tax implications. Alternatively, contemplate adopting a Systematic Investment Plan (SIP), which can pave the way for significant long-term advantages, even amidst market volatility. Tread with discernment, steering clear of speculative ventures, and remain vigilant to detail all gains—whether short-term or long-term—in your tax declarations. Additionally, don't overlook short-term capital losses, as astutely leveraging them can efficiently optimize and potentially reduce your income tax liability.

9. Ensuring Comprehensive Insurance

There's a saying that often circulates regarding life insurance: "those who can afford it don't need it, and those who need it can't afford it." However, for young professionals, prioritizing personal medical insurance, especially with a strong focus on accidental disability/death coverage, is a prudent step. It's also essential to be diligent about specifying clear nominations for your bank and Demat accounts. Consider taking the proactive step of crafting a legally registered will at an early stage. This sensitive subject is often sidestepped in conversations with loved ones, underscoring its importance. When doing so, seek expert legal counsel, especially in choosing attesting witnesses. Moreover, ensuring the will's safekeeping is paramount3.

10. Valuing Continuous Learning and Training

Seek out training courses and international experiences when possible. These avenues serve as not only refresher courses for your knowledge base but also provide valuable networking opportunities with peers. Leveraging the "Partial Funding Scheme" from DOPT can be especially advantageous. This scheme treats the study period as duty time for all intents and purposes, ensuring your salary remains uninterrupted. Moreover, it can be seamlessly integrated with study leave. It's essential to recognize that besides your on-the-job experience and retirement benefits, such training becomes a vital intangible asset that remains with you long after you've retired from the Service.

11. Leveraging Child Care Leave Provisions

Lady officers, as well as single male parents, should familiarize themselves with the child care leave rules. This provision can be availed for up to a total of 2 years (730 days) during their service to cater to children below 18, addressing needs from rearing to examinations and health issues. The benefit ensures 100% salary for the first year and 80% for the second. However, it's essential to note that this leave isn't applicable once the child surpasses 18 years of age.

12. Sharing and Mentoring

Should you find yourself at a juncture of seniority where these guidelines appear elementary, it's a testament to your enriched journey. Rather than dismissing them, embrace the opportunity they present. Use these insights as mentoring tools, passing them on to the next generation of officers. By sharing this accumulated wisdom, you not only uphold the legacy of the service but also empower budding professionals. This ensures they commence their career trajectory with amplified clarity, confidence, and a foundation rooted in the learnings of those who've paved the way before them.

Looking back— and ahead

Reflecting upon the modest innings I played within the grand theatre of the administrative service, my heart brims with fulfillment and gratitude. Each role, challenge, and bond forged became a unique thread in the intricate tapestry of my career. And as the curtain draws on my tenure, I'm buoyed by the promise that a fresh day awaits the passionate and driven individuals set to take the stage.

This collection of insights—or perhaps more fittingly, perspectives—is my heartfelt offering, a guiding light, for this upcoming generation. On their capable shoulders lies the momentous duty of navigating our nation within our vibrant democratic landscape. To these trailblazers of tomorrow: may you revere the legacy, shape today's narrative, and forge an even brighter tomorrow4.

Retire Early and Rich: Investing in Your Future as an Indian Millennial

Why should I care? My retirement is decades away! Retirement may seem like a far-off event, but it’s never too early to start planning for it. In my previous article “Top Twelve Retirement Tips”, I had suggested several steps — both financial and non-financial — that a retiring p…

Smart Savings and Tax Planning Tips for Parents of Minors

Introduction One of the best ways to secure your child's future financially is to start saving and investing as early as possible. As a parent, you need to make sure that your child's money, which you hold in trust for her as a natural guardian, is put to good use, and that the right savings and investment vehicles are chosen, especially from the Income …

“Who Will Cry When You Die?” The Importance of Bank Nominations and Wills in Estate Planning

Introduction When it comes to estate planning, two key tools that individuals can use to ensure that their assets are distributed according to their wishes are “bank nominations” and “wills”. A bank nomination allows individuals to specify who should receive the funds in their bank…

"TREASURE-TROVE OF TIMELESS TIPS: INVESTING IN REAL ESTATE" (Year 2007 Blog)

AN OLD ARTICLE— STILL RELEVANT I had originally published this article as a personal blog in January, 2007. The idea then was perhaps to develop it into a small book or a booklet meant for the general reader. However, the idea did not fructify and they article lay buried in the archives of the internet.