The White Paper Chronicles 15 UPA-era Super Scams

Full marks to the Finance Minister Nirmala Sitharaman for a comprehensive presentation but her officers fail to present the complete picture regarding the recovery of the "proceeds of crime".

Introduction to the White Paper

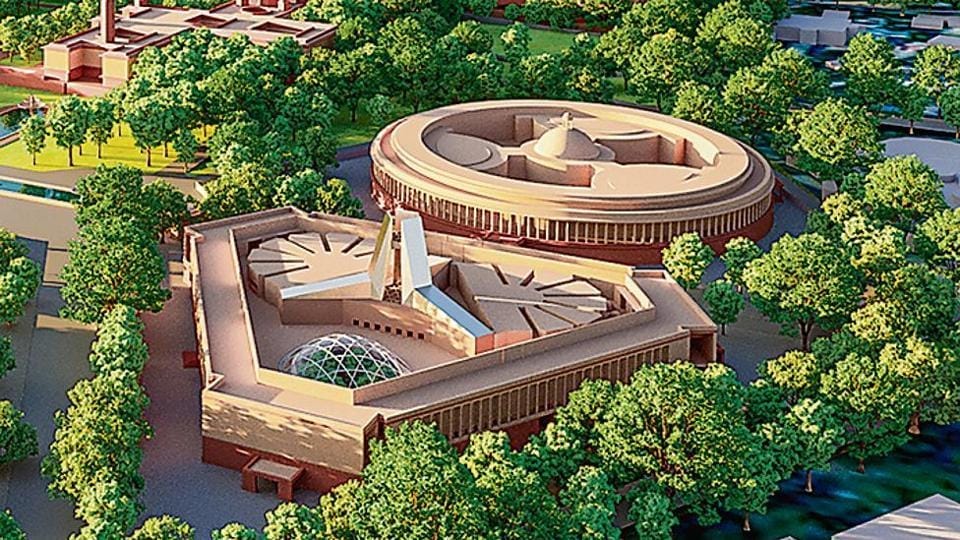

Finance Minister Smt. Nirmala Sitharaman has done a commendable job in presenting the "White Paper on the Indian Economy" to Parliament. This document comprehensively delineates India's substantial accomplishments and significant strides under Prime Minister Narendra Modi's leadership, despite facing global adversities such as the Covid-19 pandemic and geopolitical tensions worldwide over the last decade. Concurrently, it scrutinizes the period of governance under the UPA, marked by what is described as "policy paralysis" from 1994 to 2004, and elaborates on 15 major scams of that era, depicted as egregious breaches of trust under Prime Minister Sardar Manmohan Singh's supervision. The White Paper, inter alia, offers succinct details on each scam and updates on the up-to-date status of the legal cases.

Critical Analysis of the Finance Ministry's Efforts

However, the core focus of our analysis is to critically examine the areas where the Finance Ministry's efforts have been lacking. Despite the diligent work of the Finance Minister, there are instances where the ministry officials have merely provided incomplete and superficial data, failing to offer a comprehensive view of the scams' nature and extent. This piece also attempts to delve into the oversight of actions taken by investigative agencies and the income tax department, which have not been adequately covered in the White Paper.

Overview of Major Scams

For readers interested in the specifics of the scams mentioned in the White Paper, please refer to the latter half of this article. There, you will find a summarized account of these financial irregularities, highlighting the need for a more thorough presentation and analysis by the Finance Ministry to accurately reflect the extent of malfeasance during the UPA's tenure.

Our scrutiny not only provides a clear introduction and critique of the White Paper but also guides the reader towards a deeper understanding of the financial controversies that have marred India's economic landscape. The critique encourages a call for transparency and detail in governmental reports to ensure accountability and informed public discourse.

Gaps in Reporting Financial Recoveries

Inadequate Disclosure of Economic Impact and Recovery Efforts

The White Paper notably falls short in providing detailed information on the financial losses incurred— whether actual or notional— by the government exchequer, the recovery processes undertaken, and the outcomes of such efforts, especially in relation to the assets attached by the Enforcement Directorate (ED) in connection with the scams outlined. This lack of detailed financial impact analysis and recovery updates leaves a significant gap in understanding the full scope of the economic repercussions and the effectiveness of the recovery mechanisms employed.

The Role of Enforcement Agencies

It is crucial to understand that the Central Bureau of Investigation (CBI) often serves as the primary investigative body in these cases, identifying them as "scheduled offences." This triggers the ED to register its ECIR, to launch its own inquiries or investigations into the potential financial trails and proceeds of crime. The White Paper, however, does not delve into the extent of the "money trail" uncovered or the specifics regarding the identification and attachment of proceeds from these crimes.

Legal and Procedural Aspects of Asset Attachment

The process of asset attachment by the ED, which can be initiated soon after the registration of the primary FIR for a temporary period of six months, pending confirmation by a quasi-judicial authority, is another area left untouched by the White Paper. The continuation of such attachments, especially after the CBI files its charge-sheet and the trial begins, is critical for ensuring that the assets remain secured throughout the legal proceedings. Yet, the document does not address the status of these attachments or the progress in securing the proceeds of crime for the benefit of the government exchequer.

Recommendations for Comprehensive Reporting

To address these gaps, it is recommended that future reports and white papers include detailed sections on the economic impact of each scam, including estimated losses, the status of recoveries, and the assets attached by the ED. Such transparency would not only provide a clearer picture of the financial integrity of the government's operations but also reinforce public trust in the effectiveness of its investigative and recovery efforts.

Delays in Criminal Trials: An Analysis

The Issue of Protracted Trials

The question of why criminal trials, especially those involving high-profile scams, extend over many years, often without a foreseeable conclusion, is a matter of significant concern. Once an investigation is completed, evidence gathered, and charges framed based on the CBI's charge sheet, the trial is expected to commence. Typically, these trials are overseen by a Special Court equivalent to the rank of an Additional Sessions Judge, designed to ensure a focused and expedited process. However, the persistence of prolonged delays is perplexing and undermines the efficacy of the judicial process.

Inefficiencies in the Trial Process

The White Paper's silence on the protracted nature of these trials is notable. It fails to address or propose any measures to hasten the trial process, leaving a critical aspect of judicial reform unexplored. Such delays not only deny justice to the affected parties but also diminish public faith in the legal system's ability to efficiently handle cases of significant economic and political import.

The Role of Enforcement Directorate (ED)

The involvement of the ED, through the registration of Enforcement Case Information Reports (ECIRs) under the Prevention of Money Laundering Act (PMLA), 2002, introduces an additional layer of investigation and, subsequently, another set of trials. While these money-laundering trials are materially connected to the original criminal cases, they proceed separately, often in different courts. The White Paper overlooks the necessity of outlining the progress of these interconnected trials and the need for mechanisms to streamline and expedite their resolution.

Recommendations for Judicial Efficiency

To mitigate the challenges of unending criminal trials, the White Paper should have delineated specific strategies aimed at expediting both sets of trials (criminal and money-laundering). Potential measures could include:

Judicial Reforms: Implementing procedural reforms to streamline case management and reduce bottlenecks in the trial process.

Increased Resources: Allocating more resources to Special Courts, including additional judges and support staff, to handle the caseload more efficiently.

Technological Integration: Leveraging technology for case management, evidence presentation, and virtual hearings to speed up the trial process.

Inter-Agency Coordination: Enhancing coordination between the CBI and ED to ensure seamless sharing of evidence and information, avoiding duplication of efforts.

Summing up

The White Paper's failure to address the critical issue of prolonged trials in high-profile corruption cases represents a missed opportunity to propose meaningful reforms. By focusing on measures to expedite the judicial process, the government can reinforce the rule of law and reaffirm its commitment to combating corruption and ensuring timely justice.

Addressing the 2G Spectrum Scam Acquittals

Unaddressed Acquittals and Appeal Process

The White Paper's omission of a detailed summary regarding the acquittals in the widely publicized 2G Telecom Spectrum Scam is a significant oversight. Furthermore, the document does not discuss the measures taken to expedite the appeal process in the Delhi High Court, leaving readers uninformed about the government's efforts to challenge these acquittals and seek justice.

Summary of Pervasive Corruption During the UPA Decade

Overview of Corruption Instances

The White Paper, as per the analysis provided by the Finance Minister, uncovers fifteen instances of pervasive corruption during the UPA's tenure, highlighting the widespread malpractices in government operations. This corruption spanned various sectors, including procurement processes, allocation of natural resources, and regulatory approvals, even affecting procurements critical to the nation's security.

Public Confidence Shaken

The revelation of these scams and corruption cases severely undermined the public's confidence in the government, highlighting the urgent need for transparency, accountability, and stringent anti-corruption measures. The documented instances serve as a stark reminder of the detrimental impact of corruption on governance and public trust.

Recommendations for Future Transparency and Action

Enhancing Disclosure and Action on Judicial Proceedings

Future documents and reports should aim to include comprehensive analyses of judicial outcomes, such as acquittals in high-profile cases, and detail the steps being taken to address these outcomes in higher judicial forums. This will ensure that the public is kept informed about the government's continued efforts to combat corruption and uphold the rule of law.

Strengthening Anti-Corruption Frameworks

To restore and maintain public confidence, it is imperative that the government not only highlights past instances of corruption but also outlines clear, actionable strategies for preventing such issues in the future. This includes strengthening the legal and institutional frameworks for combating corruption, ensuring timely and fair judicial processes, and fostering a culture of transparency and accountability within all levels of government.

By addressing these critical areas, the government can demonstrate its commitment to eradicating corruption and building a more transparent, accountable, and efficient administration.

Summary of High-Profile Corruption Cases

Coal Block Allocation Scam: Highlighted in 2012, it involved irregular allocation of coal blocks, causing a loss of ₹1.86 lakh crore. The Supreme Court cancelled 204 allocations, with 47 cases seeing final reports filed, 10 under investigation, 14 convictions, and others ongoing.

Commonwealth Games Scandal: Corruption and mismanagement in the 2010 Games' organization led to charge-sheets in 8 cases, all under trial.

2G Telecom Scam: Potential revenue loss of ₹1.76 lakh crore due to flawed spectrum allocation. The cases are now in the appellate court.

Saradha Chit Fund Scam: A ponzi scheme collapse in 2013, impacting millions of investors.

INX Media Case: Involves money laundering and irregularities in foreign investment approvals, currently under trial.

Aircel-Maxis Case: Allegations of irregular foreign investment approvals and illegal gratification, under trial.

Antrix-Devas Deal: Corruption in a satellite deal with Devas Multimedia, with the Supreme Court confirming fraud and a charge-sheet filed.

Land for Jobs Scandal: Accusations of land or property exchange for railway job appointments, under investigation.

Panchkula and Gurgaon Land Cases: Involves the release and allotment of prime land through corrupt means, with charge-sheets filed.

J&K Cricket Association Fraud: Misappropriation of nearly ₹44 crores, with a charge-sheet filed.

Embraer Deal Corruption: Related to corrupt aircraft purchases from Embraer, with the case pending trial.

Pilatus Aircraft Corruption: Involves corruption in the procurement of Pilatus trainer aircraft for the Indian Air Force.

Hawk Aircraft Purchase Scandal: Allegations of bribery in the procurement of Hawk Aircraft, under investigation.

Adarsh Housing Society Scam: Irregularities in the allotment of apartments on defence land, currently at the trial stage.

AgustaWestland Helicopter Scam: Involves kickbacks in the procurement of helicopters, with details of the trial stage not specified.

These cases collectively underscore the pervasive corruption challenges across different sectors of governance and the comprehensive efforts required to address them through judicial processes and systemic reforms.

Opportunity for Comprehensive Scam Analysis During Election Code of Conduct

Preparing for a Thorough Review

With the interim Budget or Vote-on-account passed until July 2024 and the Parliament session concluded, India is transitioning into election mode. The forthcoming announcement of the detailed election schedule by the Election Commission of India will initiate the "Election Code of Conduct." This period represents a pivotal opportunity for the Finance Ministry to engage in an in-depth review and analysis of significant financial irregularities, including but not limited to the alleged Delhi Excise Policy Scam and the National Herald Case, which involves senior members of the Congress Party.

The Importance of Coordination and Efficiency

Achieving a more comprehensive understanding of these cases requires effective coordination between various investigative and prosecutorial bodies, including the Central Bureau of Investigation (CBI), the Enforcement Directorate (ED), and other relevant agencies. Given the complexities involved in unraveling financial scams that span multiple jurisdictions and involve intricate legal and financial details, the collaboration between these entities is crucial.

Strategic Use of the "Lean Period"

The "lean period" during the Election Code of Conduct provides a unique window for the Finance Ministry's team to conduct thorough investigations without the immediate pressures of ongoing parliamentary sessions. This time should be used to gather evidence, complete investigations, and prepare detailed reports that shed light on the nature, extent, and implications of these scams.

Achievable Timelines

With a dedicated approach and efficient teamwork, a period of four to five months is deemed sufficient to make significant progress. This effort is not only about pursuing legal actions but also about ensuring transparency and accountability in governance. By providing a clearer picture of these financial scams, the government can reinforce public trust and demonstrate its commitment to combating corruption.

Use the “lean months”

The coming months offer a critical juncture for the Finance Ministry to refine its analysis and reporting on major scams, ensuring that the electorate is well-informed about the outcomes of these investigations. This process will reinforce the principles of good governance and strengthen the democratic fabric of the nation by ensuring that acts of corruption are thoroughly investigated and appropriately addressed.

Enhancing Transparency and Accountability in High-Profile Cases

Emphasizing Recovery and Extradition Efforts

In the wake of the comprehensive "White Paper on the Indian Economy" presented by Finance Minister Nirmala Sitharaman, there is a crucial need for the Finance Ministry to extend its focus beyond the surface of financial scams. The Ministry should aim to illuminate the progress in cases involving high-profile figures like Vijay Mallya, Nirav Modi, and Lalit Modi, especially regarding efforts in recovery and extradition. Additionally, the developments in the cases of Chanda Kochhar, former CMD of ICICI Bank, and Naresh Goyal, founder of Jet Airways, warrant public attention. The paper should also have detailed the progress regarding the refund of money to investors, which was illegally collected by Sahara Group Companies and other similar collective investment schemes, currently under the supervision of the Lodha Committee. Regular updates on these matters could significantly bolster public and media scrutiny, maintaining pressure for these cases to reach their logical conclusions within the ambit of the law.

Beyond Statistics: A Call for Deeper Analysis

While the initiative to publish the White Paper is commendable, it's imperative that the bureaucrats and economists within the Finance Ministry delve deeper into the intricate details of these cases. It's not enough to present mere statistics and figures, which can be easily dismissed by critics. A thorough exploration of the recovery processes, extradition successes and challenges, and the current legal status of the involved individuals is essential. Such an approach will not only ensure a transparent and informed public discourse but also reinforce the government's commitment to accountability and justice.

Conclusion: Upholding the Integrity of Financial Governance

As the country moves forward, the continuous and detailed reporting on these high-profile cases is essential. By providing quarterly updates and highlighting the efforts in recovery and extradition, the Finance Ministry can keep the public engaged and informed. This strategy not only upholds the integrity of financial governance but also serves as a testament to the government's dedication to combating corruption. The efforts of FM Nirmala Sitharaman and her team in bringing about this White Paper are laudable, but the journey towards complete transparency and accountability is ongoing. The meticulous follow-up on these cases will ensure that public opinion remains a vital force in the pursuit of justice and the upholding of the rule of law.