10-Year US Treasury Bond Yield Pierces 5% Ceiling

This breach has taken place for the first time since the global meltdown of the year 2007: Implication for the World and India.

Skyrocketing 10-Year Treasury Yields Rattle Global Markets

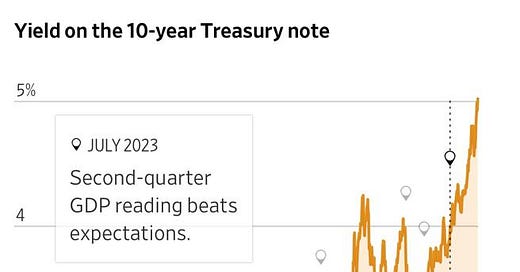

For the first time in 16 years, since the global financial crisis, the yield on the 10-year U.S. Treasury note breached the ceiling of 5% on Monday, 23 October 2023. This pivotal milestone has not only unsettled stock markets but also escalated mortgage rates, thereby amplifying persistent fears of an economic downturn. As the Indian markets, the Government of India, and RBI offices were closed due to the Dussehra holiday, no immediate market reactions or official statements were available. We thus seize this opportunity to present our comprehensive analysis of this critical and potentially landmark event.

Why Are Bond Yields Rising?

There are multiple factors contributing to the rising bond yields. Firstly, the Federal Reserve's decision to hike interest rates to curb inflation— a stance that is likely to continue under the Chairmanship of Jerome Powell— has prompted investors to sell off their bonds. The natural mechanics of supply and demand have consequently led to falling bond prices and climbing yields. Secondly, concerns about high government spending are making government bonds less attractive. The U.S. Government's debt accounted for 121.6% of the country's nominal GDP in June 2023, compared to 120.1% in the previous quarter. This, coupled with President Joe Biden's announcement of an "unprecedented" support package for Israel amounting to $14.3 billion, adds to the long list of unbudgeted and unforeseen liabilities that could swell government spending further. These circumstances have raised concerns among investors about the sustainability of the fiscal trajectory, contributing to the sell-off in bonds.

Unforeseen Expenses and Global Geopolitical Uncertainty

Additionally, the geopolitical landscape and its effects on investor sentiment can't be ignored. While the aid package for Israel may not be significant relative to the U.S. GDP, its political and fiscal implications are far-reaching. The aid is earmarked for military support, including air and missile defence, and replenishing the Defense Department's stocks provided to Israel. Furthermore, the Biden administration has committed $100 million to humanitarian assistance in Gaza and the West Bank. In an already jittery financial environment, these developments signal an uptick in government spending and potentially add to deficit concerns, both of which are factors influencing rising bond yields. Notably, the statement of Bill Ackman, the influential billionaire investor, that there is "too much risk in the world" seems to echo this broader apprehension, causing further volatility in the bond market. After peaking at 5%, the yield on 10-year bonds has eased back to 4.85%, but the multiple pressures causing this movement continue to persist.

Consequences for the Average U.S. Consumer

For the average U.S. consumer, these rising yields are not good news. They serve as the benchmark against which many other interest rates are set. Mortgage rates are now sky-high, making homeownership a far more expensive venture compared to renting. Car loans are also more expensive, leading to a rise in Americans struggling to meet their payments. It's safe to say that the rising bond yields have made everyday borrowing more costly, putting financial strain on ordinary people.

Global Impact on Investors

The repercussions of the yield hike are not confined to the U.S. Investors worldwide use the 10-year Treasury yield as a risk-free benchmark for various asset classes, including stocks and other forms of debt. High yields in the U.S. have also led to rising bond yields globally. Investors may start to seek alternative investments, potentially driving up yields in other markets as well. Emerging markets, which are often seen as higher risk compared to developed markets, may experience capital flight as investors seek safer assets.

Contending Views

Optimistic Perspective

Some market analysts argue that rising yields indicate a strong economy and are a natural part of the economic cycle. They point out that higher interest rates could benefit savers and could indicate a tapering off of inflationary pressures in the long term.

Pessimistic Perspective

On the other side of the spectrum, there are those who believe that the soaring yields are a red flag for an impending economic downturn. They caution that higher interest rates could stifle consumer spending and corporate borrowing, thereby leading to job cuts and a stagnation in economic growth.

Navigating the Complexity: A Global Perspective

The current rise in 10-year U.S. Treasury yields to 5% is indeed a significant financial milestone that presents a complex puzzle for policymakers. While it's tempting to view the development through the prism of benefits for savers and inflation control, the sharp increase also brings with it a degree of volatility and instability that has global repercussions. For policymakers, the challenge lies in delicately calibrating their approach to neither stifle economic growth nor let inflation spiral uncontrollably. The ripples of this financial movement are not confined to the U.S.; they touch economies and markets around the world, warranting a careful and vigilant response from all stakeholders.

The Indian Context: Implications and Challenges

For India, the uptick in U.S. Treasury yields could herald a high-interest rate environment, especially if inflation continues to defy moderation despite the Reserve Bank of India's (RBI) best efforts. This surge in yields has a cascading effect on Indian equities, potentially making them less appealing to overseas portfolio investors. These investors often factor in the future depreciation of the Indian rupee against the U.S. dollar, further diminishing the allure of Indian assets. From a Foreign Direct Investment (FDI) perspective, the U.S. bonds offering 5% yields might be perceived as a safer and more attractive option in a geopolitically and financially uncertain world. Therefore, the sudden shift in the U.S. bond market warrants keen attention from Indian policymakers, investors, and the general populace, as it has intricate implications for the nation's economic landscape.

The silver lining, of course, is a robust growth rate for the Indian economy in a global scenario of low growth, if not stagnation. Driven largely by India's own domestic demand, this could potentially insulate India to a significant extent from the interest rate fluctuations in U.S. Treasury Bonds.