Beyond Interest Rates: Innovative Strategies for Inflation Control by the FED

Inflation Management in a Complex World: The Limitations of Interest Rates and the FED's Way Forward

Introduction:

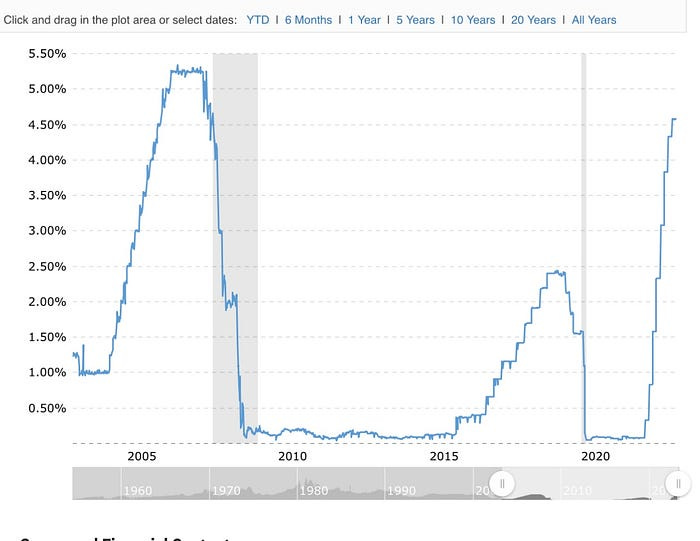

Today, on 22nd March, 2023 (11.00 PM IST; 2.00 PM ET), the US Federal Reserve System (FED), raised the interest rates from 4.75% to 5.0%. Although the hike is lower than the expectation of the markets, the interest rate still remains the highest since the year 2008. The chart below demonstrates the successive decisions made by the FED to increase interest rates, in its bid to curb inflation, not witnessed since before the global meltdown in the year 2008.

What is inflation?

Inflation is a sustained increase in the general price level of goods and services in an economy over time. It is a major macroeconomic challenge faced by governments worldwide. Both the Federal Reserve System (FED) in the United States and the Reserve Bank of India (RBI) have the responsibility of regulating the monetary policies of their respective countries to control inflation, maintain price stability and achieve economic growth. One of the conventional methods to check inflation is increasing bank rates by the central banks. However, there are certain limitations and unintended consequences of using this method.

In this piece we will explore the limitations as well as the unintended consequences of increasing bank rates, other factors that impact inflation, and additional measures that can be taken to fight inflation in the context of the United States and India.

Limitations and Unintended Consequences of Increasing Bank Rates:

Increasing bank rates is an effective way to reduce the amount of money circulating in the economy. When central banks raise interest rates, borrowing becomes more expensive, which reduces consumer spending and business investment. This reduction in spending and investment leads to a decrease in demand for goods and services, which in turn decreases the prices of these goods and services, and eventually reduces inflation. This is the underlying theoretical logic. However, there are limitations to the effectiveness of this method.

First, it takes time for the increased rates to have an impact on the economy. It may take several months or even years for the inflation rate to decrease.

Second, increasing bank rates can lead to a decrease in economic growth. When businesses and consumers have less access to credit, or more costly credit, they are less likely to invest and spend money, which can lead to a slowdown in economic activity.

Finally, increasing bank rates can lead to an increase in the value of the currency, which can negatively impact the export sector and increase the trade deficit.

Other Factors that Impact Inflation:

Apart from the monetary policy of central banks, there are several other factors that can also impact inflation. One of the significant factors is the government’s fiscal deficit. When the government spends more money than it earns, it has to borrow money from the central bank or from the open market, which increases the money supply in the economy and leads to inflation. This is in addition to the adverse effect of the borrowing by the theoretically more efficient private sector being “crowded out”.

The supply-side constraints can also lead to inflation. When there is a shortage of goods and services, their prices increase due to high demand, leading to inflation. Logistical issues such as those illustrated by the Ukraine War can add another dimension this.

The printing of notes by central banks — often fancily described as monetizing the deficit — can also contribute to inflation by simply increasing the money supply in the economy.

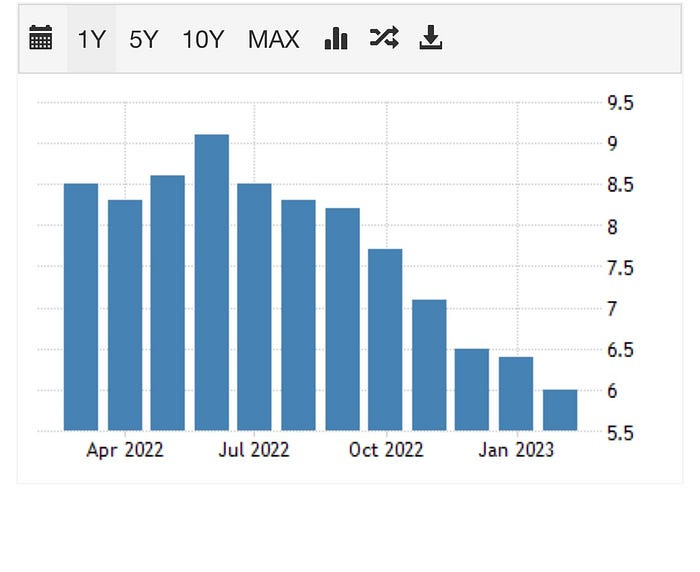

In the United States, the government’s fiscal deficit has been a significant factor contributing to inflation. The COVID-19 pandemic lead to a significant increase in government spending, which has resulted in a higher fiscal deficit. The US Federal Budget deficit is projected to total $1.4 trillion in 2023,and averages $2.0 trillion per year from 2024 to 2033, which is 5.5% of gross domestic product (GDP) for the year 2022, although its down from 14.9% in the year 2020 an d 12.4% in the year 2021, the two years that were severely impacted by the global pandemic. This increased spending has contributed to the rise in the inflation rate, which is currently estimated to be around 6.0%, down from a recent high of 9.1% in June, 2022. It still, however, remains unacceptably high for the US Treasury as well as the FED.

In India, supply-side constraints have been a significant factor contributing to inflation. The country has been facing a shortage of goods, particularly in the agriculture sector due to supply chain disruptions caused inter alia by the COVID-19 pandemic and also loss of crops on account of unseasonable rains or deficient monsoons, if not unexpected droughts. This shortage has led to an increase in the prices of essential commodities, contributing to inflation. The prices have not crawled back even after the end of the pandemic, and global prices of food grains are often blamed for this phenomenon.

Additional Measures to Fight Inflation:

Apart from increasing bank rates, there are several other measures that can be taken to fight inflation. One of the measures is to reduce government spending and increase taxes to reduce the fiscal deficit. Where the economy is already teetering on the brink of a recession, increasing taxes may not be a viable alternative. Another available measure is to increase the supply of goods and services to reduce the prices of essential commodities, such as oil products, by foregoing some portion of the government taxes. This will, however, increase the government borrowing and the fiscal deficit.

The government can invest in infrastructure, which can increase the supply of goods and services in the economy, leading to lower prices. This, however, is an inherently slow process and takes time to reflect in the macroeconomic indicators. The central bank can also use other monetary policy tools, such as open market operations and reserve requirements, to control the money supply in the economy. These measures can have a more direct impact on inflation than increasing bank rates.

In the United States, the Federal Reserve has already taken measures to fight inflation by increasing interest rates and tapering its bond-buying program. The Fed has also signaled that it will continue to monitor the economic data and adjust its policies accordingly. The US government is also taking steps to reduce the fiscal deficit by proposing tax increases and reducing spending. In India, the government has taken measures to increase the supply of essential commodities by investing in agriculture and infrastructure. The Reserve Bank of India has also increased interest rates in its bid to control inflation.

Conclusion:

In summary, inflation is a macroeconomic challenge faced by governments worldwide. Increasing bank rates is one of the conventional methods used by central banks to control inflation. However, there are limitations and unintended consequences of using this method. Other factors that impact inflation include the government’s fiscal deficit, supply-side constraints, and the printing of notes by central banks. To fight inflation, governments can take additional measures such as reducing spending and increasing taxes, increasing the supply of goods and services, and using other monetary policy tools. Both the United States and India are taking steps to fight inflation, and it remains to be seen how effective these measures will be in controlling inflation in the long run. It is crucial for policymakers to carefully monitor economic data and adjust their policies accordingly to achieve price stability and sustainable economic growth and work harmoniously with their respective central banks.

_________________________________________________________________

The author superannuated as Special Chief Secretary, Punjab in July, 2021, after nearly 37 years of service in the IAS.

He can be reached on kbs.sidhu@gmail.com