Billions in Illicit Cash Moves Unchecked Through Major International Airports

Flights from Heathrow to Dubai are a prime route for money laundering. Heathrow doesn't scan outbound luggage for cash, while Dubai readily accepts large sums of it.

The Heathrow-Dubai Cash Route

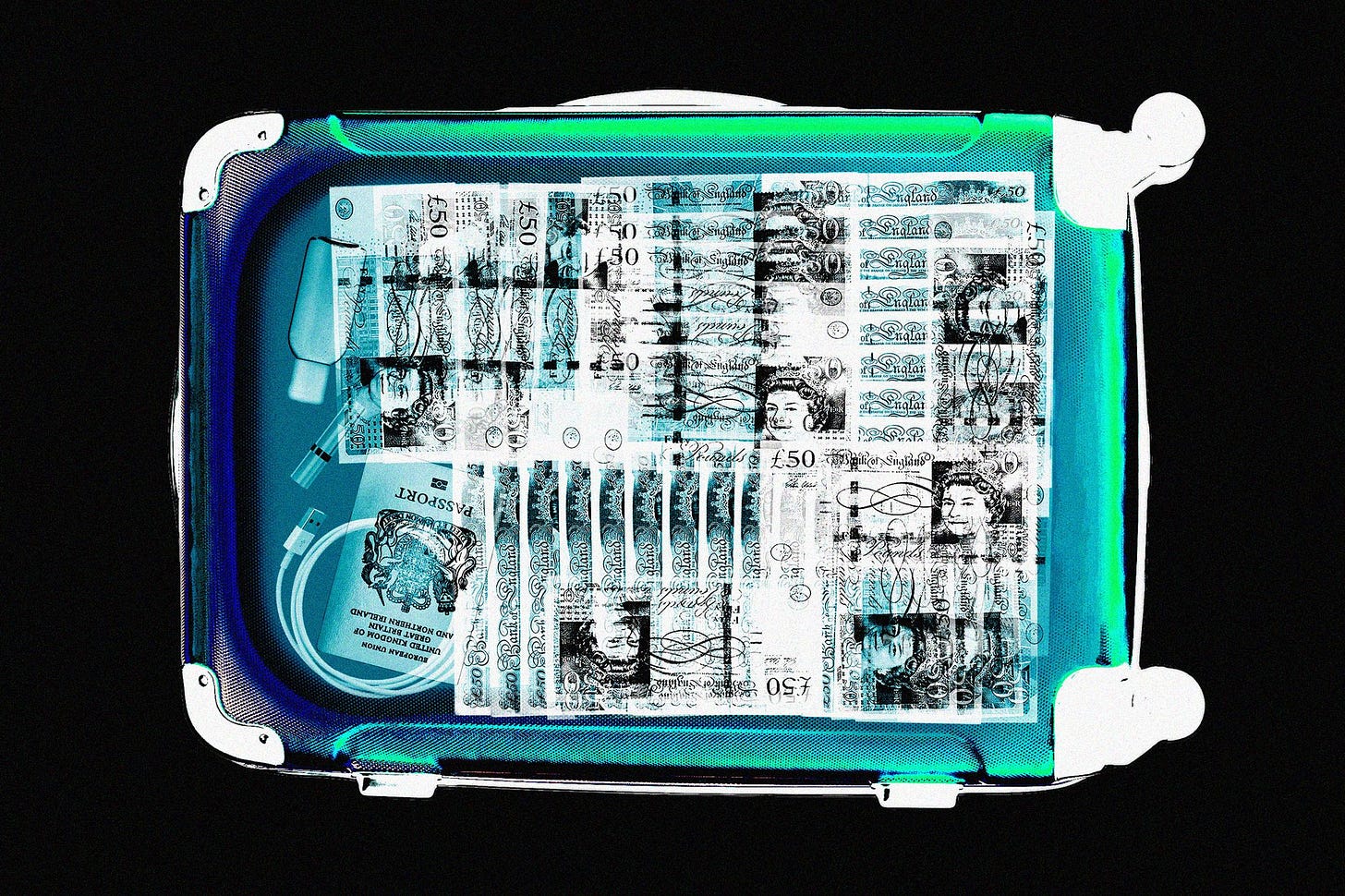

In August 2020, Jo-Emma Larvin and her business-class companion traveled through London's Heathrow Airport with seven heavy suitcases packed with millions of British pounds1. The women were en route to Dubai, one of the world’s busiest airports for international passengers. Despite carrying large sums of cash, they faced no significant scrutiny at Heathrow, where outbound luggage is only scanned for explosives, not cash. This laxity in security provides a loophole for international money laundering.

Weak Security Measures

The UK's regulations require passengers to declare to customs if they carry more than $10,000, yet Larvin and her companion evaded this rule, risking arrest. Dubai, the flight's destination, permits any amount of cash to enter the UAE as long as it is declared. This relaxed attitude toward cash inflow allows money launderers to operate with relative ease. Smuggling cash on flights is facilitated by the lack of scanning for currency, as most airports, including those in the U.S., find it costly to check for cash in luggage.

The Money Laundering Operation

The Heathrow-Dubai route became a preferred method for an international money launderer. The operation involved transporting cash from Heathrow to Dubai, where it could be exchanged for gold or other currencies. The estimated total for illegal global cash flow exceeds $2 trillion, with a substantial portion carried by international airline passengers. Abdulla Alfalasi, the man behind the operation, managed 36 couriers, using the business class baggage allowance to transport large sums of cash.

Legal Crackdown and Arrests

British authorities eventually apprehended Alfalasi in December 2021 after a large-scale investigation into his operation. He was sentenced to a 9-year, 7-month prison term for money laundering. Subsequent arrests followed, involving eight more couriers and several other individuals connected to the smuggling operation. The case revealed the vulnerabilities of airport security and customs procedures, highlighting the need for stricter regulations.

Implications for India

This case has significant implications for India, which also faces challenges with money laundering and black money. The ease with which cash is moved between countries through major airports reveals systemic weaknesses in border controls and financial monitoring. For India, tightening airport security and customs checks for outbound and inbound cash could help mitigate the risk of illegal financial flows. Additionally, stronger international cooperation and intelligence-sharing are crucial in combating cross-border money laundering operations, reducing the impact of black money on the Indian economy.

Summarized from an article in “Wall Street Journal”