From UPI to Global PayTech: How Tez Sparked Google Pay’s Rise

Powered by Digital India, UPI now drives half the world’s instant payments, as America’s FedNow and card rails lag far behind.

About the Author

Karan Bir Singh Sidhu is a retired IAS officer of the Punjab cadre and former Special Chief Secretary, Punjab. A gold medalist in Electronics and Communication, he writes at the intersection of digital payments, transaction costs, and the empowerment of ordinary citizens.

UPI, Google Pay, and the Digital Rupee Revolution

Most people don’t realise this: Google Pay began as an India-first experiment. When Google launched Tez in 2017, it wasn’t importing Android Pay. It was testing something entirely new—an app built specifically to run on the Unified Payments Interface (UPI), a homegrown Indian innovation that would quietly change global finance.

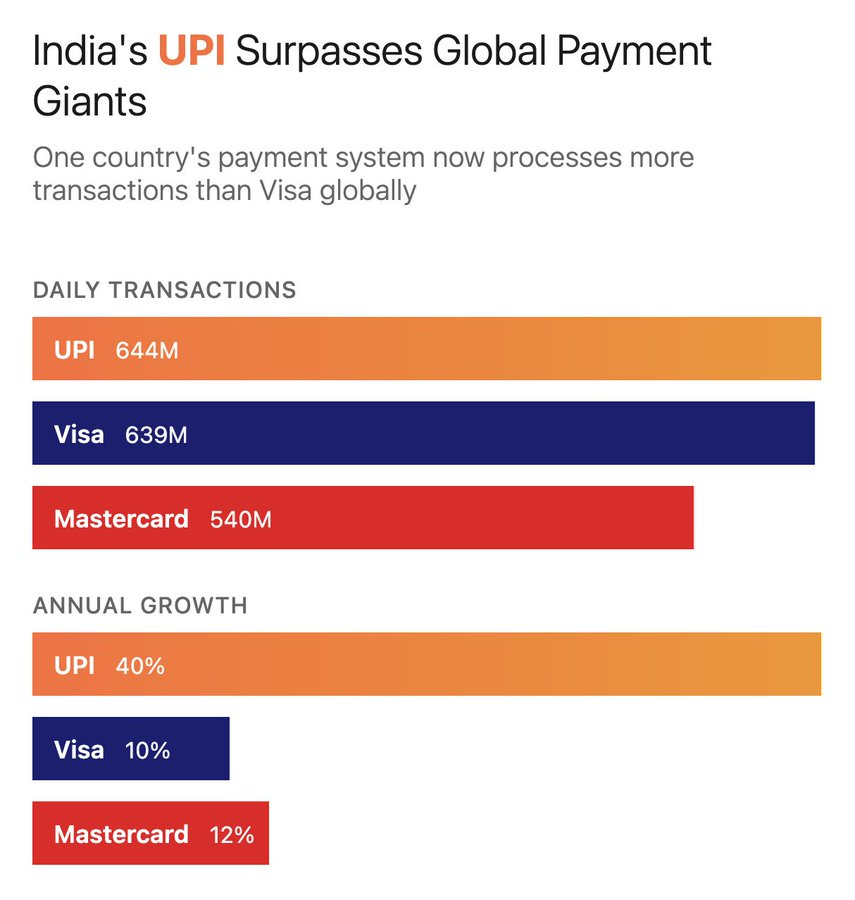

Today, that bet looks prophetic. UPI, launched in 2016, has leapfrogged the world’s most established payment systems. In August 2025, UPI processed an average of 644 million transactions a day, compared with VisaNet’s 639 million worldwide. A system serving primarily India now moves more money daily than Visa’s core global network.

As technologist Bilawal Sidhu, whose earlier tweet on blinkit went viral, put it :

“Most don’t know that Google Pay actually started as an app made for the Indian market to take advantage of UPI… UPI literally powers half of the world’s real-time transactions. My mind is blown.”

(link)

The Digital India Backdrop

UPI didn’t spring from nowhere. It was seeded in the Digital India initiative, launched in 2015 by Prime Minister Narendra Modi. The mission: to transform India into a digitally empowered society and knowledge economy.

Digital India focused on three pillars—digital infrastructure, digital services, and digital literacy. Aadhaar gave every Indian a digital identity. Cheap mobile data and near-universal connectivity brought smartphones within reach. NPCI (the National Payments Corporation of India) created the interoperable rails. The result was a payments ecosystem that democratised access, even for the smallest merchants and the poorest households.

UPI became the jewel in this crown.

How Google Read the Signs

When Google studied the Indian market in 2017, it noticed something unusual. Instead of mimicking credit-card-heavy economies, India was leapfrogging straight to mobile-first, bank-linked instant payments. Rather than grafting Android Pay onto this landscape, Google built Tez, a UPI-native app.

Tez wasn’t flashy; it was functional. It even used Audio QR, an ultrasonic technology to transfer money between phones without NFC chips. Within five weeks, it had 8.5 million downloads and had processed 30 million transactions.

By 2018, Tez had been rebranded as Google Pay and integrated into Google’s global payments strategy. But its India-first DNA remained. What started as a small experiment in New Delhi became a blueprint for digital payments worldwide.

Numbers That Stun

The statistics tell the story:

UPI daily transactions (Aug 2025): ~644 million

VisaNet daily transactions (FY2024): ~639 million

Global real-time share: UPI accounts for nearly half the world’s instant payments

And unlike Visa or Mastercard, which charge merchants significant fees, UPI transactions—especially for small amounts—are free. That “zero MDR” policy, combined with simple QR codes, explains why everyone from high-end malls to street vendors adopted it.

A Duopoly at the Front End

UPI is open by design, but the app layer has consolidated. By mid-2025:

PhonePe: 48.6% market share

Google Pay: 35.5%

Paytm: 8.5%

BHIM (government app): ~0.2%

PhonePe and Google Pay together control over 80% of UPI transactions. Regulators worry about concentration, but for users the duopoly has meant slick apps, constant innovations, and reliability at scale.

Beyond Payments: The Digital Rupee Arrives

If UPI made money move like a message, the RBI’s digital rupee (e₹) is making money behave like software.

Launched in pilot form in 2022 and steadily expanded, the digital rupee is India’s central bank digital currency (CBDC). Unlike UPI, which moves money between banks, e₹ is digital cash—legal tender issued by the RBI, stored in digital wallets, and spendable offline or online.

Why does this matter?

Offline power: e₹ works even without internet, crucial in rural areas.

Programmability: payments can carry conditions—say, a subsidy usable only for fertiliser.

Interoperability: e₹ is being integrated into the same QR ecosystem as UPI, so merchants don’t need new hardware.

By March 2025, circulation had crossed ₹1,000 crore, with more than 60 lakh users onboarded across 17 banks. The RBI is also piloting cross-border corridors and allowing big third-party apps to distribute e₹ wallets—bringing the CBDC into the mainstream.

Petty International Payments: Do You Still Need a Card?

This is the real-world question. You’re travelling abroad. Can UPI replace your card for coffee, taxis, and museum tickets?

The answer: partly yes, partly not yet.

Yes, in some countries. India has struck UPI International partnerships with Singapore, UAE, France, Mauritius, Sri Lanka, Nepal, Bhutan, and others. Switch on “UPI International” in your app, scan a local QR, and your Indian bank debits you in INR at the FX rate. It works at select merchants, especially in tourist-heavy spots.

Yes, for cross-border remittances. The UPI–PayNow corridor between India and Singapore lets people send money instantly across borders—now live with 19 Indian banks. More such corridors are coming.

No, for now, in many cases. For hotel deposits, e-commerce, and in countries without UPI deals, you’ll still need debit or credit cards. Visa and Mastercard remain the fallback.

Not yet, for the digital rupee. While the RBI is exploring CBDC cross-border pilots, e₹ remains domestic for now. Think of it as digital cash at home, not yet spendable abroad.

So for petty payments overseas, UPI is becoming a handy option—but cards remain your safety net.

Why the World Should Care

UPI is no longer just an Indian success story. It’s a global case study in how public infrastructure, private innovation, and political will can combine to deliver outsized results. Its ingredients—government backing, open architecture, zero-cost adoption, Aadhaar-based KYC—offer lessons to any country grappling with financial inclusion.

Already, nations from Kenya to Brazil are studying the Indian model. NPCI’s international arm is advising central banks. And as e₹ matures, India may soon export not just a payment rail, but a template for the very future of money.

UPI’s Quiet Revolution—and What Comes Next

UPI’s rise is proof that revolutions don’t always begin in Silicon Valley; they begin with policy architects and engineers in Mumbai and Bengaluru solving everyday problems of cash, queues, and exclusion. That’s why a Google app that started life in India is now part of a system that moves half the world’s instant payments—and why the RBI’s digital rupee is the next big chapter, turning money into programmable, sovereign digital cash.

Setting the Global Digital Standard (While the US Lags)

India has already shaped global IT services and became a pharmacy to the world; now it’s exporting a financial architecture that could stand alongside SWIFT, Visa, and Mastercard as core money infrastructure. By contrast, the US Federal Reserve’s FedNow rail (launched in 2023) remains early-stage—handling a tiny fraction of national payments while everyday spend still runs predominantly over Visa and Mastercard. The revolution is in motion, and for the first time in modern history, India isn’t just adopting global financial standards—it’s creating them.

UPI is a great success story for India. Taking it international, opening it to more and more countries will make it more prone to cyber-crimes, particularly fake currency in the digital currency world. Hopefully the government and associated agencies continuously upgrade the security systems as well. World is waiting and wanting to see us failing, we have to be extremely careful about it. Detailed rigorous testing, positive, negative, and regression, for each field, each workflow step, must be conducted and the fall back procedures must be documented before expanding the scope of UPI, particularly to the western countries which are usually the targets of hackers from across the world.

Well documented and very informative 🙏