Retirement is Just the Beginning: Superwoman's Next Adventure

A superwoman may superannuate from her job but she can never retire. At best, she can re-attire or re-tyre herself for her next foray. Who knows where her free-flight may take her?

Retiring but not Retreating: The Story of a Superwoman

“Retirement is not the end of the road. It is the beginning of the open highway.” — Unknown

Poonam Khaira Sidhu superannuated yesterday[1] from the Indian Revenue Service (IRS) after nearly 36 years of service. Her final posting was Principal Director General of Income Tax (Administration), New Delhi. It was the end of a titanic innings, an illustrious and unblemished career in government service that began in 1987.

We have been married for over 33 years. People often ask us whether ours was an “Academy Marriage” or a “Love marriage”. My canned reply is: “It was an arranged marriage; love blossomed afterwards.” I have been truly blessed to have been married to this remarkable woman for all these years. Apart from being the mother of our two wonderful sons, now young men of 32 and 29 years, she has extended me unwavering and unflinching support in our journey together, which has had its own ups and downs. Above all, she has been my conscience-keeper and my moral GPS.

Marriage and the deferred honeymoon

We got married in middle of January, 1990 and she took a month off, while she was posted as Assistant Commissioner of Income Tax at Chandigarh. However, she had a pile of time-barring scrutiny assessment cases that had to be completed before the end of the Financial Year[2]. We mutually agreed to postpone our proposed honeymoon to Rajasthan and Poonam was back to work, literally burning midnight oil to meet here department’s statutory obligations.

This commitment to her job was evident throughout her career, even as we were blessed with Bilawal (1990) and Sehajbir (1993). I remained posted as Additional Deputy Commissioner Amritsar (1990–92) and as Deputy Commissioner, Amritsar (1992–96), and her department was “happy” to post her there because not many officers were opting for this station, on account of the disturbed conditions, at least during the first 3 or 4 years.

Wife of DC Amritsar

The official residence of the DC Amritsar, on Maqbool Road, is virtually next door to the local Income Tax and Customs Office, which was good from the security angle. The mobile security “bandobast” of DC Amritsar then included a bullet-proof car and an LMG-mounted escort vehicle. However, Poonam agreed to have a one-constable security only with much reluctance.

In a scenario where staying put in Amritsar was, by itself, regarded an act of courage, I remember, one particular instance, which still serves as a motif or icon for her intrepid sense of duty. A particularly notorious transport company, with alleged links with extremists, did not pay heed to any notice to clear the tax arrears, served by her department. Their collection was all in cash, as were their purported expenses. Even the process-servers were threatened or intimidated when they went to deliver any notice.

One fine morning, she drove to the bus-stand with a single security-guard and her driver and the next thing one knew was that she was sitting in a bus of the defaulter company, after affixing the attachment order, and guiding her driver to bring the bus to the Income Tax Office. This created quite a few ripples not only from a security perspective but also sent shivers down the spine of other wilful tax defaulters.

In the single calendar month of April, 1993 we had two separate cases of hijacking in Amritsar. It was weekend on both the occasions, when the buccaneered planes were forced to land at the airport. It was my duty, along with the SSP Amritsar, to negotiate with the hijackers, which could also have involved a face-to-face contact with hardened terrorists who were possibly armed to teeth. Poonam was carrying our second baby (Sejhajbir’s birthday 1st July, 1993) but she told me not to be deterred from performing my hazardous duty, saying that she would be praying of our safety[3]. It was this type of unflagging support she extended to me, throughout our stay in Amritsar, even as she attended to her official duties, with due diligence and devotion.

As wife of the Deputy Commissioner, Poonam was also the ex-officio Chairperson of the Hospital Welfare Section of the local District Red Cross Society and President of the Association of Social Health in India (ASHI) as well as the Child Welfare Council. These positions had traditionally been regarded as merely ceremonial but Poonam infused a new energy into these organisations. Apart from blood- donation camps, she was instrumental in setting up a “De-addiction Centre”, “Sahara” (Short-Stay Home) for deserted women and literally re-built the “School for Deaf and Dumb Children”. ASHI also regularly met over the weekends to mediate in and resolve matrimonial disputes, where she was ably assisted by an IPS Probationer, who is now holding a top position in the Punjab Police, today.

Our Manchester (UK) Sojourn

Immediately after my record tenure at Amritsar, I was deputed by the Government of India for a year-long MA (Economics) course at the University of Manchester (UK) in 1996–97. Poonam, availing of extra-ordinary leave[4] without pay accompanied me with our two kids. In addition to the household chores, including cooking, cleaning and washing, and apart from looking after the children (then 3 and 6 years old), Poonam managed to arranged an attachment and training for herself with UK Inland Revenue, Manchester. She came out with a comprehensive report, highlighting the lessons that the Income Tax Department in India could draw from the British reforms. This effort was applauded by her Department when we came back.

Postings in Chandigarh, Bangalore and Delhi

In August 1997 we were back and both of us were posted in Chandigarh. Poonam as Joint/ Additional Commissioner cracked a TDS[5] fraud case, where forged TDS certificates were allegedly fabricated by a Chartered Accountant to illegally milch the government exchequer. She continued to appear as the star prosecution witness in the trial over a period of many years.

Her assessment orders, rejecting the claims of the so-called forest plantation companies that their income was agricultural in nature (hence tax exempt), were upheld till the highest level. Many such companies later turned out to be the part of a systemic fraudulent network that was conning the petty investors into making deposits, promising them huge tax-free returns. Many properties of such entities were attached, saving them from being nibbled away by unscrupulous elements.

In 2004–05, she availed of “study leave” and virtually produced a PhD thesis, which is still a must-read for the IRS Officers working in the domain of “International Taxation and Transfer-Pricing”. Opting for deputation with the Punjab State Power Regulator[6] thereafter, Poonam lead the Commission’s initiative in the framing of statutory regulations in respect of “Green Energy” and long-term “Power-Purchase Agreements”. Many of her academic papers on these two subjects have been published in reputed International Journals.

Transferred to Bangalore in 2008 on her promotion as Commissioner, Poonam linked the data of high-value land/ property registration deeds to assessee PAN numbers, thereby detecting tax evasion/ avoidance running into hundred of crores of rupees. This software model was later to become the basis of a nation-wide adoption of such electronic linkages in sale-purchase transactions.

Back in Chandigarh, Poonam spent two good years in the Regional Training Institute (RTI) of the Income Tax Department, building up comprehensive course-work in tax and non-tax domains, as well as in setting up a new RTI Complex in Mohali. In her annual assessment as the Director of the RTI, it is a matter of record that the number of short-term and long-term courses that she ran in Chandigarh exceeded courses run by all the remaining RTIs in the country put together.

Though well-settled with the family at home in Chandigarh, Poonam applied for and got the post of Director (Commissioner) International Taxation at New Delhi in 2010. This wing of the department deals with the Income Tax liability of multinational companies, on the income attributable to their India operations. Most such companies are advised by top lawyers and finance/tax consultants and minimize their tax liability by transferring bulk of their profits to overseas jurisdictions, especially one’s with lower tax rates. Poonam plugged those loopholes in a number of cases and undertook scrutiny/ investigations of MNCs like Cairns Energy and Nokia. She found that the avoidance/ evasion was less through the manipulated profit-and-loss accounts but more through transfer, including infusion and buyback, of equity shares, usually involving tax havens. She helped raise tax demands and effect recovery running into thousands of crore rupees. Her job included actively assisting the government law officers in the Supreme Court and Delhi High Court. Her tool-kit for such cases is still a standard reference in her department.

The Michigan LLM

She was selected, for the academic year 2012–13, purely on a competitive basis, for a government-funded one-year LLM course in the University of Michigan Law School, USA, in “International Taxation”. As a “mature” student, along with her brilliant young JD (Juris Doctor) classmates, Poonam added new perspectives to the classroom discussions and seminars. Remember, the winter of that year was particularly inhospitable in that part of USA but she demonstrated tremendous mental and physical resilience to complete her LLM degree summa cum laude.

She received a number of lucrative job offers, including at the level of a firm partner, from some of the leading employers in USA, with the option to be stationed in USA or India. However, she said, having worked to protect the interest of the “revenue” throughout her career, she couldn’t psychologically accept opposing the interest of the Union of India. She was back.

She spent fruitful three years at Delhi, mainly in the domain of International Taxation till she was promoted as Principal Commissioner of Income Tax and posted at Chandigarh. Her jurisdiction included the cases of some of the most influential political families of the region but she discharged her duties without fear or favour, By this time, she had built up a reputation of not being influenced by any political pressure and most of the “requests” were made through me, which I tactfully deflected. In terms of both quality and quantity, her work was adjudged among the best in the North-West Region (NWR).

Promotion as Chief Commissioner

Getting her well-deserved promotion as Chief Commissioner of Income Tax towards the end of 2019, she was posted at Amritsar, which included the erstwhile State of Jammu and Kashmir. Her tenure coincided with the lockdown and she stayed put in Amritsar, working with skeleton-staff. Before the abrogation of Article 370, the presence of the Income Tax Department in J&K, particularly in Srinagar was at best notional. The new building was lying incomplete and even the DDOs[7] of the State Government were not well-versed the law and practice of the TDS, whether on salaries or huge contractual payments. She was in Srinagar practically every month and the new building was got expeditiously completed. She also received a lot of support from the local administration in what was now a Union Territory.

Transferred to Ludhiana in the same rank, she was now in-charge of the commercial capital of Punjab. She worked collaboratively with the trade and industry organisations as well the CAs and Advocate associations to achieve the highest ever tax collection in her region. She also retrieved department’s land worth hundreds of crores, where a new office complex is coming up. She was worked closely with the women organisations to encourage enterprise and entrepreneurship among the qualified female professionals.

Her final promotion, as Principal Chief Commissioner, in the Apex Scale, came in the 2022. She was posted to New Delhi, a place where she shifted immediately, accompanied by the lovely Oreo, her delightful Chihuahua, who had been keeping her company since her most-recent Amritsar posting. Allotted a 5-bedroom Lutyen’s Bungalow as government accommodation, was not entirely an unmixed blessing as she was effectively living there alone. Working around-the-clock, as usual, Poonam injected dynamism into her job and hacked off, one by one, a number of pending projects. Her performance was duly recognised by the government of the day.

Towards the Second Innings

Financial year ending is always a busy time for the Income Tax department, more so this year, since the Parliament was in Session. Poonam worked overtime to finish the pending tasks, without any regard to the fact that 31st Match, 2023 would be very last working day in the government job. She didn’t want us to arrange for even a modest “retirement” celebration within the family, although she had taken the initiative to have small but emotional luncheon for me when I had superannuated from the IAS on 31st July, 2021. She even requested her immediate staff to keep the ceremonial send-off very frugal, preceded only by a simple tea in office.

In our spiky discussions, I often quote: “The trouble with being in the rat race is that even if you win, you’re still a rat.”― Lily Tomlin

Recently, she quoted back. “Retirement: It’s nice to get out of the rat race, but you have to learn to get along with less cheese.” — Gene Perret

I could understand exactly what she meant. Today, as the month of April glided in, I wished her “Happy Independence Day” — to celebrate and commemorate her first day as a “free” citizen. She gave me a mysterious Mona Lisa type of smile, and said “Thanks, honey. I might have been bruised along the way, but I have come out alive — rest assured, the healing shall be quick.” Her words were barely audible.

Poonam has shared with me only very sketchy details of what she wants to do now. What’s the kind of second innings she would like to play? Official assignment? Strict no, no. Joining private sector? Naaah. Her own enterprise? Maybe, with focus not on profits but on women’s empowerment. Travel, write, podcasts? Very much possible. Work for and in Punjab? Probably. Join active politics, or activism? Who knows? Play with Oreo? For sure. Looking forward to spending time with soon-expected grandchild? Absolutely!

I have known Poonam long enough. I have often described her as “The Bionic Woman”, the heroine of an American mid-1970s, TV science-fiction action adventure serial. I am convinced that a superwoman may superannuate from a government job but she can never retire. At best, she can re-attire or re-tyre herself for her next foray. Who knows where her free flight may take her? More power to her!

Per aspera ad astra.

_______________________________________________________________

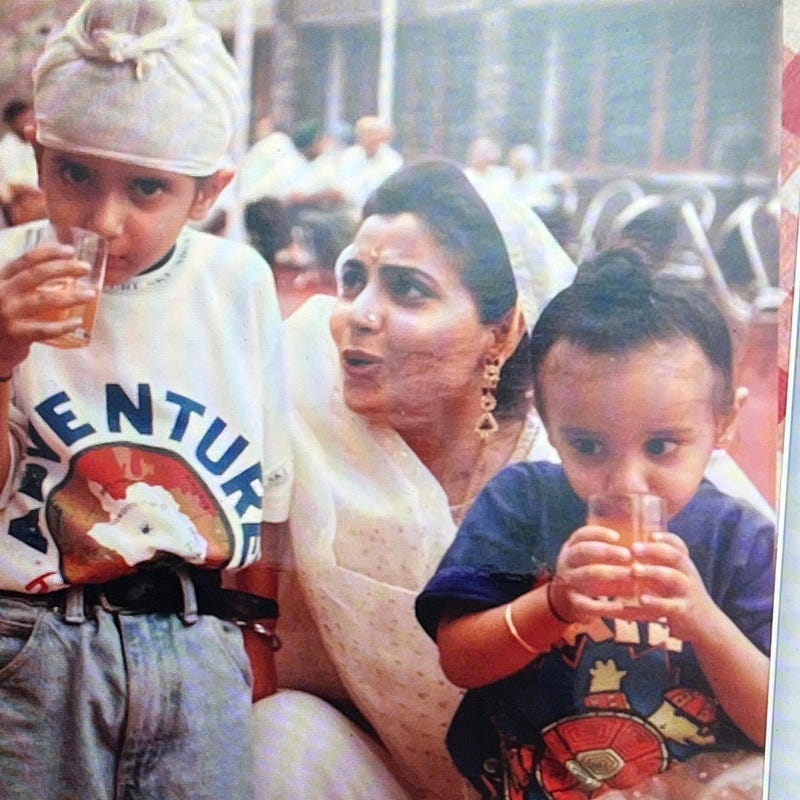

Link to some more pics from the family album. Please bear with us — the quality of the old pics may not be up to the mark.

https://acrobat.adobe.com/id/urn:aaid:sc:AP:cdf300e6-e738-4980-9b9e-df67850f5510

[1] 31st March, 2023

[2] 31st March, 1990

[3] Both the hijackings were handled successfully. In the first one, the lone hijacker was talked into surrendering. In the second incident, we engaged the heavily armed hijacker for almost 14 hours, before the NSG team stormed the plane and neutralized the terrorist.

This before the 1999 Kandahar incident, where a similar aircraft, having landed at Amritsar as allowed to take-off again and ultimately the Nation paid a very heavy price for the same.

[4] The scheme of the Child-Care Leave was not prevalent then.

[5] Tax Deduction at Source.

[6] Punjab State Electricity Regulatory Commission.

[7] Drawing and Disbursing Officers.

_____________________________________________

The author superannuated as Special Chief Secretary, Punjab in July, 2021, after nearly 37 years of service in the IAS.

He can be reached on kbs.sidhu@gmail.com

You can reach her on punamsidhu@gmail.com

Congrats for retiring & coming out of race; best wishes for some unique re-attire. One job for her is to write a detailed "brief" about her great husband who has enlightened us about you, ma'am.

Wow! Made for each other, in all its dimensions. Your en career has been equally exciting and purposeful. May your creed grow 🙏