India's Fintech Revolution: A New Era of Innovation, Inclusion and Cybersecurity.

Overview of the Prime Minister's Address at the Global Fintech Fest 2024. We also highlight the Privacy Concerns and the Cybersecurity Measures Required to be Interwoven.

Prime Minister's Address at the Global Fintech Fest 2024

Prime Minister Narendra Modi's address at the Global Fintech Fest (GFF) 2024 in Mumbai on Friday (August 30) underscored the remarkable advancements India has made in the financial technology sector. In his 25-minute speech, delivered in Hindi, he highlighted the transformative impact of fintech on India's economy, financial inclusion, and global standing (video clip). Here is a detailed summary of the key points from his address.

India's Fintech Revolution

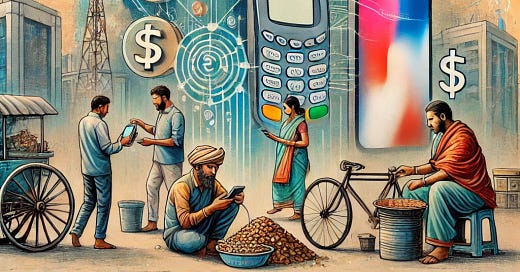

The Prime Minister proudly declared that India is experiencing a fintech revolution, significantly enhancing financial inclusion, driving innovation across the nation, and serving as a powerful vehicle for socio-economic empowerment. He emphasised that the diversity within India's fintech sector is as rich and varied as the country's cultural heritage, garnering admiration from international observers. This dynamic sector has emerged as a symbol of technological progress and inclusive growth, reinforcing India's position as a global leader in digital finance.

Financial Inclusion and Digital Infrastructure

PM Modi underscored the achievements of key government initiatives that have laid the groundwork for India's fintech success. He pointed out that the Jan Dhan Yojana has been instrumental in promoting financial inclusion, bringing millions into the formal banking sector. Furthermore, the Unified Payments Interface (UPI) was highlighted as a prime example of India's fintech innovation, enabling seamless digital transactions and empowering individuals financially. The Jan Dhan programme, in particular, has significantly boosted the financial empowerment as well as social dignity of women, contributing to broader socio-economic development.

Social Impact and Democratization

The transformation brought about by fintech goes far beyond technological advancements. The Prime Minister highlighted the profound social impact of these innovations, noting that fintech has played a pivotal role in democratising financial services. By making these services accessible to everyone, regardless of socio-economic status, fintech is helping to reduce inequality and significantly improve the quality of life for millions of Indians. Additionally, it has substantially cut transaction costs and accelerated transaction speeds to near-instantaneous levels, further enhancing convenience and efficiency for users.

Global Impact and Future Prospects

Looking beyond India's borders, Prime Minister Modi expressed confidence that the country’s fintech ecosystem would significantly enhance the ease of living on a global scale. He emphasised that India’s most substantial contributions to the global fintech sector are still ahead, indicating a future rich with innovation and leadership. India’s strong commitment to technological advancement and financial inclusion positions it as a crucial player on the world stage, with a fintech ecosystem that can serve as a model for other nations. The Prime Minister also commended the role of financial intermediaries and investment advisors, including Chartered Accountants, and urged them to actively promote and encourage the widespread adoption of digital payments, further embedding the culture of digital finance.

Key Statistics and Achievements

The Prime Minister shared impressive statistics to highlight India's fintech achievements:

The fintech industry has received over $31 billion in investments over the last decade.

The growth of startups in the sector has surged by 500%.

Broadband users in India have expanded from 60 million to 940 million.

Over 530 million people now have Jan Dhan accounts.

Approximately half of the world's digital transactions are now conducted in India.

Government Initiatives and Future Focus

PM Modi outlined several government initiatives that have supported the fintech sector's growth and will continue to do so in the future:

The Digital Personal Data Protection Act has been implemented to safeguard user data and privacy.

The government has allocated Rs 1 lakh crore for research and innovation, emphasising sustainable economic growth and green finance.

There is a strong focus on enhancing digital literacy and strengthening cybersecurity to protect citizens and businesses from cyber threats.

Privacy and Cybersecurity Concerns in India's Fintech Landscape

While the Prime Minister's speech celebrated India's remarkable achievements in fintech, it also indirectly highlighted the critical need for robust cybersecurity measures. Although not explicitly mentioned, his remarks underscored the importance of safeguarding the digital financial landscape as fintech continues to revolutionise financial services. This rapid growth brings with it significant challenges related to privacy and cybersecurity, which must be addressed to ensure the protection of citizens' financial information.

The Current Regulatory Landscape

India's fintech ecosystem is regulated by multiple bodies, each with specific roles and responsibilities. The Reserve Bank of India (RBI) is a key regulator, overseeing financial aspects of fintech companies, particularly those involved in payment systems and digital lending. To ensure cybersecurity, the RBI has implemented stringent guidelines, including mandatory security audits, vulnerability assessments, and penetration testing for fintech firms. However, as highlighted by the Prime Minister, there is a pressing need for even more comprehensive measures to counter cyber fraud and promote digital literacy among users.

While the RBI focuses on the financial side, the Ministry of Electronics and Information Technology (MeitY) is responsible for the digital and technological aspects of fintech operations. The Information Technology Act, 2000 provides the legal framework for addressing cybersecurity and data protection issues in India. Additionally, the proposed Digital Personal Data Protection Bill aims to strengthen data privacy regulations further. However, the rapid pace of fintech innovation often outstrips existing regulatory frameworks, creating potential vulnerabilities that cybercriminals can exploit.

This is particularly crucial in the realm of cryptocurrencies, where existing regulations are not only patchy but often inadequate from a consumer protection perspective. Moreover, the regulatory gaps also pose significant concerns regarding national security and income tax compliance. Ensuring robust oversight and comprehensive regulation in this area is essential to safeguard consumer interests, protect national security, and ensure proper taxation.

The Need for Enhanced Cybersecurity Measures

To address these growing concerns, there is an increasing need for a more proactive approach to cybersecurity in the fintech sector. A dedicated authority or a collaborative effort between existing regulatory bodies could be established to conduct independent due diligence on fintech applications from a cybersecurity perspective before they are made available to Indian citizens. This could involve rigorous testing of applications for potential vulnerabilities, ensuring robust encryption standards, and verifying the implementation of multi-factor authentication systems.

Without comprehensive regulation, the presence of multiple regulatory bodies with overlapping jurisdictions could leave significant gaps, where certain areas fall under the purview of none. This regulatory ambiguity creates fertile ground for sophisticated hackers to exploit, targeting not only innocent users but also those who are relatively digitally savvy. Ensuring clear, coordinated oversight is essential to protect all users and maintain the integrity of the fintech ecosystem.

Furthermore, regular audits and real-time monitoring of fintech platforms could help detect and prevent potential security breaches, identity theft attempts, and unauthorized access to financial information. By implementing such measures, India can foster a secure fintech ecosystem that balances innovation with the protection of its citizens' digital and financial well-being.

In Summary

Prime Minister Narendra Modi's address at the Global Fintech Fest 2024 highlighted the remarkable growth of India's fintech sector and its potential to transform lives both within the country and globally. However, as the sector continues to expand, it is crucial to address the associated privacy and cybersecurity concerns. By strengthening regulatory frameworks, enhancing digital literacy, and implementing robust cybersecurity measures, India can ensure that its fintech revolution benefits all citizens while safeguarding their personal and financial information.

Citations

Scrut.io

VCCircle

LinkedIn

PWC

Burgeon

Inc42

Business Standard

The Hindu Business Line