Income Tax Reforms in Budget 2024-25: Some Gains, Some Pains

Part 2 in our series, post-Budget. Direct Taxes in the Budget 2024-25: A Comprehensive Analysis.

Income Tax Relief: Mixed Bag in Budget 2024-25

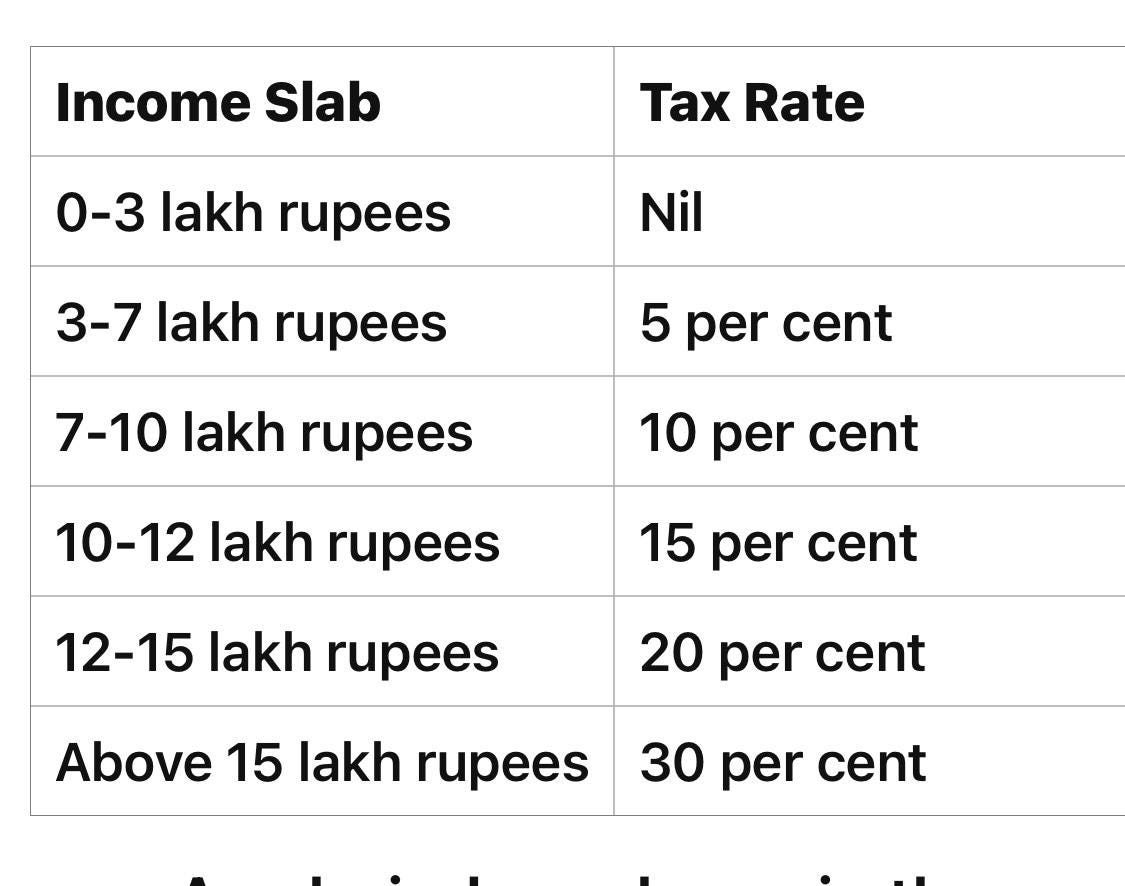

The Budget Estimates for 2024-25 introduce significant changes in the direct tax regime, aiming to simplify the tax structure, provide relief to the salaried class and pensioners, and enhance revenue generation. Given the widespread impact on common taxpayers, especially the salaried class and pensioners, this segment of the Budget is particularly noteworthy. The new tax rates and the table are presented at the beginning of the article to highlight the most important part of the Budget as it relates to the common taxpayer.

By and large progressive, the provisions of enhanced Securities Transaction Tax (STT) and upward adjustments in Long-Term Capital Gains (LTCG) and Short-Term Capital Gains (STCG) may not be well-received by some investors, particularly those active in the stock market. The increased standard deduction for salary and pension will provide a modicum of relief to the salaried class, although it may not entirely meet their expectations.

a.) Revised Personal Income Tax Rates

The new tax regime for personal income tax has been revised to benefit a broad spectrum of taxpayers. The revised rates are as follows:

A salaried employee in the new tax regime stands to save up to ₹ 17,500 in income tax due to these changes.

b.) Increased Standard Deduction

The standard deduction for salaried employees is proposed to be increased from ₹ 50,000 to ₹ 75,000. Similarly, the deduction on family pension for pensioners is proposed to be enhanced from ₹ 15,000 to ₹ 25,000. This measure is expected to provide relief to approximately four crore salaried individuals and pensioners.

Simplification of Taxation and Efforts to Reduce Litigation

a.) Comprehensive Review of the Income-tax Act, 1961

A comprehensive review of the Income-tax Act, 1961, has been announced to make the Act concise, lucid, and easy to read and understand. This review aims to reduce disputes and litigation, thereby providing tax certainty to taxpayers and reducing the demand embroiled in litigation. This review is proposed to be completed in six months.

b.) Simplification for Charities and TDS

The two tax exemption regimes for charities are proposed to be merged into one. The TDS rate structure is also being simplified:

The 5 per cent TDS rate on many payments is being merged into the 2 per cent TDS rate.

The 20 per cent TDS rate on the repurchase of units by mutual funds or UTI is being withdrawn.

The TDS rate on e-commerce operators is proposed to be reduced from 1 per cent to 0.1 per cent.

Moreover, credit of TCS is proposed to be given in the TDS to be deducted on salary. Delays in the payment of TDS up to the due date of filing the statement will be decriminalized, and a standard operating procedure for TDS defaults will be provided.

c.) Simplification of Reassessment (reopening old case)

The provisions for reopening and reassessment are proposed to be simplified. An assessment can be reopened beyond three years from the end of the assessment year only if the escaped income is ₹ 50 lakh or more, up to a maximum period of five years. In search cases, the time limit is reduced from ten years to six years before the year of the search.

d.) Simplification and Rationalisation of Capital Gains

Capital gains taxation is set to be simplified:

Short-term gains on certain financial assets will attract a tax rate of 20 per cent, while all other financial and non-financial assets will continue with the applicable tax rate.

Long-term gains on all financial and non-financial assets will attract a tax rate of 12.5 per cent.

The exemption limit of capital gains on certain financial assets will be increased to ₹ 1.25 lakh per year.

Listed financial assets held for more than a year will be classified as long-term, whereas unlisted financial assets and all non-financial assets must be held for at least two years to be classified as long-term.

Unlisted bonds and debentures, debt mutual funds, and market-linked debentures will attract tax on capital gains at applicable rates, irrespective of the holding period. This is the single most important measure to discourage the investors from pulling out their funds from the bank FDRs and investing them in such debt-instruments.

Enhancing Tax Payer Services and Reducing Litigation

a.) Digitalisation of Tax Payer Services

All major taxpayer services under GST and most services under Customs and Income Tax have been digitalised. The remaining services will be digitalised and made paperless over the next two years.

b.) Addressing Litigation and Appeals

To dispose of the backlog of first appeals, more officers will be deployed. The Vivad Se Vishwas Scheme, 2024, is proposed for the resolution of certain income tax disputes pending in appeal. Monetary limits for filing appeals related to direct taxes, excise, and service tax in various courts will be increased to ₹ 60 lakh, ₹ 2 crore, and ₹ 5 crore respectively.

Promoting Employment and Investment

a.) Support for Start-ups and Foreign Investment

The so-called angel tax for all classes of investors will be abolished to bolster the Indian start-up ecosystem. This was virtually a unanimous demand by the startup founders, angel investors as well as institutional investors and the Venture capitalists (VCs).

A simpler tax regime for foreign shipping companies operating domestic cruises will be introduced to promote cruise tourism.

Safe harbour rates will be provided for foreign mining companies selling raw diamonds in India to support the diamond cutting and polishing industry.

The corporate tax rate on foreign companies will be reduced from 40 per cent to 35 per cent. Although this rate remains higher than that for domestic companies, it narrows the gap, especially since corporate income tax rates for domestic companies were slashed in 2019 while those for foreign companies were left unchanged. This reduction is expected to spur Foreign Direct Investment (FDI) and also benefit existing foreign companies operating in India.

Deepening the Tax Base

To deepen the tax base, the Security Transactions Tax on futures and options of securities is proposed to be increased to 0.02 per cent and 0.1 per cent respectively. Additionally, income received on the buyback of shares will be taxed in the hands of the recipient.

Other Noteworthy Proposals

The deduction of expenditure by employers towards NPS is proposed to be increased from 10 per cent to 14 per cent of the employee’s salary.

Non-reporting of small foreign assets up to ₹ 20 lakh will be de-penalized under the Black Money Act.

Withdrawal of the equalization levy of 2 per cent and expansion of tax benefits to certain funds and entities in IFSCs.

Immunity from penalty and prosecution to benamidar on full and true disclosure to improve conviction under the Benami Transactions (Prohibition) Act, 1988.

Revenue Implications

As a result of these proposals, revenue of about ₹ 37,000 crore – ₹ 29,000 crore in direct taxes and ₹ 8,000 crore in indirect taxes – will be forgone while revenue of about ₹ 30,000 crore rupees will be additionally mobilized. Thus, the total revenue forgone is about ₹ 7,000 crore annually.

In Summary— satisfactory but not satisfying

The Budget Estimates for 2024-25 present a progressive approach towards direct taxation, aiming to simplify the tax structure, provide relief to the salaried class and pensioners, and enhance revenue generation. While the increased standard deduction and revised tax rates offer some relief, the provisions of enhanced Securities Transaction Tax (STT) and adjustments in capital gains taxation may not be well-received by certain classes of investors. The salaried class may find the new proposals satisfactory but not entirely satisfying, although they cannot claim that there is nothing in the Budget for them. Overall, the proposals reflect a balanced approach to fiscal management, striving to promote economic growth, reduce litigation, and enhance taxpayer services. One hopes the new tax code arising from the comprehensive review of the Income Tax Act, 1961, comes out within the stipulated six months as this is the single most important reform that remains to be implemented.