Curious Case of Sharnam Jewels: ₹4,000 Crore Foreign Exchange Remittance Scam in Surat SEZ Exposed by ED.

The simple yet sophisticated method of remitting money abroad could trigger systemic supervisory reforms, given that SEZs are legally regarded as "deemed foreign territory."

Enforcement Directorate Cracks Down on ₹4,000 Crore Illegal Outward Remittance Case

A seemingly ordinary Surat-based jewellery firm, Sharnam Jewels Ltd (SJL), operating from a tiny 20x22 feet commercial office in a Special Economic Zone (SEZ), has been thrust into the spotlight by the Enforcement Directorate (ED), as reported by The Economic Times. The firm stands accused of siphoning over ₹4,000 crore in foreign exchange under the guise of importing goods, taking advantage of loopholes in SEZ regulations. While the scale of the scam is staggering in itself, the simple yet elegant modus operandi employed raises critical questions about the gaps and loopholes that need to be plugged to prevent unscrupulous operators from exploiting SEZ laws for money laundering, bypassing foreign remittances with Tax Collected at Source (CTS)/Customs Tariff Act (CTA), or facilitating the illegal transfer of unaccounted money abroad.

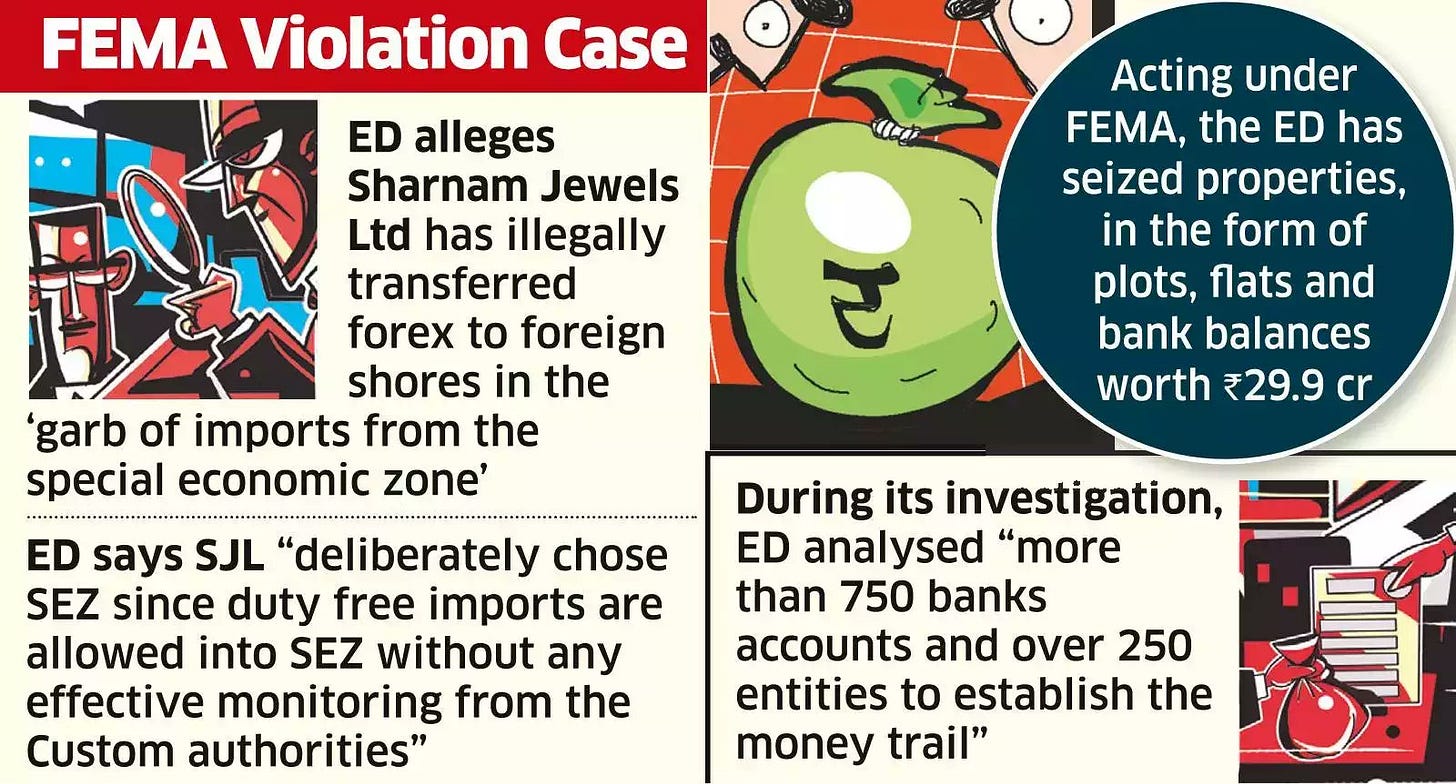

Allegations Against SJL and ED Action

The Enforcement Directorate has launched an extensive investigation into the matter, seizing properties—movable as well as immovable— worth ₹29.9 crore. Over 750 bank accounts and 250 entities connected to the firm have been scrutinized to trace the intricate money trail, including any potential “proceeds of crime”. SJL is believed to have utilized the SEZ route to bypass stricter customs oversight and carry out duty-free imports, thereby facilitating its illegal remittances.

The incident underscores the challenges in SEZ operations and raises concerns about the effectiveness of current regulatory frameworks, demanding a more robust oversight system.

Strengthening SEZ Regulations: A Comprehensive Approach

The fundamental principle of an SEZ is that it is treated as a “deemed foreign territory,” exempt from GST or IGST that would typically apply to a domestic entity. Additionally, there is no customs duty, which means there is minimal scrutiny for goods entering the SEZ. However, if these goods are not exported and are instead brought into the domestic Indian market, all applicable taxes come into effect. In this context, to safeguard the objectives of SEZs while addressing their vulnerabilities, a multifaceted regulatory approach is crucial.

A senior customs officer with prior experience in an SEZ told The KBS Chronicle: “The department’s entire focus is on monitoring goods exiting the SEZ into the Indian mainland. In this case, the scamsters exploited the other dimension—goods entering the SEZ, where physical inspection is minimal.” While he did not rule out the possible collusion of local customs staff, he noted that the loophole provided an easy avenue for manipulation.

With this foundational understanding, we propose the following measures to outline key strategies that strike a balance between facilitation and enhanced oversight.

Balancing Facilitation and Oversight

a.) Risk-Based Monitoring

A risk-based monitoring system would allow SEZ authorities to focus on suspicious transactions while maintaining streamlined procedures for low-risk activities. By categorising transactions based on risk levels, high-risk entities can be subject to rigorous checks without disrupting the overall efficiency of SEZ operations. In this case, the SJL scamsters appear to have evaded computer-based checks by keeping the value of each transaction below the threshold, while executing numerous smaller transactions across hundreds of bank accounts.

b.) Technology Integration

Advanced technologies, such as artificial intelligence and blockchain, offer a solution for real-time transaction tracking and anomaly detection. This integration would automate monitoring processes, enhance transparency, and ensure that potential violations are identified promptly without imposing unnecessary delays on legitimate businesses.

Regulatory Framework Enhancement

a.) Clear Guidelines for Intangible Goods

Given the rise of software and fintech services within SEZs, such as GIFT City in Gujarat, the need for specific guidelines regarding intangible goods and financial derivatives is clear. Tailored regulations would address the challenges posed by these sectors and reduce the risks of misuse or regulatory evasion.

b.) Collaborative Oversight

Forming a multi-agency task force that includes customs officials, financial regulators, and cybersecurity experts can strengthen oversight. This would be particularly relevant for complex financial and tech transactions within SEZs, ensuring that multiple regulatory bodies contribute to monitoring efforts.

Strengthening Customs Procedures

a.) Smart Customs Checks

The implementation of intelligent sampling techniques would allow customs authorities to focus on high-risk transactions. Data analytics could further enhance this process, ensuring operational efficiency while identifying potential violations without subjecting every transaction to exhaustive checks.

b.) Enhanced Training

Providing customs officials with specialised training on emerging technologies and sophisticated trade practices would enable them to better detect and prevent illegal activities. Such training would cover evolving financial instruments and trade mechanisms that may otherwise go unnoticed.

Financial Monitoring

a.) Integrated Financial Tracking

A centralised system that consolidates data from various financial institutions and regulatory bodies would offer better visibility into fund flows in and out of SEZs. Such a system would facilitate real-time tracking of cross-border transactions and help prevent financial crimes.

b.) Mandatory Reporting Mechanisms

Stricter reporting requirements for companies operating in SEZs are crucial. These requirements should mandate detailed disclosures of cross-border transactions, beneficial ownership, and the purpose of funds transferred abroad, creating greater transparency in financial operations.

International Cooperation

a.) Information Sharing Agreements

Cross-border financial crimes can be better tackled through international cooperation. Establishing robust information-sharing mechanisms with global partners would enhance the ability to track illicit financial flows and prosecute violators effectively.

b.) Global Best Practices

Regularly reviewing and adopting international best practices in SEZ management and financial oversight can help India strengthen its regulatory framework. Tailoring these practices to local contexts will ensure that SEZs remain attractive for legitimate businesses while deterring illegal activities.

Periodic Review and Adaptation

a.) Regular Policy Reviews

The rapidly changing global economic landscape necessitates periodic reviews of SEZ policies and regulations. By regularly assessing emerging loopholes and new risks, authorities can ensure that SEZs continue to serve their intended purpose without being exploited.

b.) Stakeholder Engagement

Involving industry stakeholders in discussions about regulatory measures is critical. Engaging with businesses operating in SEZs can provide valuable insights that inform practical, effective regulations, ensuring compliance while maintaining the SEZs' attractiveness.

In Summary: Balancing Growth and Integrity in SEZs

The Sharnam Jewels case highlights how a relatively simple yet effective scheme managed to evade detection, with the firm using the SEZ’s lack of stringent oversight to transfer ₹4,000 crore abroad under the pretext of imports. This operation flew under the radar until ED sleuths uncovered the elaborate scam. However, this ₹4,000 crore may just be the tip of the iceberg, as the Reserve Bank of India's (RBI) supervision of entities within SEZs is far less stringent compared to the scrutiny applied to outward remittances by scheduled banks, money changers, and NBFCs. To prevent such cases from recurring, adopting the outlined strategies—integrating technology, enhancing cross-agency collaboration, and adapting regulations—will allow SEZs to maintain their role in fostering economic growth while closing the loopholes that make them vulnerable to exploitation.