New RBI Governor Appointed: The IAS Legacy Continues

Ten “good” reasons why IAS officers make better RBI Governors than technocrats or economists.

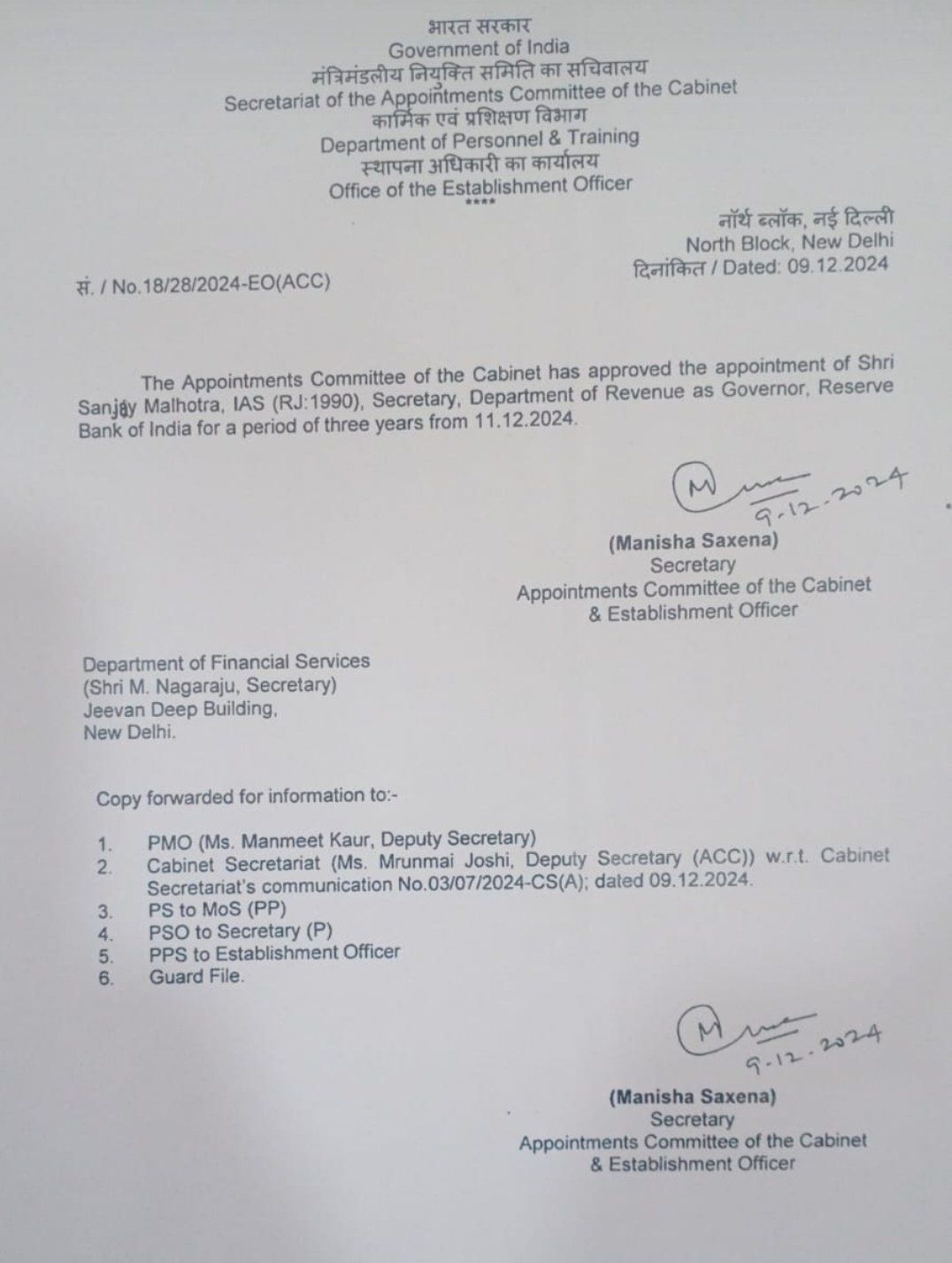

Central Government Appoints Sanjay Malhotra as RBI Governor

The Central Government today announced the appointment of Sanjay Malhotra, currently serving as Revenue Secretary, as the 26th Governor of the Reserve Bank of India (RBI). Malhotra, a 1990-batch Indian Administrative Service (IAS) officer from the Rajasthan cadre, will succeed Shaktikanta Das in this crucial role. An alumnus of IIT Kanpur with an engineering degree in Computer Science and a Master’s in Public Policy from Princeton University, Malhotra brings a wide-ranging portfolio of experience in finance, taxation, power, and information technology to the helm of India’s central bank.

As the regulator of the banking system, the RBI plays a critical role in ensuring financial stability and fostering economic growth. It also administers interest rates and formulates monetary policy autonomously, independent of the Finance Ministry. Malhotra’s immediate challenges include addressing rising inflation, which surged to 6.21% in October, exceeding the RBI’s upper tolerance limit. As he assumes office on December 11, 2024, he will need to carefully navigate calls for interest rate cuts to spur growth while maintaining price stability—a delicate balancing act that will shape his tenure.

Legacy of the Outgoing Governor, Shaktikanta Das

Malhotra’s appointment follows the conclusion of Shaktikanta Das’s remarkable six-year tenure as RBI Governor, that end on Tuesday (December 10). Das’s leadership has been defined by resilience and deft crisis management, steering the central bank through challenges such as the economic fallout of the COVID-19 pandemic and global supply chain disruptions. Recognized internationally, Das earned accolades as Central Banker of the Year from multiple global forums.

Under Das’s stewardship, the RBI introduced sweeping reforms aimed at strengthening the economy. Key initiatives included adjusting interest rates and liquidity measures to tackle inflation while ensuring a robust growth trajectory, projected at 6.6% for the current fiscal year. His tenure has been widely praised for balancing the twin mandates of economic growth and price stability. As Malhotra steps into this critical role, he inherits both the challenges and opportunities created under Das’s transformative leadership, with the financial sector closely watching how he will shape India's economic trajectory in the years ahead.

Reflecting on IAS Leadership at the RBI

Six years ago, when Shaktikanta Das was appointed as the RBI Governor by the Modi 1.0 Government, I had published an article titled "Ten 'Good' Reasons Why IAS Officers Make Better RBI Governors Than Technocrats or Economists." The piece, written during my tenure as an active IAS officer in the Punjab cadre, was a mix of serious analysis and tongue-in-cheek commentary. Now, as I reflect on Das's performance over a remarkable six-year tenure—the longest in recent decades—I find my arguments still resonate with the same relevance.

While Das was not the first IAS officer to hold this coveted position, his accomplished tenure, followed by the appointment of another IAS officer, Sanjay Malhotra, as his successor, underscores the enduring value of administrative leadership at the helm of the RBI. This prompts me to revisit and share my earlier article, largely unchanged, as a tribute to the administrative acumen and steady governance that have defined this historic period for India’s central bank.

IAS Officers as Reserve Bank of India Governor

When the Central Government appointed Shaktikanta Das, a former/ retired/ superannuated IAS officer, as the Governor of the RBI, the social media was abuzz with the incongruity of a History Major heading the autonomous apex banking regulator. Many wondered how a “generalist” could be considered worthy of manning such a super-specialist position. Mr Das, a Tamil Nadu cadre IAS officer of 1980 batch, had retired as the Union Finance Secretary in May 2017 and is neither the first nor perhaps would be the last IAS officer to have been so appointed. Maybe what created ripples was partly the fact that he came in succession to two high-profile economists of international repute, Raghuram Rajan and Urjit Patel, and partly because his immediate predecessor, an appointee of the current Government, resigned prematurely, without completing his stipulated three-year term.

In a scenario, where the generalist versus specialist controversy had been triggered by the Government of India’s (GOI) decision to induct officers at the level of the Joint Secretary to the GOI on contractual basis through “lateral entry”, this decision of the Government created more than the usual ripples. However, it is argued that an IAS officer, with requisite experience in the Finance Ministry and / or the State Finance Department would be an ideal RBI Governor, for the following reasons, right or wrong.

1. Bureaucrats are generally conservative and risk-averse and no country can afford a Central Bank Supremo who is entrepreneurial and exhibits “irrational exuberance’.

2. A former IAS officer would know his way about the North Block (read Finance Ministry), literally as well as metaphorically.

3. His juniors would be occupying top positions as Secretaries of the four Departments under the Finance Ministry (Revenue, Expenditure, Financial Services and Economic Affairs), who would have no problem in “sir_ing” him. This working relationship would also extend to the RBI’s Central Board Meetings. He would have probably worked under the incumbent Finance Minister and would, in turn, have no problem in “sir_ing” or “ma’ming the FM.

4. Having experienced the Government’s frustration with the RBI, he’d be better equipped to handle RBI’s frustration with the Government.

5. He would better appreciate that the term “autonomous” is not synonymous with “sovereign”. He would also know that it is the Finance Minister and not the RBI Chief who is accountable to the Parliament and it is the FM who’d be answering questions in the Lok Sabha as well as Rajya Sabha, even when these relate to the RBI. He would be able to handle the Parliamentary Committees with finesse, thanks to his previous hands-on experience, and accord them the importance they deserve.

6. He would better understand the “market borrowing” requirements of the Central Government as well as the State Governments (including the quantitative borrowing limits placed on them). He would be aware about the back-door borrowings from the banks tapped by the State Governments, through their Boards and Corporation, against their guarantees. He’d understand the political necessity of persisting with the Small Savings Schemes and PPF.

7. He would appreciate the trade-off between interest-rates and inflation, with due regard to growth targets and the fiscal deficit.

8. He’d understand the importance of Bank Credit, having interacted with District Level Bankers Committees and State Level Bankers Committees. He would also understand the importance of recovery effected by the District Administration on behalf of the Banks under the SARFESI Act.

9. He’d be expert in being politically correct, giving bites to the waiting TV crews and understand that often the form and packing is more important than the content.

10. An IAS officer would be seen as a neutral man by the bankers, markets, RBI and the Government, since he’d come with no ideological tab.

Summing Up: The Generalist-Specialist Debate in Context

The appointment of a serving IAS officer, Sanjay Malhotra, to succeed another former IAS officer, Shaktikanta Das, following Das’s remarkable six-year tenure at the helm of the RBI, highlights the enduring significance of India’s steel frame in pivotal national roles. Malhotra’s tenure as Revenue Secretary, where he oversaw both direct and indirect taxation, equips him with a comprehensive understanding of fiscal mechanisms, providing him with a distinct advantage as he takes charge of the central bank.

While the Indian Administrative Service may sometimes be perceived as under strain amid evolving governance dynamics, the demand for its brightest talents and exceptional outliers remains steadfast. Prime Minister Narendra Modi’s choice to entrust former IAS and IFS officers with key ministerial portfolios further underscores the invaluable expertise, leadership, and versatility that these officers bring to the highest echelons of public service.

The case for IAS officers leading the RBI, as demonstrated by Das’s successful innings, lies in their unique blend of caution, diplomacy, and strategic foresight. These qualities, coupled with their ability to balance autonomy with accountability, enable them to navigate the complex interdependence of fiscal and monetary policy. Whether through a risk-averse approach, an insider’s grasp of government mechanics, or the ability to harmonize institutional objectives with national priorities, IAS officers have proven their mettle as central bank governors.

The latest appointment reaffirms the enduring importance of administrative leadership in steering India’s economic future, even amidst evolving challenges and expectations. This includes the recent appointment of another distinguished IAS officer, Girish Chandra Murmu, to the constitutional office of the Comptroller and Auditor General (CAG) of India, further highlighting the continued trust in the administrative cadre to helm crucial roles shaping the nation’s governance and accountability frameworks.