Economic Survey of India (2024-25): The Good, the Bad and the Ugly

The Economic Survey presents a mixed yet resilient picture of India's economy—one of undeniable progress, but also persistent challenges that require urgent attention.

Economic Survey 2024-25: A Balanced Appraisal

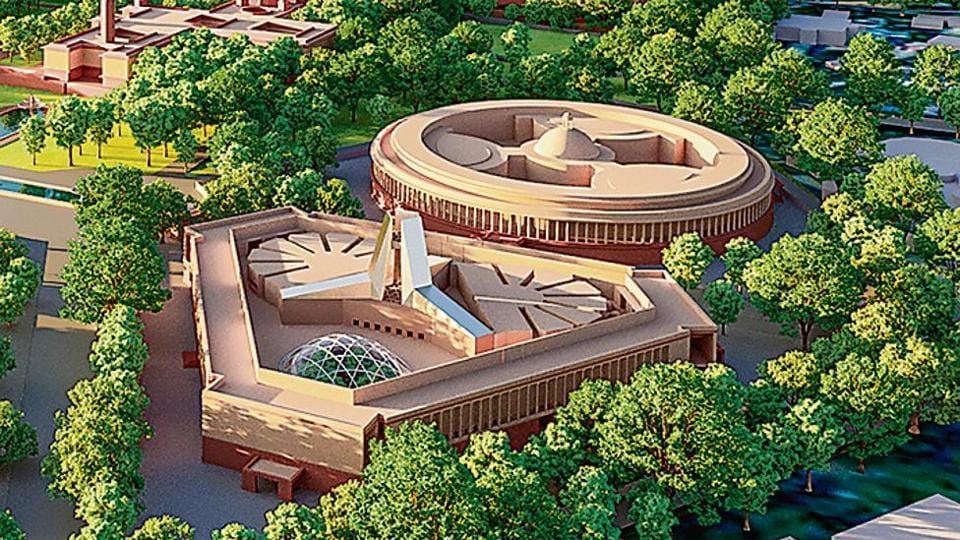

The Economic Survey 2024-25, released today on the opening day of the first session of Parliament and on the eve of the Union Budget, set to be presented on Saturday, February 1, 2025, offers a comprehensive assessment of India's economic performance and outlook amidst global uncertainties. As the nation strives to accelerate its growth trajectory, the survey underscores both achievements and challenges, shedding light on the complex forces shaping India's economic landscape.

In this analysis, we present a dispassionate appraisal—the good, the bad, and the ugly. The sections categorized as "bad" and "ugly" should not be seen as mere criticism but rather as areas demanding greater focus—issues that are often overlooked in mainstream discourse yet require urgent attention. However, before delving into this classification, it is essential to first examine three key economic parameters that impact every citizen of India: unemployment, inflation, and the depreciation of the Indian rupee.

1. Unemployment: A Persistent Challenge for India's Youth

India’s unemployment problem, particularly among its youth, remains a pressing concern. In 2023-24, the unemployment rate for individuals aged 15 years and above stood at 3.2%, marking a slight improvement from 3.3% in the previous year [365]. However, this figure masks deeper structural issues affecting young job seekers. The worker population ratio across states in 2023-24 highlights significant disparities, with some states struggling to generate adequate employment opportunities [366]. Despite various government initiatives aimed at skill development and entrepreneurship, the challenge of creating enough quality jobs for India's growing youth population persists. The transition from education to employment remains a critical hurdle, with a mismatch between acquired skills and industry requirements frequently cited as a major factor [400].

2. Inflation and Rupee Depreciation: Striking a Balance for Stability

India's inflation has shown signs of moderation but remains a key economic concern. In 2024, headline inflation eased globally, with India's core inflation also witnessing a downward trend [119]. However, food inflation, particularly driven by volatile prices of vegetables and pulses, continues to pose a challenge [121]. The Reserve Bank of India (RBI) responded with six consecutive rate hikes, pausing in April 2023 to evaluate their impact [8]. Simultaneously, the Indian rupee has experienced depreciation pressures, especially against the US dollar. Between April and December 2024, the rupee depreciated by approximately 3% against the USD [114]. While currency depreciation can potentially boost exports, it also creates inflationary pressures and challenges for import-dependent sectors.

3. Foreign Exchange Reserves: Strengthening Resilience Amid Global Uncertainty

India's foreign exchange reserves have demonstrated resilience despite global economic uncertainties. As of December 2024, these reserves stood at USD 617.2 billion, reflecting a strong buffer against external shocks [113]. The composition of reserves, including foreign currency assets, gold, and special drawing rights, provides flexibility in managing external challenges. However, policymakers must continuously balance reserve adequacy with the costs of maintaining high reserves, particularly in the face of global economic fragmentation and trade uncertainties.

Let us now delve into the good, the bad and the ugly of the Economic Survey.

The Good

Resilient Growth: Despite global headwinds, India's GDP growth remained close to its decadal average since FY15, demonstrating the economy's resilience. In H1 FY25, GDP growth stood at 6.0%, with the highest share of private consumption at 61.2% across all years.

Fiscal Discipline: The survey notes a strong focus on fiscal discipline, with the government maintaining a sound footing in union finances for FY25. The fiscal deficit has been contained at 5.9% of GDP, down from 6.4% in the previous year.

Infrastructure Development: Significant progress has been made in infrastructure sectors, with increased capital expenditure and improvements across railways, highways, and ports. The overall capex of the union government increased by 31.7% year-on-year in FY25 [165-172].

Digital Transformation: The survey highlights advancements in digital infrastructure, including the expansion of telecommunication networks and the success of initiatives like the Open Network for Digital Commerce. The number of internet subscribers per 100 population increased from 55.1 in September 2023 to 62.3 in September 2024 [176, 235].

Agricultural Performance: The agriculture sector has shown steady performance, with increased productivity and diversification into high-value crops like floriculture. The gross value added (GVA) in agriculture grew by 4.2% in FY25 [246-247].

The Bad

External Sector Vulnerabilities: The survey raises concerns about the sustainability of India's current account deficit, given global trade uncertainties and declining net foreign direct investment. The current account deficit widened to 2.8% of GDP in FY25 from 2.0% in FY24 [104-107].

Skill Mismatch: There is a notable mismatch between education, skills, and occupations, indicating a need for better alignment of the education system with industry requirements. Only 46.2% of the workforce has received formal or informal vocational/technical training [400].

R&D Spending: The survey points out that India's R&D spending as a percentage of GDP lags behind other major economies, calling for a significant increase in both public and private sector investment. India's R&D expenditure stands at 0.7% of GDP, compared to 3.1% in the US and 2.4% in China [205].

Climate Change Impacts: The increasing frequency of extreme weather events is affecting agricultural production and contributing to food price volatility. The number of heatwaves increased from 36 in 2022 to 46 in 2024 [123-124].

Regional Disparities: The survey reveals significant inter-state differences in industrialization levels and services sector development, highlighting the need for more balanced regional growth. The share of industrial GSVA in total GSVA ranges from 8.5% in Kerala to 52.8% in Gujarat [212-214].

The Ugly

Ultra-Processed Food Consumption: The survey raises alarm over the rapid increase in ultra-processed food consumption, which rose from about USD 900 million in 2006 to over USD 37.9 billion in 2019, posing serious health risks. This represents an annual compounded growth rate of over 33% [xxxv].

Mental Health Concerns: The survey acknowledges growing mental health issues, particularly in relation to work culture and lifestyle habits. About 14% of India's population reported suffering from mental disorders in 2024, up from 10% in 2020 [339-342].

Regulatory Complexity: The survey points out that excessive and complex regulations are hindering business growth and innovation, calling for significant deregulation efforts. India ranks 63rd out of 190 countries in the World Bank's Ease of Doing Business index [153-156].

Gender Gap in Labour Force Participation: Despite some improvements, the female labor force participation rate remains low, indicating persistent barriers to women's economic empowerment. The female LFPR stood at 37.2% in 2023-24, compared to 75.3% for males [371].

Environmental Challenges: The survey highlights ongoing issues with air pollution, particularly in urban areas, and the need for more effective measures to address this persistent problem. In 2024, 14 out of 20 most polluted cities in the world were in India [297].

A Cautious Optimism for the Road Ahead

In conclusion, the Economic Survey 2024-25 presents a mixed yet resilient picture of India's economy—one of undeniable progress, but also persistent challenges that require urgent attention. While advancements in digital infrastructure, fiscal prudence, and macroeconomic stability inspire confidence, the survey also highlights structural weaknesses in areas such as employment generation, research & development investment, and environmental sustainability. As India navigates an increasingly volatile global economic environment, the ability to balance growth with equity, innovation with inclusion, and stability with agility will determine the country’s long-term trajectory.

Precursor of the Union Budget?

With the Union Budget 2025 set to be presented by Finance Minister Nirmala Sitharaman on February 1, all eyes will be on whether the government moves beyond symbolic gestures and delivers meaningful relief to India's middle class—a segment that has long borne the weight of economic reforms and inflationary pressures. A bold, forward-looking budget that prioritizes job creation, tax relief, social security, and real income growth could reinforce the optimism that India's economic story deserves. The coming months will reveal whether policy intent translates into tangible impact, ensuring that India’s growth is not just high, but also broad-based and sustainable.

The RBI since 2022 has spent 200BN USD defending the rupees. It is showing up and the currency crisis evolving will likely damage domestic inflation and infrastructure companies. The government should stop denial to improve matters