Telecom Policy Package

The Union Cabinet on 15th September, 2021 came out with a bold and transparent policy package to rescue and revive the beleaguered Telecom Industry in the country. The Industry as a whole, and a few telecom companies in particular, had been pushed to the brink of bankruptcy, following the Supreme Court’s Judgment dated 1st September, 2020, wherein stringent directions had been issued to the Telecom Companies to deposit the AGR dues to the Central Government in a 10-year framework, along with interest and penalty. It had also rejected their plea to exclude the non-telecom dues from the calculation of AGRs. The Apex Court reiterated its directions on 19th July, 2021, while dismissing the review petitions filed by some telecom companies.

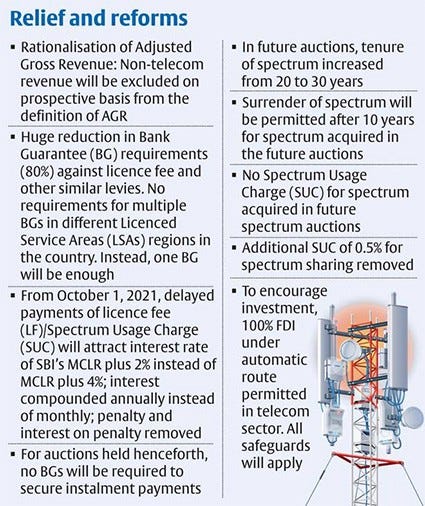

The Policy package, made applicable prospectively, had the stated objective of saving the Telecom Industry from the verge of collapse, while protecting arrears of Government dues upheld by the Supreme Court, while also paying the customary lip-service to the citizen-users. The new initiative of the Government was received by the companies as well as the stock markets enthusiastically. Its salient features are encapsulated below.

As far as the prospective policy changes are concerned, these are fair and transparent and no fault can be found with them, in-principle.

Old AGR Dues

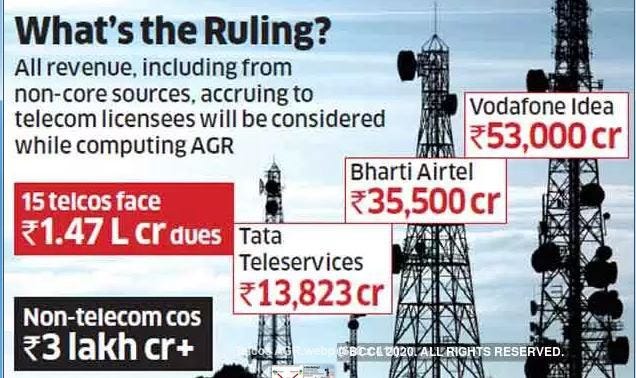

The previous AGR dues, including telecom and non-telecom revenues, had been frozen by the Supreme Court of India vide its judgement dated 1st September, 2020 and order dated 19th July, 2021, these companies had been given 10 years to clear the dues. The latest approximate figures are given below.

Providing a four-year moratorium, although with payment of interest at the rate of MCLR +2%, may not technically be a transgression of the Apex Court’s verdict but it essentially amounts to the Central Government lending to these companies to comply with the strict directions of the Apex Court, even as it is borrowing heavily from the markets / Banks to finance its own deficit.

Relief Provided by the Government

The companies have also been given the option of adjusting the interest payable in form of equity shares to be issued in favour of the Government. The valuation methodology of these shares has to be determined by the Finance Ministry separately but it cannot be expected to be at a significant discount vis-à-vis the prevailing market price of the equity shares of the respective companies. The Government may thus become a minority stake-holder in these companies, without having any worthwhile control over their internal management. Similarly, the Government has been given the option to obtain equity even for any unpaid amount, at the end of the moratorium. The apprehension is that in case these dues are not paid, this option may become virtually a necessity. If the company is collapsing, the Government may well be saddled with dud shares.

Creeping Nationalisation?

In any case, where the central government has come out with an ambitious Rs 6 lakh crore “Remonetization of Assets” scheme, this appears to be ideologically and intellectually a 180° U-turn, to convert its recoverable revenue, as mandated by the Supreme Court, into equity. One could argue that is virtually microscopic nationalization — in a direction reverse to the recently announced remonetisation.

In addition, the markets are also looking at how the NCLT shall decide on the question whether the spectrum can be regarded as a saleable asset in the bankruptcy proceedings. The Apex Court had left this question open, to be decided by the NCLT. It is felt that that the spectrum in fact belongs to the Government and the licences are essentially a kind of lease of the spectrum to the telecoms, subject, however, to the payment of the agreed fees and statutory charges. This may indirectly affect the efficacy of the new package, since the running companies might like to go in for such licences, if auctioned by the NCLT.

Likely future scenario

The Supreme Court had provided a 10-year breather to the telecoms and it was expected that Bharti Telecommunication/ Airtel would easily survive, in spite of the tough competition provided to it by the Reliance-Jio behemoth. In fact, the Bharti Telecom had already taken over the telecom business of Tata-Teleservices, along with its spectrum licences and the concomitant Government dues and liabilities. The future of Vodofone-Idea remains uncertain but if the promoters are willing to infuse fresh equity or they are able to garner the same from a strategic investor or the public, it too could remain in the market. Thus we could have a robust and competitive 3+1 Telecom market (Reliance, Airtel, Vodafone-Idea and the state-run BSNL).

With the insatiable demand for high-speed data following the Covid pandemic and given the 100% FDI in the sector through the automatic route, this initiative may well pave the way for a more stable and mature telecommunication market in the country, with a win-win situation for all — the Government, the consumers and, of source, the companies and their stakeholders. However, much more needs to be done to make India the world-hub and hence an exporter of telecommunication equipment and hardware. Mere rhetoric of #MakeInd India shall not suffice

________________________________________________________

KBS Sidhu recently superannuated from the IAS, 1984 batch of Punjab Cadre. The views expressed are personal

Kbs.sidhu@gmail.com