Ambani vs Musk: The Space Race for Satellite Spectrum Control in India

Satellite Spectrum: Auction or Allotment— that's the question.

The Battle for Satellite Spectrum in India

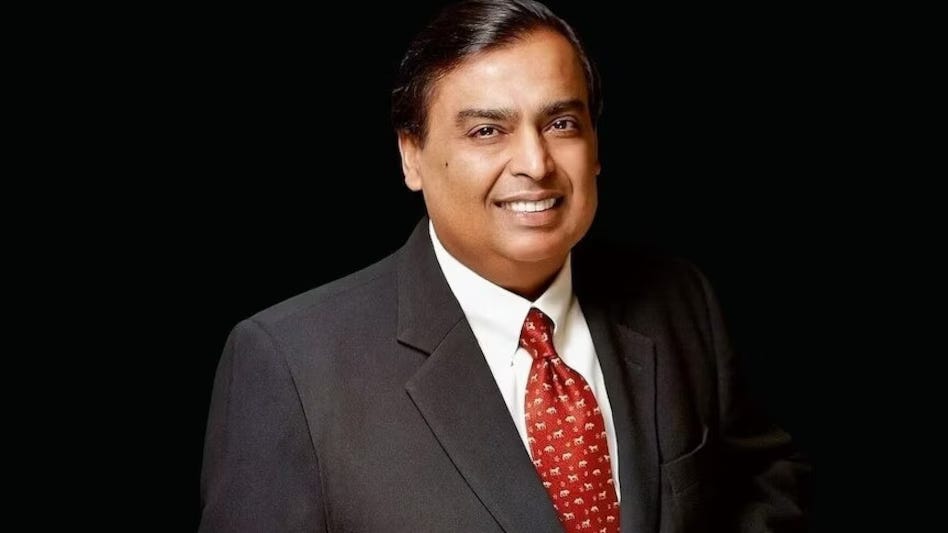

The battle for control over satellite spectrum in India has intensified into a high-stakes showdown between two global business titans—Mukesh Ambani of Reliance Jio and Elon Musk, CEO of Starlink. At the heart of this conflict is a pivotal question: how should satellite spectrum, the foundation of next-generation connectivity, be allocated? This debate goes far beyond business rivalry, touching on critical issues of regulatory policy, technological innovation, and the future of India's digital infrastructure. Ultimately, it is the Indian citizens—who stand to benefit as consumers of these technologies—whose interests are at the centre of this evolving contest.

Spectrum Allocation: Auction vs Administrative Allotment

The crux of the debate is centred on the method of satellite spectrum allocation in India. Two contrasting approaches have emerged:

Auction Process: Reliance Jio advocates for the auctioning of satellite spectrum, arguing that it ensures fairness and fosters healthy competition in the market. Jio maintains that auctions help prevent monopolisation, particularly by foreign players, and point to their success in terrestrial spectrum allocation. This method, they assert, has not only safeguarded transparency but has also significantly reduced the risk of legal disputes and frivolous allegations of favouritism or malfeasance in the allocation process, regardless of how fair or transparent it may otherwise appear.

Administrative Allocation: Favoured by global satellite players like Starlink and Amazon’s Project Kuiper, the administrative allocation approach aligns with international best practices. Proponents argue that this method would facilitate the quicker deployment of satellite technology, particularly in underserved and remote areas, by bypassing the delays typically associated with auction processes. They also highlight that the satellite spectrum in question operates in high-frequency bands such as the C-band (4-8 GHz), Ku-band (12-18 GHz), and Ka-band (26.5-40 GHz), where smaller wavelengths are used. These high-frequency bands allow multiple operators to share the spectrum without significant interference, as the communication relies primarily on line-of-sight transmission. This makes the spectrum less susceptible to congestion compared to terrestrial systems, enhancing the efficiency and coverage of satellite services.

Policy Challenges and Points of Contention

The Telecom Regulatory Authority of India (TRAI) has been deliberating on the issue, but Reliance Jio has taken issue with what it perceives as TRAI’s inclination towards administrative allocation. Reliance contends that Indian law does not explicitly allow administrative allotment for satellite spectrum, particularly as the nation’s telecommunications sector becomes more crowded with international competitors like Starlink poised to enter the market.

On the other hand, Starlink and its supporters argue that satellite spectrum is less scarce than terrestrial spectrum because it can be efficiently reused across different geographical areas. This is primarily due to its reliance on line-of-sight communication between ground antennas and low-orbit satellites, reducing the likelihood of interference. As a result, they contend that the need for competitive bidding is less critical. Adopting an administrative allocation approach, they argue, would enable a faster rollout of satellite services, which could play a pivotal role in bridging India's digital divide, particularly in rural and underserved regions.

Technological Edge: Starlink's Low-Orbit Advantage

While much of the debate centres on regulatory frameworks, it’s important to consider the technological superiority that Starlink brings to the table. Unlike traditional satellite systems, Starlink’s low-Earth orbit (LEO) satellite constellation offers several advantages:

Lower Latency: Because Starlink satellites orbit closer to Earth, the signal delay (latency) is significantly reduced compared to higher-orbit systems.

Better Coverage: Starlink’s global satellite network has the potential to deliver broadband access to even the most remote and challenging areas of India—mountainous regions, deserts, swampy deltas, and dense forests—where traditional infrastructure often struggles to reach.

Scalability: With service already available in over 100 countries, Starlink has proven its capacity to scale quickly, a vital consideration for a vast market like India.

This technological edge makes Starlink an attractive option for Indian consumers, especially in rural and remote areas, where access to high-speed internet has been limited or non-existent.

Consumer Impact: Quality, Competition, and Innovation

The outcome of the spectrum dispute will have profound implications for Indian consumers:

Service Quality: Starlink’s advanced technology promises to deliver high-speed internet with lower latency, improving user experience, particularly in underserved regions.

Pricing Pressure: Increased competition between Reliance and Starlink could drive down prices, making satellite internet services more affordable for a broader segment of the population.

Innovation and Growth: Access to cutting-edge satellite technology could spur innovation across multiple sectors, from education to healthcare, potentially transforming India's digital landscape.

Reliance’s Argument and Apprehension

However, Reliance argues that administrative allocation could give foreign companies an undue advantage, potentially stifling local competition and innovation. Reliance contends that an auction-based system would ensure a level playing field, allowing both domestic and international players to compete fairly. A key underlying concern for Reliance Jio is that while Musk's Starlink could become operational within weeks—if not days—since its satellite constellation is already in orbit, duly synchronised, and ready to deliver services upon spectrum allocation, Jio would require considerable time and investment to establish the necessary ground infrastructure, such as line-of-sight towers, or adapt its existing network. Additionally, Jio would need to prevent interference with terrestrial frequencies, adding further complexity to its rollout.

This head start could allow Starlink to capture the tech-savvy, lucrative segment of Indian consumers well before Reliance's satellite services become operational, potentially giving Starlink a significant foothold in the market even before Jio can compete on equal terms.

Broader Implications for India’s Digital Future

While this dispute might seem like a battle over regulatory details, the stakes are much higher, with significant ramifications for India’s position in the global digital economy. Some of the broader considerations include:

Global Connectivity: Starlink’s constellation can offer seamless global connectivity for Indian businesses operating internationally, providing an edge in the global digital economy.

Rural Development: Satellite broadband can play a transformative role in connecting India’s rural and remote areas, where traditional internet infrastructure has struggled to reach.

Technological Leadership: As India aims to position itself as a digital leader, access to advanced satellite technologies will be key to maintaining its competitive edge in a rapidly evolving global market.

The Road Ahead: Balancing Business and Public Interest

The battle for satellite spectrum control in India highlights the delicate balance between encouraging domestic business interests and embracing global technological advancements. Reliance’s call for auctions aligns with protecting local telecom players, but denying or delaying the entry of advanced satellite services like Starlink could slow down India’s digital revolution.

Ultimately, the Indian government will need to carefully weigh the potential benefits of Starlink’s satellite technology against the need to protect the interests of domestic businesses. The decision on how to allocate satellite spectrum will not only shape the competitive landscape of the telecommunications sector but also determine the pace at which India’s digital future unfolds.

In conclusion, the Ambani vs Musk satellite spectrum battle is more than a corporate feud—it is a critical moment for India as it navigates the challenges of becoming a global digital powerhouse. How this issue is resolved will reverberate far beyond the boardrooms of Reliance and SpaceX, affecting millions of consumers and the future trajectory of India’s telecommunications infrastructure.

……In the end, the satellite spectrum battle would be settled in the benefit of both…..!! The consumers are of inconsequence in this corporate feud—finally the corporates are to become global digital powerhouses, with the country far behind these ………