Q1 Surge in Foreign Direct Investment (FDI) — Temporary Phenomenon or a Long-term Trend?

The net as well as gross FDI figures for the first quarter are undoubtedly impressive, but how do these compare with the trend of the previous years?

Surge in FDI: Is the Increase Sustainable?

In a noteworthy development— and a sharp change of trend— underscoring investor confidence, India's net foreign direct investment (FDI) surged to $6.9 billion in the first quarter of the current financial year, representing an impressive 46.8% increase from $4.7 billion during the same period last year. According to the Reserve Bank of India's latest data, this surge was largely fueled by a robust 26.4% year-on-year growth in gross inward FDI, which reached $22.5 billion. Key sectors—manufacturing, financial services, communication services, computer services, and energy—attracted nearly 80% of these inflows, highlighting strong international interest in India's economic prospects. With around 75% of these investments originating from Singapore, Mauritius, the Netherlands, the US, and Belgium, this upswing, amid global economic uncertainties, reaffirms India's growing appeal as a premier destination for global capital.

Factors Behind the Q1 FDI Surge

The remarkable increase in foreign direct investment during the first quarter of 2024-25 can be linked to several key factors. Chief among these is the impressive 26.4% year-on-year growth in gross inward FDI, which reached $22.5 billion, indicating heightened global investor interest in India. Notably, the significant net FDI figure (46.8%), which far surpasses the gross figure of 26.4%, suggests that the outflow from disinvestment or sales of long-term investments in Indian stock markets by foreign investors has been relatively small. This upward trend reflects growing confidence in India’s economic recovery and future prospects. Moreover, the Indian government's strategic policy initiatives to improve the ease of doing business and attract foreign investment have significantly contributed to this positive momentum, further cementing India’s status as a prime destination for global capital.

Mixed Signals in FDI Trends: A Closer Look

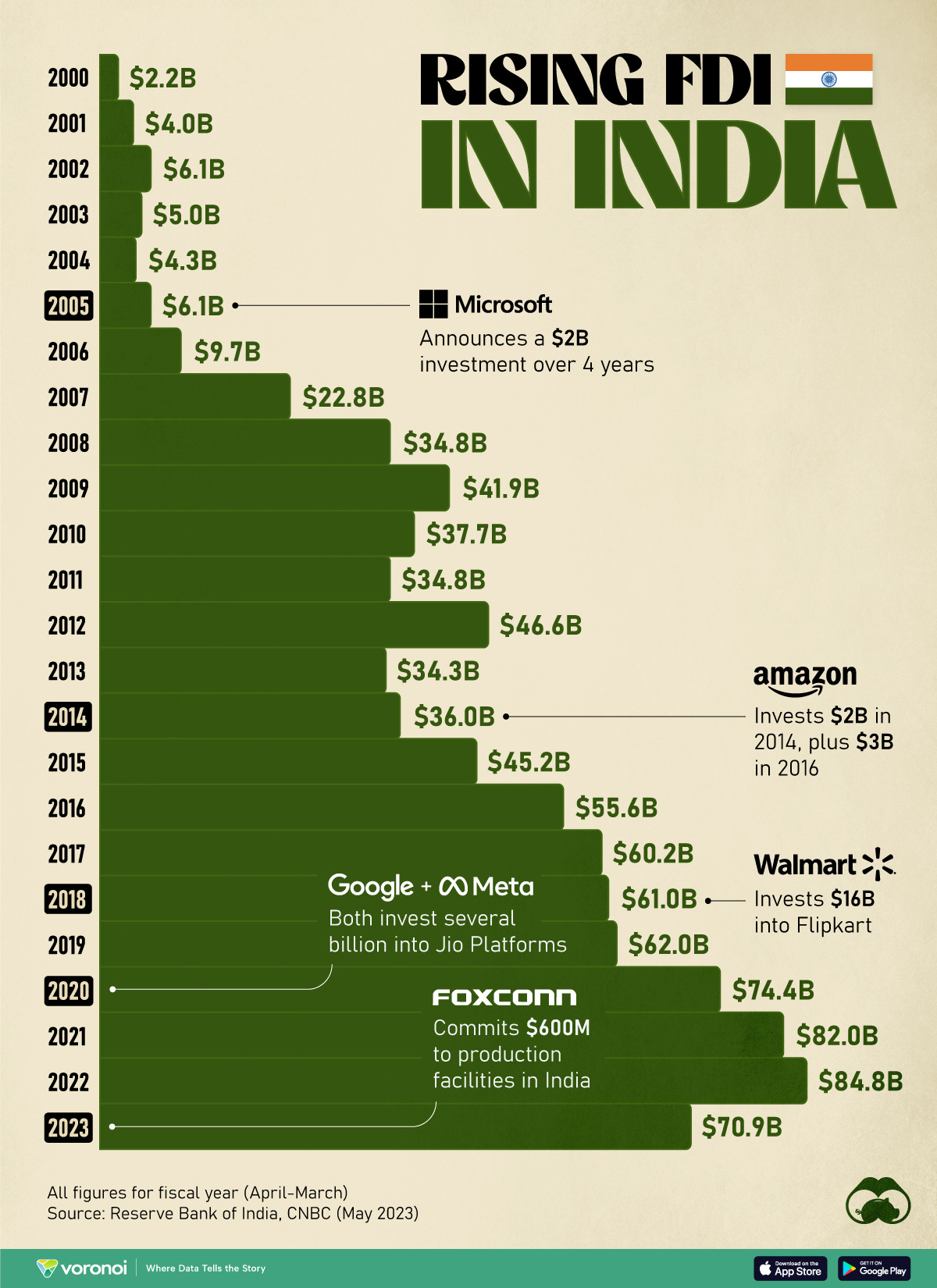

While the surge in foreign direct investment (FDI) during the first quarter of 2024-25 appears impressive, with net FDI reaching $6.9 billion—a 46.8% increase from the same period last year—the broader trend over recent years tells a more nuanced story. Annual FDI inflows have fluctuated, showing a peak of $84.84 billion in FY 2021-22, followed by a decline to $70.97 billion in FY 2022-23. This decline contrasts with the general upward trend seen in previous years: $82.0 billion in FY 2020-21, $74.39 billion in FY 2019-20, $62.0 billion in FY 2018-19, and $61.0 billion in FY 2017-18. These figures come from the data provided by the Department for Promotion of Industry and Internal Trade (DPIIT).

While the quarterly figures for 2024-25 provide a positive snapshot and spike, the overall trend in recent years suggests a slowing momentum, underscoring the need for continued and enhanced efforts to attract foreign investment amidst global economic uncertainties.

Diverging Trends in Net FDI: A Cautionary Tale

The figures from The Business Standard from which we captured the Q1 figures, also paint a concerning picture of India's net foreign direct investment (FDI) trends over the past few years. According to this reputed publication, net FDI flows dropped sharply to $9.8 billion in FY24, down from $28 billion in the previous year and $38.6 billion in FY22. These figures, which align broadly with the data observed on a financial year basis, underscore a significant decline in investor inflows over the past few years. While quarterly data might offer glimpses of optimism, the overall downward trajectory in net FDI highlights underlying challenges that need to be addressed to sustain and grow India's appeal as a destination for foreign investment.

Keys to Boosting FDI

Strategic Leadership and Aggressive Outreach

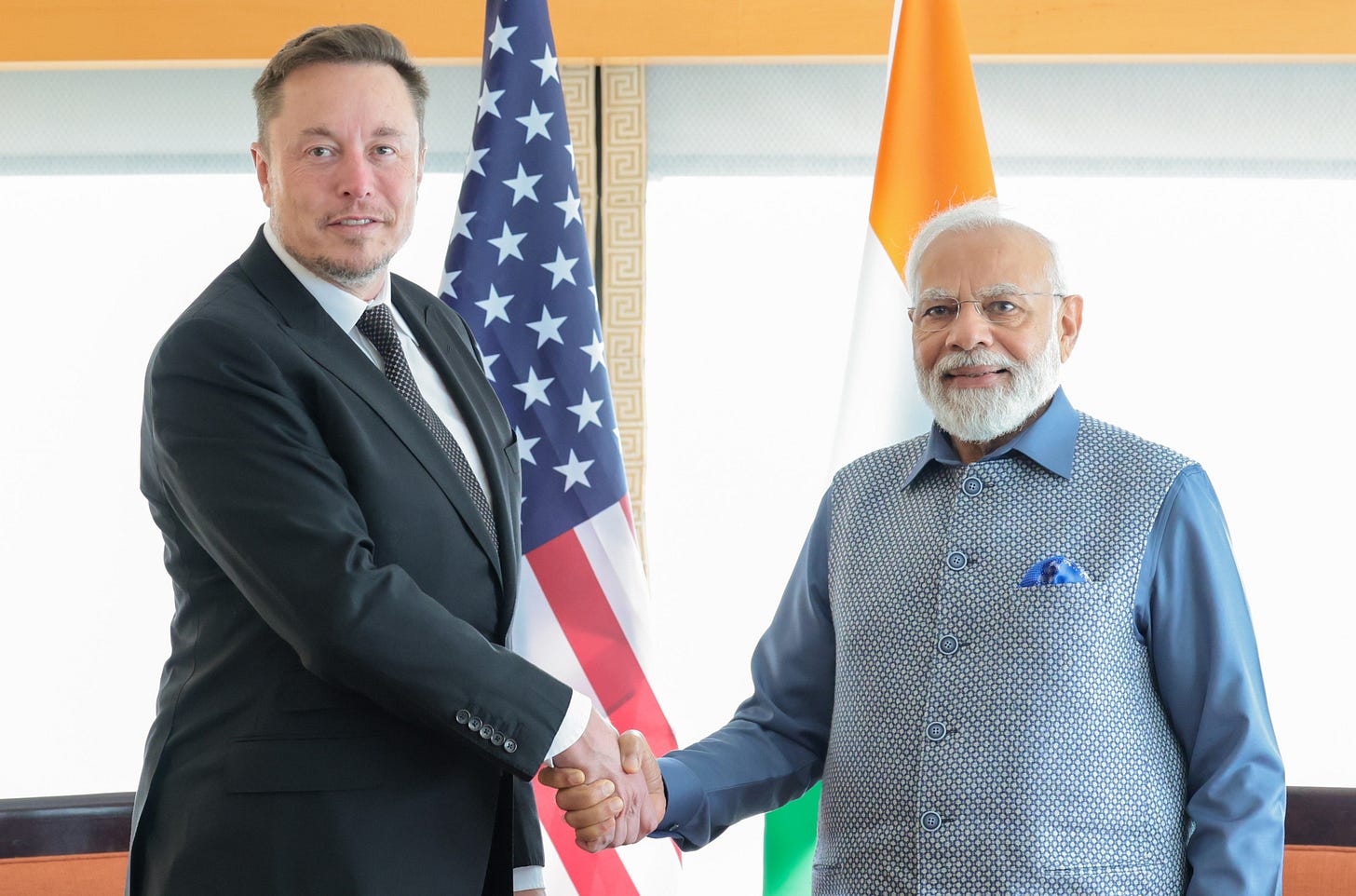

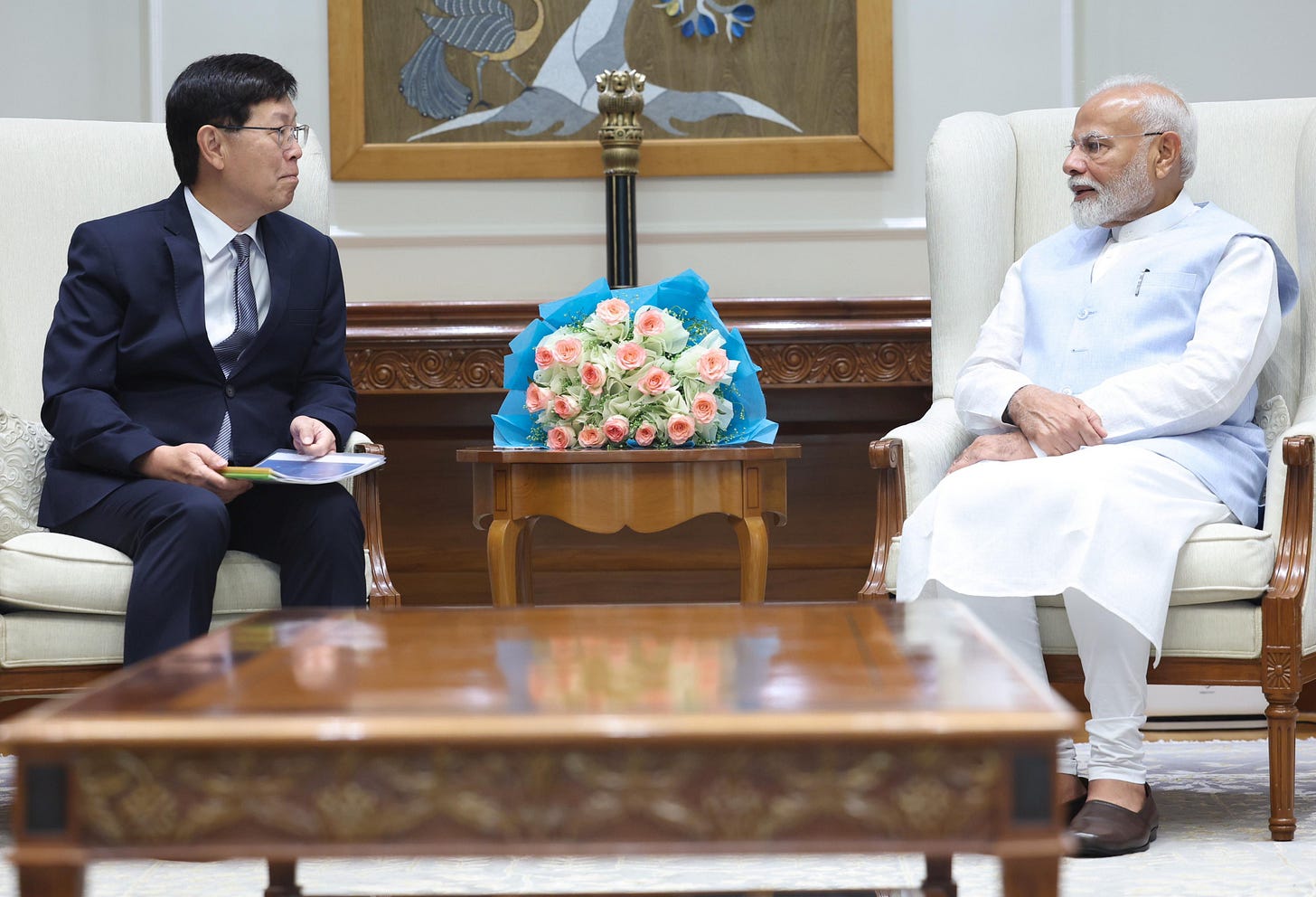

To significantly enhance FDI inflows, India must not only implement progressive policies with minimal red tape but also engage in aggressive salesmanship at the highest levels of leadership. The proactive efforts of Prime Minister Narendra Modi, coupled with the dynamic initiatives by state leaders like those in Tamil Nadu and Andhra Pradesh, have shown tangible results. The recent meeting between the Prime Minister and the Foxconn Chairman, on the eve of the Independence Day, sent a powerful message to global markets about India's commitment to attracting major investments.

India must also focus on wooing key figures like Elon Musk, encouraging Tesla to establish a manufacturing base for both driverless and self-driven cars in India. Additionally, resolving the regulatory challenges surrounding Musk's Starlink—a venture providing reliable and cost-effective internet via low-orbit satellites—will be crucial for expanding connectivity in remote areas.

Balancing Incentives and Economic Prudence

While incentives such as the Production-Linked Incentive (PLI) scheme should continue to be leveraged to promote manufacturing and exports, including in cutting-edge sectors like heavy-duty microchips and GPUs, it is vital to ensure that these incentives are proportional to the broader macroeconomic benefits. Careful consideration must be given to the long-term fiscal implications, ensuring that such measures yield substantial returns for the country.

Moreover, to restore confidence in foreign portfolio investments, it is imperative that the credibility of SEBI, India's market regulator, be restored—particularly in light of the recent Hindenburg Research allegations concerning conflict of interest on the part of SEBI Chairperson Madhabi Puri Buch. With consistent, coherent, and proactive measures, there is no reason why India’s FDI inflows, which currently lag behind China’s, cannot scale up to $100 billion in the foreseeable future.

Citations

Here are the citations with the short forms of the publications as clickable links:

DPIIT | IBEF | Visual Capitalist | Statista (FDI Inflow) | MacroTrends | Statista (FDI in India) | World Bank | Trading Economics | PPLX