$56 Billion CEO: "YES", say Tesla Shareholders.

Tesla Shareholders Approve Unprecedented $56 Billion Compensation Package for Elon Musk.

Tesla Shareholders Approve Musk’s Package

Tesla shareholders on Wednesday (12th June) voted by a wide margin to approve an unprecedented $56 billion compensation package for its CEO, Elon Musk. This package, previously set aside by a Delaware Court, underscores Musk's importance to the company's future. Musk, who has never been far from controversy, also leads companies like Starlink, Neuralink, SpaceX, and the newly incorporated AI venture xAI. His recent actions, including a scathing critique of Apple Inc. and a lawsuit withdrawal against OpenAI, the day after, continue to make headlines.

Compensation Package Details

The $56 billion compensation package for Elon Musk is contingent upon Tesla's market capitalization meeting significant milestones under his leadership. This package, beyond its substantial monetary value, is a matter of prestige for Musk. He campaigned vigorously on Twitter (X), which he now owns, urging shareholders to vote in favor of his package. The market responded nervously as Tesla headed for the vote but recovered handsomely in market-hours trading once the results were announced.

Delaware Court Ruling and Aftermath

In January 2024, Delaware Chancery Court Chancellor Kathaleen St. Jude McCormick invalidated Elon Musk's $55.8 billion compensation package— that included a handsome chunk of stock-options— from 2018, ruling that Tesla's board breached its fiduciary duties. The court found that Musk exercised undue control over the board, several directors lacked independence, and shareholders were not fully informed during the approval process. As a remedy, McCormick ordered the rescission of Musk's unexercised stock options. Following the ruling, Musk criticized the court and threatened to move Tesla's incorporation to Texas. Tesla's board has since put the invalidated package up for a re-vote by shareholders at the 2024 annual meeting, relying on a novel legal interpretation to rectify the court's identified issues.

Background of Musk's Compensation Package

In 2018, Tesla's board approved a $56 billion pay package for Elon Musk, the largest ever for a public company CEO, contingent on meeting specific milestones, especially in terms of market capitalization. In 2019, shareholder Richard Tornetta sued, alleging the package was self-designed by Musk and improperly approved by a conflicted board. In January 2024, Delaware Chancery Court Judge Kathaleen McCormick invalidated the package, citing the board's breach of fiduciary duties and Musk's undue influence.

Musk reacted by threatening to move Tesla's incorporation to Texas. On June 13, 2024, Tesla shareholders voted to re-approve a revised $56 billion package, relying on a novel legal interpretation. Despite proxy advisors recommending against it, Musk claims the vote has been passed by a wide margin. Legal experts are uncertain if the court will accept the re-approved package, and shareholders are also voting on moving Tesla's incorporation to Texas. This vote is a crucial attempt to restore Musk's compensation and will test the legal boundaries of corporate governance.

Shareholder Support for Musk's Compensation

a.) Milestone-Linked Stock Options

As part of the compensation package deal, Musk was granted stock options as Tesla hit certain valuation milestones, accumulating massive amounts of shares that led to a record pay deal and played a significant role in making Musk the richest person in the world. Musk indicated that the number of votes in favor of restoring his pay had surpassed the threshold needed for victory, with full results expected at Tesla’s shareholder meeting in Austin today (Thursday, 13th June).

b.) Divided Investor Opinions

Notably, the shareholder vote does not immediately restore Musk’s pay but sends a strong signal of broad investor support. Investors were divided, with some major shareholders criticizing Musk as a distracted leader undeserving of such a reward, while others praised him as a generational genius. "Our answer is clear, loud and unequivocal: Tesla is better with Elon. Tesla is Elon,” said billionaire investor Ron Baron, emphasizing Musk's indispensability to Tesla and the necessity of his compensation reflecting that.

c.) Applause for Preliminary Results

Investors and Musk’s supporters, including X CEO Linda Yaccarino, applauded the preliminary results. Musk, who remains among the richest people regardless of the pay package, pledged to make Tesla the most valuable company on Earth.

d.) Corporate Democracy in Action

This decision highlights the impact of shareholder votes in corporate governance. "This shows that shareholder votes can matter," noted James Park, a UCLA law professor specializing in securities regulation and corporate law, calling it a demonstration of corporate democracy in action.

Tax Implications for all Stakeholders

Reincorporating in Texas offers Tesla several tax advantages, such as no corporate income tax (compared to Delaware's 8.7%) and a low franchise tax based on margins. Executives and employees could benefit from Texas's lack of personal income tax, though remote workers may face complications. Shareholders will not face direct tax implications, especially on account of the federal Income Tax, attributable to capital gains, should they sell their shares at a profit, but moving to Texas might reduce their rights. Delaware would see minimal revenue loss, as it relies heavily on incorporation fees, while Texas might gain some franchise tax revenue. Overall, the impact is more symbolic than material, as Delaware remains the preferred state for incorporating companies aiming to go public.

Musk's Leadership and Legal Battles

Elon Musk's leadership has been a double-edged sword. While he drives innovation and growth, he also courts controversy. His recent actions, including the lawsuit withdrawal against OpenAI and criticism of Apple, reflect his complex relationship with the tech industry and regulatory environments.

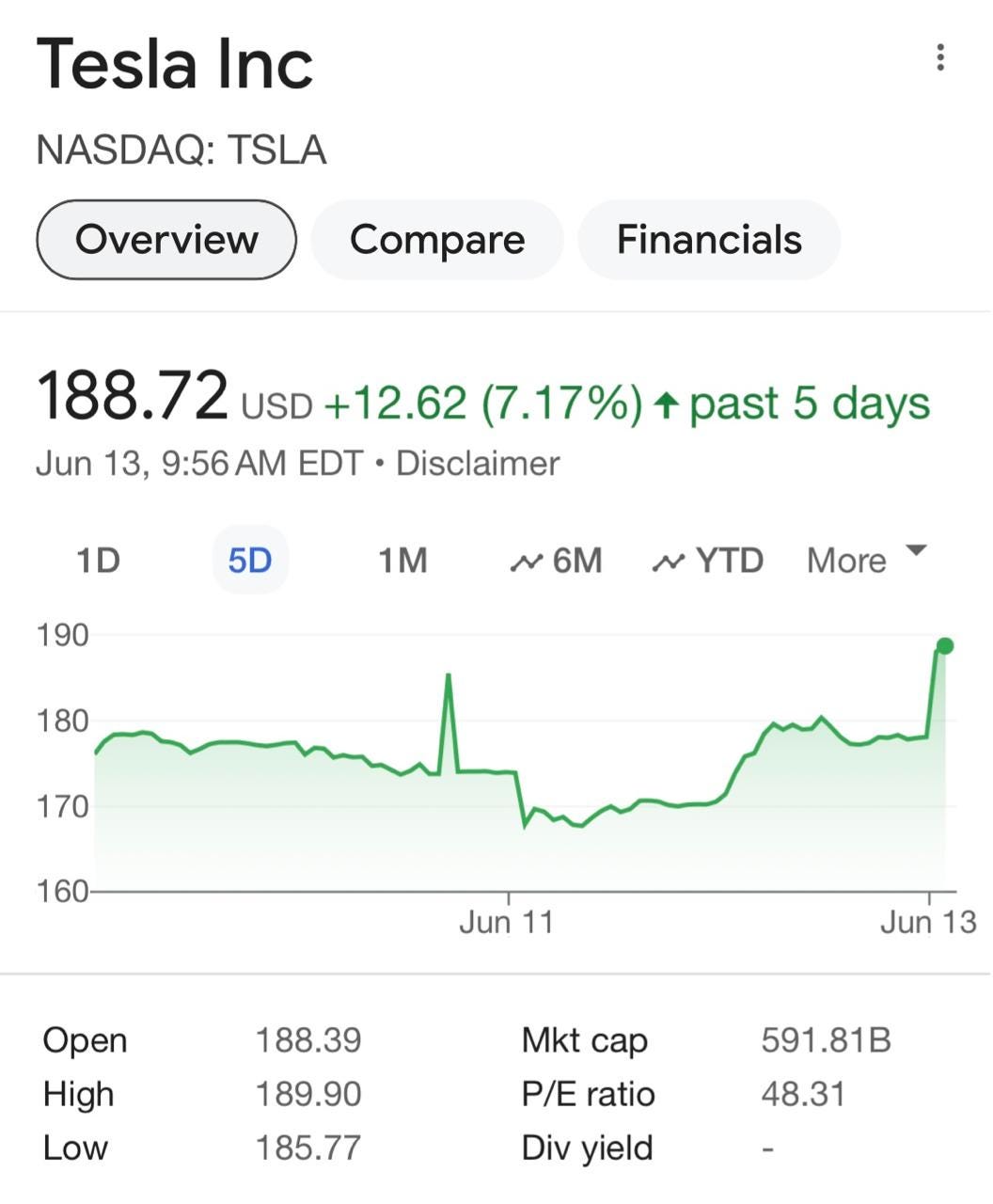

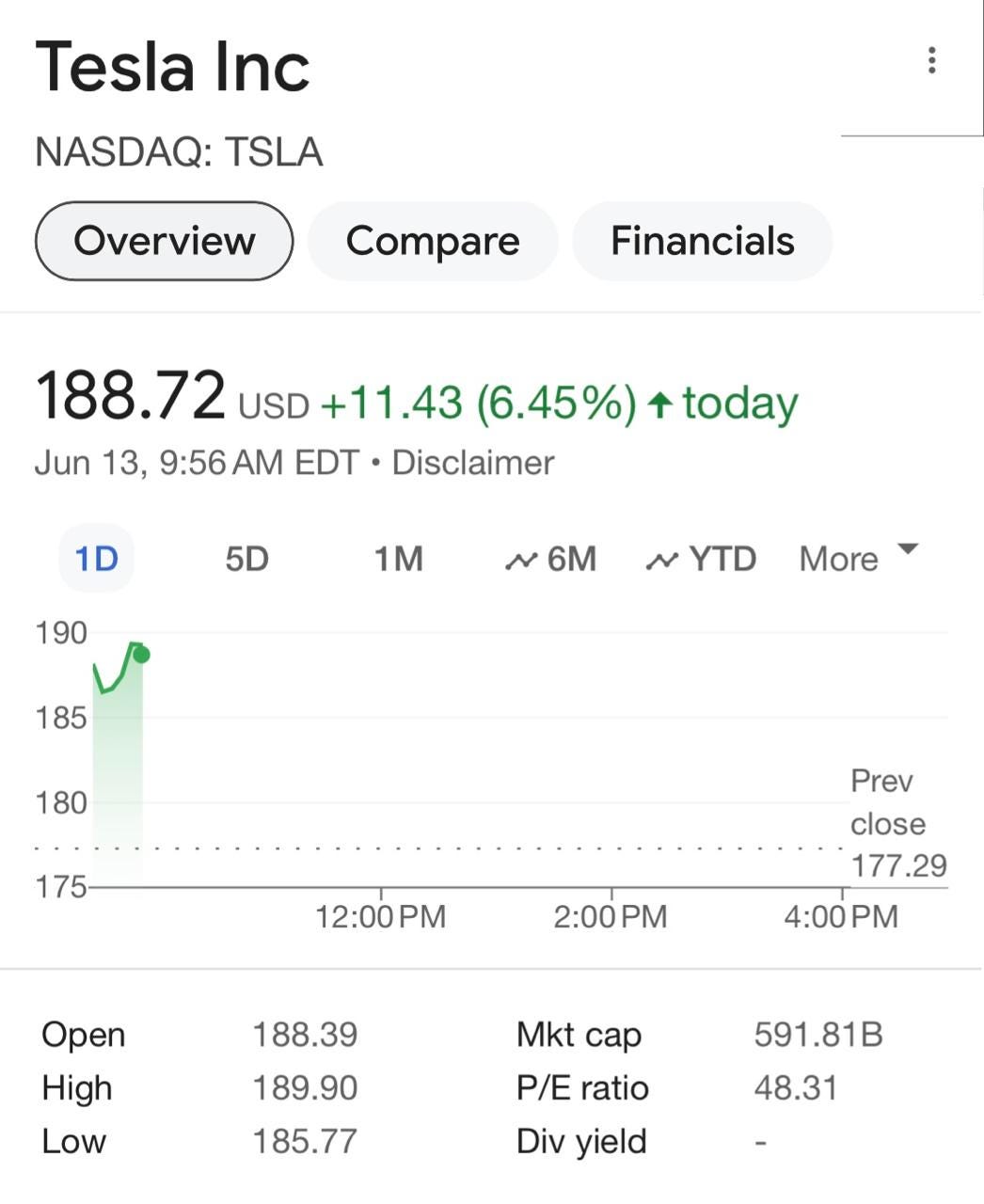

Market Reaction to Shareholder Vote

The approval of Elon Musk's compensation package led to significant market reactions. In the weeks leading up to the vote, uncertainty weighed on Tesla's stock price, which was down about 29-30% year-to-date as of June 12. However, on June 12, the day before the shareholder meeting, Tesla shares jumped 7% in premarket trading to $189.75 after Musk's tweet on preliminary voting results. The market responded positively, with Tesla stock gaining 5.1% to $186.39 in premarket trading on June 13, and opened 6.45% up on Thursday.

Tesla's Market Capitalization Growth

Since its IPO in 2010, Tesla's market capitalization has consistently grown, reflecting strong investor confidence in Elon Musk's leadership. From a modest $2.52 billion in 2010, it reached over $1 trillion in 2021, peaking at $1.061 trillion. Despite some fluctuations, Tesla's market cap remains robust at over $565 billion as of June 2024, making it more valuable than major legacy automakers like Toyota, Volkswagen, General Motors, and Ford combined. This growth underscores the market's faith in Musk's vision and execution.

Summing Up

The approval of Elon Musk's compensation package by Tesla shareholders is a significant milestone, not just for Musk but for corporate governance. While the tax advantages of moving to Texas are clear, the implications for shareholder rights and administrative complexity cannot be ignored. The market's positive response to the vote reflects confidence in Musk's leadership despite ongoing controversies. As Tesla navigates these changes, including potential legal glitches, the broader tech industry's reactions and regulatory responses will be crucial in shaping its future. This decision also underscores that while US courts will intervene to protect minority shareholders against exorbitant pay packages approved by "captive boards," the ultimate authority in corporate democratic governance lies with the shareholders, provided all procedural and substantive legal provisions are met.

If you believe this article would interest someone you know, please feel free to share it anonymously (for us), using any platform that you prefer.