Hindenburg's Explosive Reply to SEBI Show-cause Notice: Renewed Allegations Against the Adani Group

Hindenburg's blog post accuses SEBI of going soft on Adani Group, while failing to protect investors. The US short-seller Vows to Pursue the Matter, Despite Intimidation.

Hindenburg’s Reply to SEBI Notice

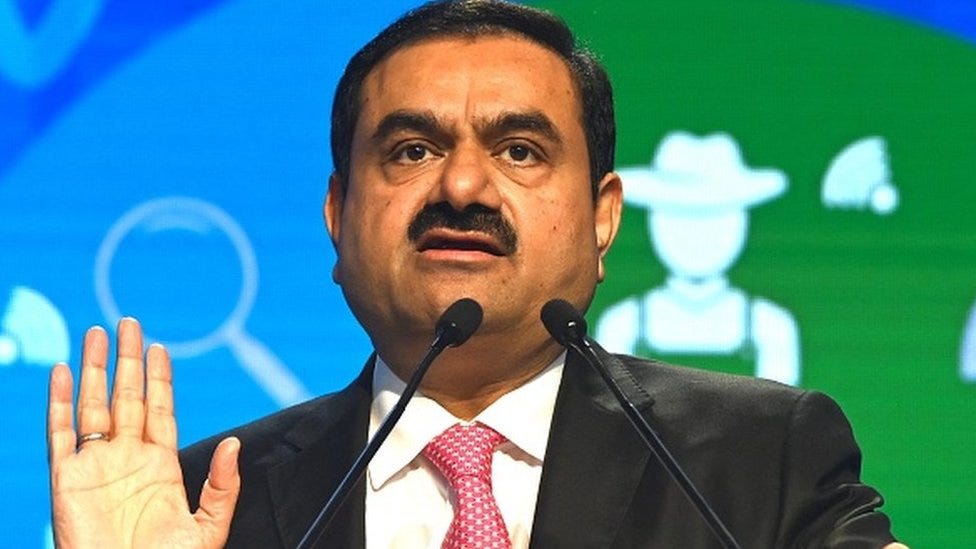

On 1st July 2024, Hindenburg Research, an overseas firm, posted a detailed and verbatim public response to SEBI's show-cause notice on its official blog, reigniting the controversy that had already shaken the equity shares of the Adani Group companies, apart from rocking the broader equity markets. Their initial report, alleging serious wrongdoings, including insider trading, published in January 2023, had created tumultuous volatility not only in the Indian stock markets but also within the political sphere, leading to widespread debate and scrutiny.

Hindenburg Accuses SEBI of Enabling Adani's Fraud

In a scathing response to India's market regulator SEBI notice dated 27th June, 2024, the US short-seller Hindenburg Research has now accused the watchdog of neglecting its duty and aiding Adani Group, after SEBI issued a show-cause notice alleging Hindenburg's report on the Adani Group contained misleading statements.

SEBI Found No Factual Errors, Only Trivial Issues: Hindenburg

Hindenburg claims that after a 1.5 year probe into their 106-page report on Adani, SEBI was unable to identify any factual inaccuracies. Instead, the regulator took issue with trivial things like Hindenburg's use of the word "scandal" to describe prior fraud charges against Adani, and Hindenburg quoting a source who alleged SEBI is corrupt. "As far as alleged 'inaccuracies' with our research, that was all SEBI came up with: nothing," Hindenburg wrote. "We encourage readers to review the notice for themselves and draw their own conclusions."

Over 40 Media Investigations Corroborated Hindenburg's Findings

Hindenburg pointed out that in the months since its initial report, over 40 independent and reputed media investigations, both within India and abroad, have corroborated and dilated upon their findings of suspected fraud and malfeasance at the Adani Group of companies. Meanwhile, the Adani corporate conglomerate has still failed to directly address the substance of the allegations, instead offering blanket denials.

SEBI Accused of Protecting Perpetrators Over Investors

"In our view, SEBI has neglected its responsibility, seemingly doing more to protect those perpetrating fraud than to protect the investors being victimized by it," Hindenburg stated. The short-seller accused SEBI of attacking those who expose wrongdoing while shielding powerful businessmen like Adani from scrutiny. Hindenburg noted that SEBI's notice conspicuously failed to name Kotak Bank, which created the offshore fund structure used by Hindenburg's investor partner to bet against Adani. Kotak's Founder Uday Kotak personally led SEBI's 2017 Committee on Corporate Governance, it pointed out.

Hindenburg Refutes Claims of Massive Profits

The research firm also used the post to refute media reports suggesting they made massive profits from their Adani short position. Hindenburg said it had only one investor partner, and after accounting for legal and research expenses over a two-year investigation, they expect to barely break even on the Adani short.

Recapitulation

In January 2023, U.S. short seller Hindenburg Research released a report accusing the Adani Group of stock manipulation and financial fraud. This triggered a massive selloff in Adani stocks, erasing over $150 billion in market value. India's market regulator SEBI initiated a probe into the allegations against Adani, with the Supreme Court overseeing the investigation.

Core Findings in Hindenburg’s Initial Report

Hindenburg Research's report had purportedly provided evidence of a vast network of offshore shell entities controlled by Gautam Adani’s brother, Vinod Adani, and close associates. The report detailed how billions were surreptitiously moved through these entities into and out of Adani public and private entities, often without related-party disclosures. Additionally, it described how a network of opaque offshore fund operators helped Adani evade minimum shareholder listing rules, substantiated by numerous public documents and interviews. Following the report, in August 2023, "Big-4" auditor Deloitte resigned from its role as statutory auditor for Adani Ports, citing undisclosed related-party transactions flagged in the report.

Adani’s Relationship with SEBI

The report claimed that this confidence in navigating regulatory scrutiny may be derived in part through Adani’s relationship with SEBI top-brass. Gautam Adani met the SEBI Chairperson Madhabi Buch twice in 2022, becoming “the first high profile businessman” to do so, according to The Hindu Business Line. One of those meetings was to discuss Adani’s $10.5 billion acquisition of cement companies ACC and Ambuja, where, according to Reuters, SEBI had specifically been examining the offshore special purpose vehicles used to fund the transaction, which were later revealed to be linked to Vinod Adani. The second meeting, reportedly in October 2022, disclosed “no specific agenda” per an earlier Right To Information (RTI) request.

Supreme Court Verdict

On January 3, 2024, nearly a year after the Hindenburg report, the Supreme Court ruled that the Adani Group did not need to face additional investigations beyond SEBI's ongoing scrutiny. The Apex Court dismissed requests to transfer the probe to other agencies like the CBI or set up a special investigation team, reposing faith in SEBI to handle the matter. The Supreme Court directed SEBI to complete its investigation into Adani within three months, noting that 22 out of 24 investigations into alleged violations by Adani had already concluded by then.

Implications of the Apex Court Decision

The Supreme Court verdict is seen as a relief for Adani, limiting the regulatory scrutiny the group faces. Adani called it a confirmation that "truth has prevailed." However, the court order did not give Adani a complete clean chit, as SEBI's investigations are still ongoing. As her the Hindenburg’s latest reply, over 40 media investigations have corroborated Hindenburg's findings since the initial report, revealing further evidence of fraud and irregularities at Adani. The controversy is thus far from settled, with the regulator yet to pronounce its final verdict. How SEBI handles the high-profile case could have major implications for corporate governance standards in India.

SEBI's Actions Send Wrong Message: Hindenburg

In its latest reply, Hindenburg has argued SEBI's actions in the Adani case send a message to Indian companies that stock manipulation and fraud carry little risk, while investors are told they "have no real protection from fraud." The US short-seller vowed to continue exposing malfeasance despite the intimidation efforts. In conclusion, Hindenburg's sharp rebuttal accuses SEBI of turning a blind-eye to Adani's alleged fraud, if not actively facilitating it, while failing to protect investors. With the short-seller standing by its initial findings and dozens of media probes raising further questions about Adani, the onus is now on regulators to prove they can effectively police India's markets and corporate giants. This is essential if India has to retain the confidence of both the domestic as well as the overseas investors.

Political Implications and Future Outlook

The reference to the Adani Group during the course of the Lok Sabha elections by both the BJP top leadership and the opposition Congress party leaders had undoubtedly heated the political landscape. Hindenburg’s bombshell reply, made public on the day the newly-constituted Lok Sabha meets to adopt the "Vote of Thanks" on the President's address, is sure to provide ready ammunition for the opposition benches to embarrass and pin down the NDA-coalition government led by PM Modi. While the opposition's demand for a Joint Parliamentary Committee (JPC) on the Adani Saga or the stock market semi-crash based on the exit polls before the Lok Sabha results may not be acceded to, one thing is certain: this matter is not going to die anytime soon. As a political leader put it, "Not only the weather, it's also the political climate that has changed."

DISCLAIMER: This article is primarily based on the reply posted by Hindenburg Research on its website on 1st July 2024 and supplemented with information from reputable news outlets. We are not in a position to personally verify the accuracy of the contents or the allegations contained therein.

If you believe this article would interest someone you know, please feel free to share it anonymously (for us), using any platform that you prefer.

Based on a comprehensive search of major Western media outlets, here is a summary of how they have covered Hindenburg Research's response to the show cause notice issued by India's market regulator SEBI regarding their report on the Adani Group:

## Hindenburg Accuses SEBI of Aiding Adani, Calls Allegations 'Nonsense'

In a scathing blog post on July 1, 2024, Hindenburg Research denied allegations from SEBI that its report on Adani contained misleading information meant to deceive readers. The U.S. short seller called SEBI's 46-page show cause notice "nonsense" and an attempt to silence critics who expose fraud by the powerful in India.[1][3][5][7][9][10]

Hindenburg accused SEBI of neglecting its duty and doing more to protect perpetrators of fraud than investors. It alleged the regulator had "surreptitiously aided" Adani after the January 2023 report.[3][5][9]

## New Details on Hindenburg's Adani Short Position

SEBI's notice revealed Hindenburg worked with one investor partner, U.S. hedge fund Kingdon Capital Management, on the Adani short trade.[3][4][10] A Mauritius fund set up by India's Kotak Mahindra Bank created the offshore structure Kingdon used to short Adani, providing new details on these trades.[3][4][5][8][10]

However, Hindenburg said it made only $4.1 million in gross revenue from the Adani short and $31,000 from its own short position in Adani bonds. Net of legal and research costs, it barely expects to break even, refuting claims of a massive windfall.[3][5][9][11]

## Hindenburg Cites 40+ Media Probes Backing its Findings

Hindenburg argued that since its initial report, over 40 independent media investigations have corroborated its findings of suspected fraud at Adani. Meanwhile, the Indian conglomerate has still not directly addressed most of the allegations, instead offering blanket denials.[1][3][5][8][9]

## Adani Stocks Shrug Off Hindenburg Rebuttal

Unlike the crash after Hindenburg's January 2023 report, Adani Group stocks largely held steady following the short seller's sharp response to SEBI. Adani company shares closed flat to marginally lower on July 2, suggesting investors gave a cold shoulder to Hindenburg's latest salvo.[4][6][9]

In summary, Hindenburg's strong rebuttal to SEBI has brought its clash with Adani back into the spotlight, while revealing new details about its short trade. But the impact on Adani's market value has been limited so far compared to the initial report. The focus is now on SEBI to see if it can conclusively prove wrongdoing by either Adani or Hindenburg as it wraps up its long-running probe.[3][4][5][6][7][8][9][10][11]

Sources

[1] paste-2.txt https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/1437275/d90601fa-427e-4981-8a85-eea03640503e/paste-2.txt

[2] paste.txt https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/1437275/ad2c1242-71c8-4d6c-ae2d-ea1bebed41e6/paste.txt

[3] Hindenburg Made Just $4 Million From $153 Billion Adani Rout https://www.bloomberg.com/news/articles/2024-07-02/hindenburg-lashes-out-on-india-regulator-over-adani-report

[4] New twist in clash between US short seller Hindenburg and India’s Adani https://www.aljazeera.com/economy/2024/7/2/new-twist-in-clash-between-us-short-seller-hindenburg-and-indias-adani

[5] Adani Update – Our Response To India's Securities Regulator SEBI https://hindenburgresearch.com/adani-update-sebi/

[6] People Dislike Activist Short Selling - Bloomberg https://www.bloomberg.com/opinion/articles/2024-07-02/people-dislike-activist-short-selling

[7] Hindenburg denies Indian regulator's allegations on Adani short bet https://www.reuters.com/business/hindenburg-receives-show-cause-letter-indian-markets-regulator-2024-07-01/

[8] Hindenburg Questions SEBI's Response Over Adani - finews.asia https://www.finews.asia/finance/41620-hindenburg-adani-sebi-response

[9] Hindenburg Lashes Out on India Regulator Over Adani Report https://www.bloomberg.com/news/articles/2024-07-02/hindenburg-lashes-out-on-india-regulator-over-adani-report?cmpId=google

[10] Indian regulators allege Hindenburg's Adani report 'indulged in unfair trade practices' https://www.ft.com/content/ae104fce-0576-4ff0-a7ec-a0eed7849e97

[11] Hindenburg says it may break even on report that knocked $153 ... https://www.morningstar.com/news/marketwatch/2024070285/hindenburg-says-it-may-break-even-on-report-that-knocked-153-billion-off-adani