Nvidia Breaches $1,000 Barrier: Beats Market Expectations

Outperforms Street Estimates in Both Earnings and Revenue, Driven by Sustained AI Growth.

Introduction

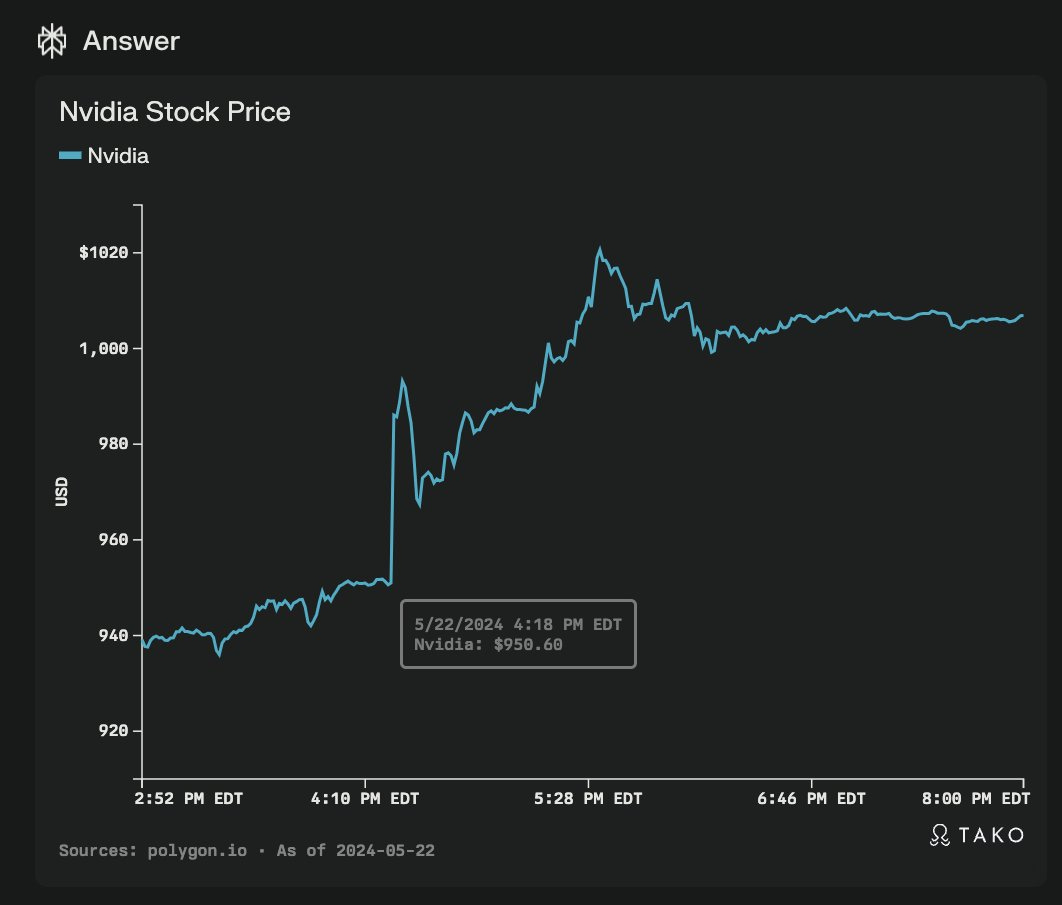

Nvidia, a California-based technology company renowned for manufacturing advanced graphics processing units (GPUs), has once again proven its dominance in the tech world by surpassing the $1,000 per-share mark for the first time. This milestone, achieved in extended trading on Wednesday (22nd May, 2024), is a testament to the company's robust performance and its pivotal role in the AI boom. The fiscal first-quarter earnings report has not only exceeded analyst expectations but also solidified Nvidia's position as a bellwether in the technology sector.

Impressive Earnings and Revenue Growth

Nvidia's fiscal first-quarter earnings showcased stellar performance, with adjusted earnings per share at $6.12, significantly surpassing the $5.59 expected by LSEG consensus estimates. The company's revenue also outperformed projections, reaching $26.04 billion against the anticipated $24.65 billion. This remarkable growth is indicative of the sustained and escalating demand for Nvidia's AI chips.

Insight from Our Tech Adviser

Our Austin, Texas-based Honorary Tech Adviser, Bilwal Sidhu, tweeted, "Buying Nvidia stock during the pre-earnings dip, when the market was jittery, hits different 📈." Speaking exclusively to "The KBS Chronicle," he elaborated, "One has to bank on the climate, not the weather," signifying that investment decisions should be based on long-term anticipated fundamentals rather than short-term air pockets that any stock may encounter. This perspective underscores the importance of a strategic, long-term approach to investing in tech stocks like Nvidia.

AI Chips Driving Success

The surge in Nvidia's stock price reflects the robust demand for its AI chips, essential components for developing and deploying artificial intelligence applications. CEO Jensen Huang announced that the company would start seeing revenue from its next-generation AI chip, Blackwell, later this year. This new chip is expected to further bolster Nvidia's market dominance and drive additional growth.

Data Center Dominance

Nvidia's data center sales have been a significant contributor to its revenue, with a staggering 427% increase from the previous year, amounting to $22.6 billion. This growth is largely attributed to the shipments of the company's Hopper graphics processors, including the H100 GPU. Meta's announcement of Lama 3, utilizing 24,000 H100 GPUs, highlights the critical role Nvidia's products play in advancing AI technologies.

Expanding Networking Revenue

In addition to its AI chips, Nvidia has seen substantial growth in its networking parts sales, which reached $3.2 billion. This increase is driven by the need for advanced networking solutions as companies build extensive AI server clusters. The InfiniBand products, in particular, have been instrumental in connecting these clusters, underscoring Nvidia's comprehensive approach to supporting AI infrastructure.

Broad Market Impact

Nvidia's influence extends beyond AI chips and data centers. The company's gaming revenue also saw an 18% increase, reaching $2.65 billion, driven by strong demand for 3D gaming hardware. Additionally, Nvidia's professional visualization and automotive sales, although smaller in comparison, contribute to its diverse revenue streams.

Strategic Financial Moves

The company has been strategic in its financial decisions, repurchasing $7.7 billion worth of shares and increasing its quarterly cash dividend from 4 cents to 10 cents per share on a pre-split basis. Post-split, the dividend will be a penny per share, reflecting Nvidia's confidence in its financial stability and future growth.

Summing Up

Looking ahead, Nvidia's future appears exceedingly bright. The introduction of the Blackwell AI GPU is expected to generate significant revenue, solidifying Nvidia's position at the forefront of AI innovation. CEO Jensen Huang's long-term vision and unwavering faith in the company's mission have resulted in a virtual monopoly in the AI chip market. With major tech giants like Google, Microsoft, Meta, Amazon, and OpenAI as its clients, Nvidia's influence is set to grow even further.

Looking Forward

The tech and AI sectors, buoyed by Nvidia's success, are likely to experience continued robust growth. This optimism extends to the broader market indices, which will benefit from the ripple effects of Nvidia's advancements. In celebrating this milestone, we also acknowledge the remarkable leadership of Jensen Huang, whose foresight and dedication have propelled Nvidia to unparalleled heights. The future of tech and AI stocks is undoubtedly promising, with Nvidia leading the charge into an exciting and innovative era.