Government Allows Employee Participation in RSS Activities, Draws Opposition Critique

Rescinds the 1966 Directive, Conduct Rules that Permit Participation in NGO and Charitable Activities, and the Legal Structure and Status of RSS.

Government Employees and RSS Activities: A Detailed Analysis

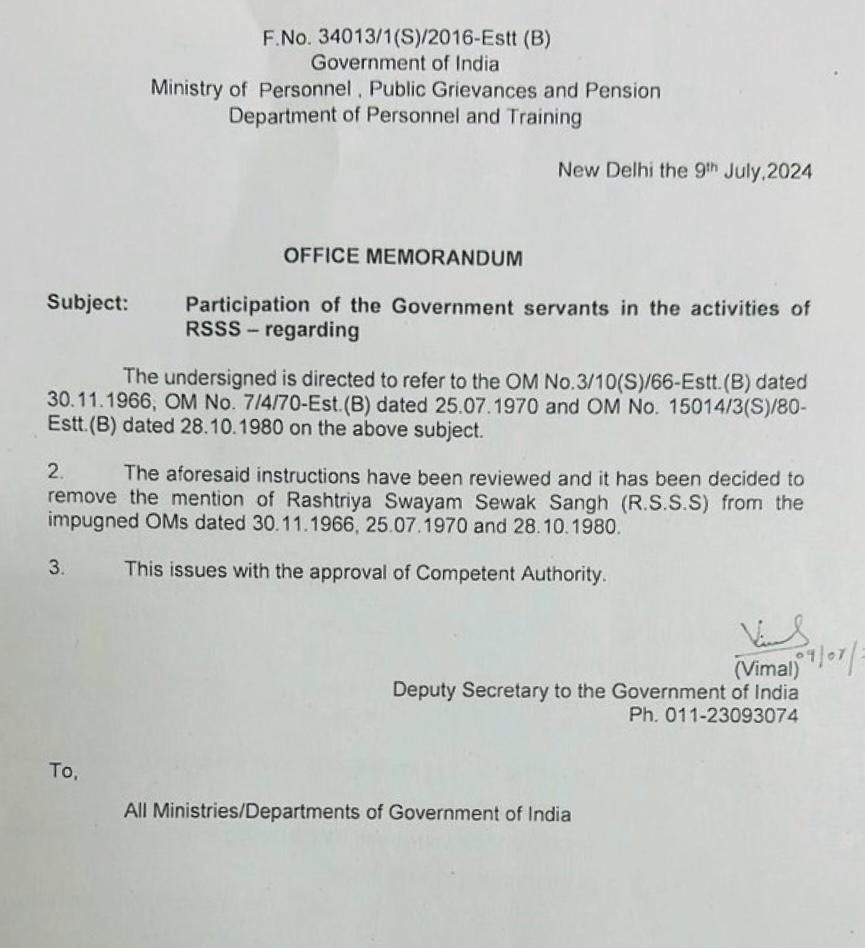

The recent decision by the Government of India to lift the ban, imposed in 1966, on government employees participating in activities of the Rashtriya Swayamsevak Sangh (RSS) has stirred significant controversy. This move has been lauded by supporters of the BJP and RSS as a correction of a historical oversight, while opposition figures, such as the former Odisha Chief Minister Naveen Patnaik and Shiv Sena (UBT) MP Priyanka Chaturvedi, have critiqued it as potentially compromising the impartiality of civil servants (video).

Central Civil Services (Conduct) Rules and NGO Participation

Under the Central Civil Services (Conduct) Rules, 1964, there are specific provisions that guide the participation of government servants in non-governmental organisations (NGOs) and charitable activities. The All India Services Conduct Rules have analogous provisions:

Key Provisions

Rule 15(2) allows government employees to:

Engage in honorary social or charitable work;

Undertake occasional literary, artistic, or scientific work.

Restrictions

Activities must not jeopardize India's sovereignty, integrity, public order, or morality.

Employees must not participate in any demonstrations that threaten national interests.

Charitable or honorary work should not conflict with official duties, and no salary should be accepted—only expense reimbursements are allowed.

Any private interests that could conflict with public duties must be disclosed.

These rules are designed to maintain the integrity and impartiality of civil servants while allowing them to contribute to society in personal capacities.

Detailed Analysis of RSS's Legal and Operational Structure

In response to the recent policy changes allowing government employees to engage in Rashtriya Swayamsevak Sangh (RSS) activities, it becomes imperative to thoroughly examine the organizational and legal structure of the RSS. This examination is not only timely but also essential for comprehending the implications of such a decision. The analysis below addresses specific queries about the RSS, focusing on its financial operations, legal registration, tax status, and internal governance mechanisms. This comprehensive overview aims to provide a clearer understanding of how the RSS is structured and operates within the legal framework.

a.) Bank Account and Financial Operations

There is ambiguity surrounding whether the RSS maintains an official bank account. This issue was spotlighted during the pandemic by an activist’s complaint, which alleged that despite not having a registered bank account, the RSS managed substantial financial transactions. This situation suggests that the RSS might utilize informal or non-traditional mechanisms for handling funds, though these claims are unverified and lack public financial documentation. It is also speculated that RSS members or volunteers might use personal bank accounts to manage funds on behalf of the organization, a practice that could potentially lead to legal complications regarding “benami” properties, where assets are held in one person's name but owned by another. This scenario complicates the financial transparency and legal standing of the organization.

b.) Legal Registration under the Societies Registration Act, 1860

The registration status of RSS under the Societies Registration Act, 1860, is ambiguous. Sources conflict, with one report citing a registration in Chandrapur (registration number 08-D 0018394), and another source referencing an earlier registration (number 113/1936-37). These conflicting reports, along with a lack of accessible official documents, create uncertainty about the true registration status of the RSS.

c.) Tax Classification under the Income Tax Act, 1961

The RSS's classification under the Income Tax Act, which defines an "Association of Persons" (AOP) as a taxable entity regardless of its objective to derive income, further complicates its fiscal identity. Judicial precedents indicate that RSS has been subjected to taxation, suggesting recognition as an AOP. Nonetheless, the current, explicit tax classification of RSS by the authorities remains inadequately documented and not fully transparent.

d.) Governance: Written Rules and Regulations

The presence of formal governance documents such as written rules, regulations, or a constitution for the RSS is not confirmed through public sources. The absence of such documentation in the public domain raises questions about the internal governance structures and the operational protocols of the RSS, not only for its members, volunteers and office-bearers but also for the public at large.

In Summary

While the extensive work done by the RSS, both nationally and globally, in promoting India and its civilizational values is significant, it is crucial that elementary questions about its structure, operations, and legal standing are publicly clarified by the RSS officially. Currently, these details are not sufficiently disclosed on the RSS's official website. The examination of the RSS in terms of its financial, legal, and operational framework presents a complex and incomplete picture. Each aspect—from financial transactions without a clear bank account, to uncertain registration details, ambiguous tax status, and undisclosed governance documents—highlights the need for greater transparency and authoritative information. This clarity is vital not only for public understanding but also for ensuring legal compliance, especially concerning the involvement of government employees with the organization.

Transparency in RSS Operations in Light of Government Circular

The Government of India’s recent circular, which permits its employees to engage with the Rashtriya Swayamsevak Sangh (RSS), albeit within the boundaries set by conduct rules, has cast a renewed spotlight on the workings of the RSS. Given the common perception of the BJP as the political extension of the RSS, the need for clear and accessible documentation becomes crucial. This transparency is essential to fully comprehend and assess the implications of government employees' involvement with an organization that holds substantial influence in India’s socio-political arena.

Without adequate transparency, critics of the RSS—not just opposition parties but broader detractors—may seize opportunities to challenge the central government and the RSS itself during the current parliamentary session, particularly in the context of the RSS leaders making politically nuanced statements. This situation underscores the importance of detailed public disclosure to mitigate potential controversies and maintain governmental integrity.

Citations

"Activist writes to ED, I-T Dept for probe into RSS funding," Hindustan Times. Link

"Revealed: RSS is already registered organisation in Chandrapur," Nagpur Today. Link

Twitter post by T.D.H. Nair. Link

"Income Tax Guide on Association of Persons," Income Tax Department, Government of India. Link

"Court ruling on RSS tax status," Indian Kanoon. Link

ਭਾਰਤ ਨੂੰ ਹਿੰਦੂ ਰਾਸ਼ਟਰ ਬਣਾ ਦਿੱਤਾ ਗਿਆ ਹੈ