Adani Bribery Criminal and Civil Trials to be Heard by the Same Federal Judge in the US

With twin trials set to proceed under the oversight of the same Judge, world is watching closely—not just for the verdict but for its broader implications on global business ethics and accountability.

Adani Bribery Criminal and Civil Trials to be Synchronised

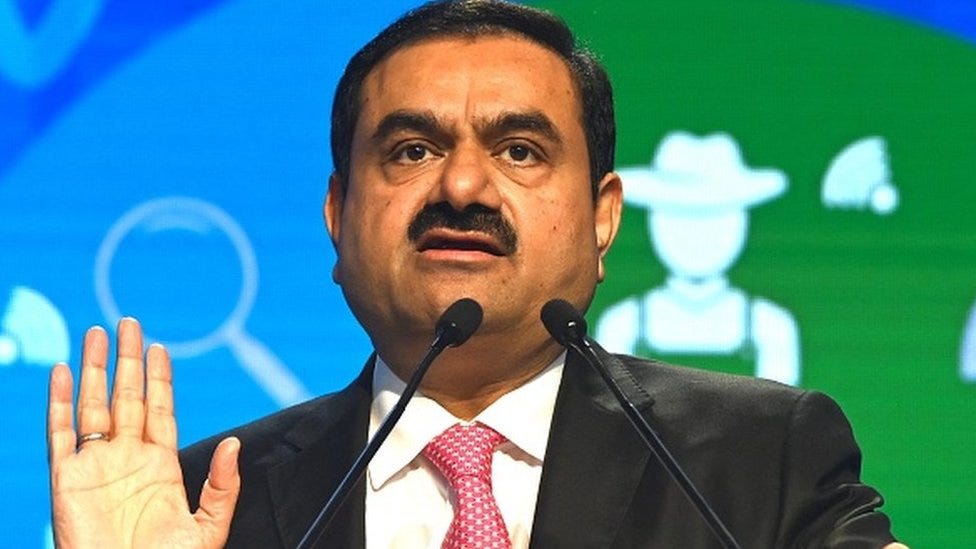

In a landmark decision, a New York federal court has ruled that the criminal and civil trials involving Indian billionaire Gautam Adani, though distinct legal proceedings, will be presided over by the same judge, US District Judge Nicholas Garaufis. This development represents a pivotal moment in the legal proceedings against Adani and his associates, who are accused of orchestrating a $250 million bribery scheme. The decision, designed to ensure judicial efficiency, carries significant implications for the case's direction and pace.

Gautam Adani and the Adani corporate group have categorically denied all charges and any allegations of wrongdoing.

Joint Trial Order: A Strategy for Judicial Efficiency

The court's decision to assign both the Department of Justice’s (DOJ) criminal case and the Securities and Exchange Commission’s (SEC) civil case to a single judge reflects a need to streamline proceedings and avoid conflicting schedules. However, it is important to emphasize that the cases remain separate and will be decided individually. This arrangement allows for a focused and coordinated approach while preserving the legal distinction between the criminal and civil charges. Legal experts believe this move will help expedite the trials in both cases.

Allegations and Charges: A Closer Look

The charges against Gautam Adani and his seven co-defendants include conspiracy to commit securities and wire fraud, advancing the bribery scheme, and obstructing investigations. US prosecutors allege that between 2020 and 2024, Adani and his associates bribed Indian government officials, including those of various state governments, to secure renewable energy contracts projected to generate over $2 billion in profits. Additionally, the indictment accuses the defendants of falsifying records to attract Wall Street investments, further intensifying the seriousness of the case.

Many senior advocates in India have recently voiced their opinions in mainstream media and on social platforms, asserting that the charges against the Adani Group, particularly those against Gautam Adani, are weak and unlikely to hold up in court. However, it remains unclear whether these synchronized and simultaneous remarks were made in their capacity as formally engaged counsels for the Adani Group or independently as prominent legal experts. Furthermore, they have not clarified whether they would advise Gautam Adani to appear personally before the Brooklyn trial court to contest the indictment.

Market Impact and Strategic Moves

The ongoing legal battle has significantly impacted Adani Group’s market performance:

Adani Enterprises: Shares have dipped 8% since November 19.

Adani Green Energy: Shares have plummeted by 26% during the same period.

In a strategic move to mitigate financial and reputational damage, Adani Enterprises recently announced its exit from Adani Wilmar, divesting its entire 44% stake. The proceeds, exceeding $2 billion, are designated to bolster its core infrastructure operations and enhance liquidity.

While the US short-seller Hindenburg Group's recent report triggered a sharp decline in Adani Group shares, and subsequent allegations of conflict of interest against SEBI Chairperson Madhabi Puri Buch caused turbulence in the broader Indian stock market, the criminal indictment in a US federal court represents a far graver challenge. Unlike market shocks, such charges cannot be dismissed with press briefings or bland denials and require a robust legal defense.

Developments in the Legal Landscape

Recent developments, in light of the election of Donald Trump as the next President of USA, have added layers of complexity to the case:

Resignations: US Attorney Breon Peace and FBI Director Chris Wray, key figures in the investigation, have stepped down.

Adani’s Stance: The conglomerate continues to deny the allegations, labeling them baseless and politically motivated.

Potential Court Appearances: Speculation surrounds whether Adani and his co-defendants will personally appear before the Brooklyn court.

The Role of Presidential Pardons

The extensive powers of the US President to grant pardons for federal offenses could play a significant role, depending on the political landscape. This factor adds an element of unpredictability to the case, particularly with the imminent change in administration.

The Integrity of Due Process

As the trials progress, the robustness of the US legal system will be on display. The swearing-in of Donald Trump and the anticipated changes in key federal officials under the new administration are unlikely to materially affect the adherence to due process. This case underscores the impartiality and resilience of the US judiciary, ensuring justice is served irrespective of political shifts.

Summing Up

The Adani bribery case serves as a litmus test for the legal and corporate governance frameworks in both India and the United States. With the trials set to proceed under the vigilant oversight of Judge Nicholas Garaufis, the world is watching closely—not just for the verdict but for its broader implications on global business ethics and accountability. These proceedings are unlikely to fade away or lose momentum with mere efflux of time.

Hindenburg Research Unleashes New Allegations, Targeting SEBI Chairperson

Hindenburg Research Levels New Allegations