America's $175 Trillion Problem: Is the US Government Going Bankrupt?

Balaji Srinivasan, the Visionary Technologist and Economic Analyst Paints a Gloomy Picture for USA; We Respond

Doomsday Forecast for USA

Balaji Srinivasan is a prominent technologist, entrepreneur, and the former chief technology officer of Coinbase. Holding a Ph.D. in Electrical Engineering from Stanford University, his estimated net worth of around $150 million reflects his success across various technology ventures. Srinivasan is renowned for his profound insights at the intersection of technology and society. He is a strong proponent of decentralized, technology-driven governance models, which he thoroughly explores in his book, "The Network State: How To Start a New Country." As an influential figure in the tech community, Balaji frequently shares his perspectives and analyses on platforms like Substack, contributing to important discussions on the future of governance and technology.

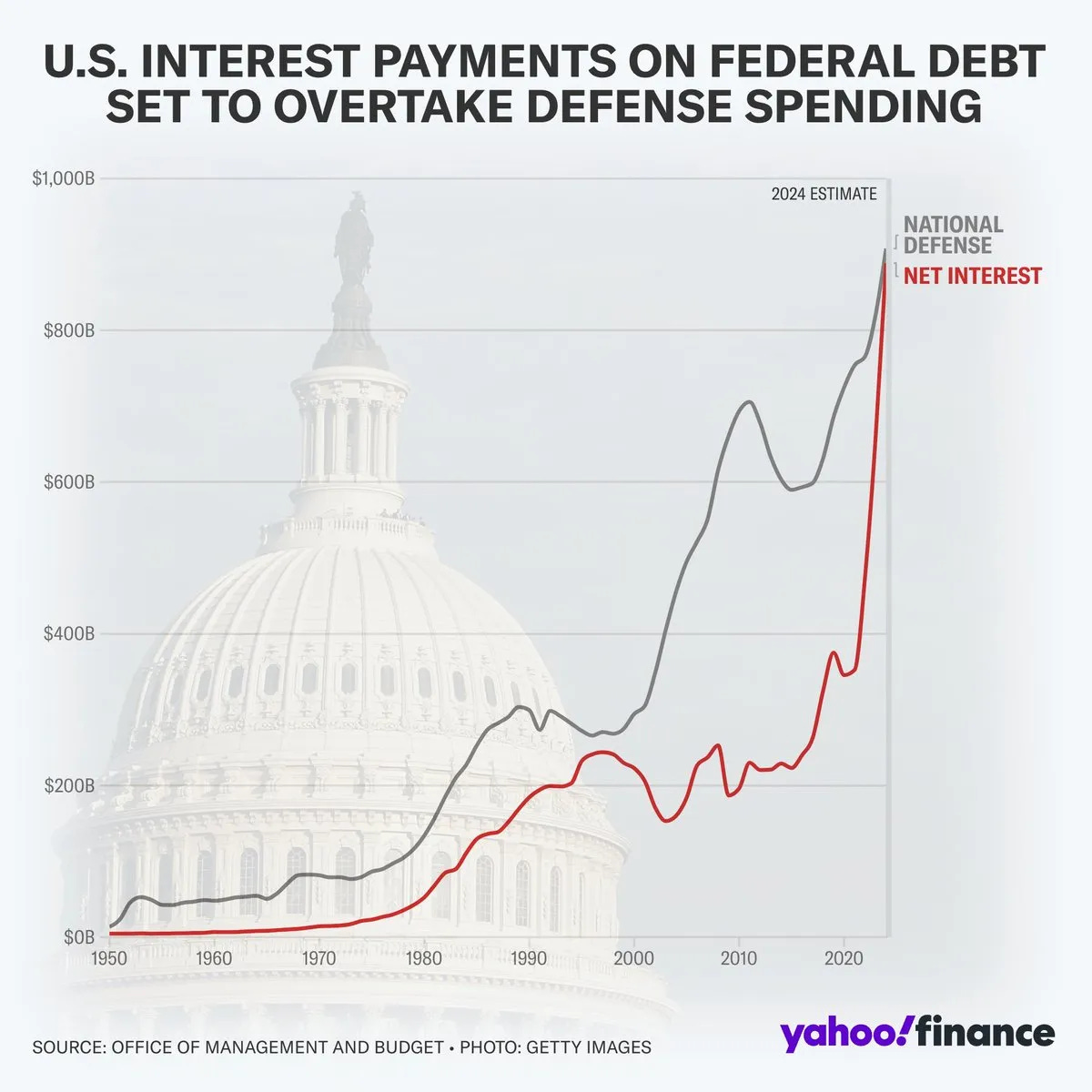

In one such recent article captioned “America's $175 Trillion Problem”, he highlights the precarious financial position of the United States, pointing to the alarming proportion of U.S. tax income now required to cover interest payments on its debt. His analysis presents clear red flags that the U.S. Federal Government could be teetering on the verge of bankruptcy, emphasizing the urgency of reevaluating its fiscal policies and economic strategies.

Summary of Balaji's Article

Balaji's article paints a grim picture of the American economy, highlighting a series of issues that suggest a looming financial crisis potentially more severe than that of 2008. Here are the key points he raises:

Increased Emergency Loans: The Federal Reserve made more emergency loans in 2023 than during the 2008 financial crisis, indicating a banking system heavily reliant on government support.

Rising Borrowing Rates: The U.S. government's borrowing has surged beyond COVID-era levels, now occurring at peacetime and at higher interest rates, suggesting desperation in fiscal management.

Surging Interest Payments: Interest on the national debt has become the largest expense for the government, surpassing defense and social security spending.

Dollar Devaluation: The dollar has lost significant value, exacerbated by rate hikes and inflation, decreasing its purchasing power.

Treasury Bonds and China: China has accelerated its dumping of U.S. Treasury bonds, reducing external demand and influencing market perceptions negatively.

Gold Accumulation by BRICS: Countries in the BRICS alliance are accumulating gold, moving away from U.S. dollar assets.

Decreasing Dollar Utilization: The global use of the U.S. dollar in trade and savings is declining, with countries like China moving to transact in their currencies.

Sanctions Losing Impact: U.S. sanctions are becoming less effective as other economies adapt and bypass the U.S. financial systems.

Historic Debt Levels: U.S. peacetime debt is now comparable to that of World War II, with an overall debt figure surpassing any historical empire.

Future Uncertainty: Balaji questions the sustainability of the U.S. economic strategy and hints at the inability of future technologies like AI to resolve these deep-seated issues due to the sheer scale of debt.

Contrarian View: The Resilience of the American Economy

Despite the alarming points raised, there are several reasons to remain optimistic about the fundamental strengths of the American economy.

Economic Growth and Innovation

Innovative Edge: The U.S. remains at the forefront of technological and scientific innovation, with sectors like technology, biotech, and renewable energies driving growth. This innovation provides a pathway for economic expansion and increased productivity, which can help manage and mitigate debt levels over time.

Dollar Dominance

Reserve Currency Status: The U.S. dollar remains the world’s primary reserve currency, offering substantial flexibility in financial management compared to other nations. This privileged status facilitates lower borrowing costs and reinforces the U.S.'s global economic influence. Notably, the dollar's dominance extends to the international oil trade, where it continues to be the preferred currency, even as countries like China and Iran, and India and Russia conduct oil transactions in alternative currencies, including their national currencies. This enduring preference underscores the dollar’s broad-based stability and appeal in global markets.

Flexible Monetary Policy

Robust Monetary Tools: The Federal Reserve has proven adept at managing economic crises, using tools such as quantitative easing and interest rate adjustments to stimulate the economy during downturns and cool it during overheats. This flexibility is crucial in navigating economic challenges.

Global Influence and Military Strength

Strategic International Position: The U.S.'s geopolitical and military strength ensures it remains a key player on the global stage, which in turn supports its economic stature and stabilizes its currency through global crises.

Potential for Recovery

Recovery and Adaptation: History shows that the U.S. has a strong capacity for recovery. Post-2008, regulations and reforms strengthened the financial system, suggesting that current challenges could similarly lead to systemic improvements that safeguard future growth.

Summing Up

Navigating Through Economic Challenges

While Balaji’s analysis highlights significant risks within the U.S. economic framework, especially in terms of high debt levels and monetary policy challenges, it's important to view these in a broader context. The resilience of the U.S. economy, fueled by innovation, strategic global influence, and effective monetary policy tools, suggests that it is well-equipped to handle these challenges through necessary adjustments and reforms. This inherent strength, often underplayed in overly pessimistic evaluations, offers a basis for cautious optimism, supporting the economy's ability to adapt and evolve amidst both internal and external pressures.

Economic Resilience as a Key Election Issue

As the U.S. approaches the presidential election scheduled for November 5th, the focus on domestic economic issues intensifies. Recent improvements in inflation figures, reported on July 26th, have raised hopes for an interest rate cut by the Federal Reserve as early as September, potentially earlier than anticipated. Such a move could energize not only the stock markets but also the broader economy, highlighting the importance of economic stability in the electoral discourse. Despite Balaji's skepticism and his focus on the network state, which he posits could supplant traditional sovereign states like the U.S., the core strength of the U.S. economy continues to be robust, even if the government's balance sheet is under some pressure. Echoing the sentiments of Warren Buffett, it's prudent to remain cautious but not paranoid when assessing the economic prospects of America. As the Sage of Omaha wisely advises, “Never bet against America.”